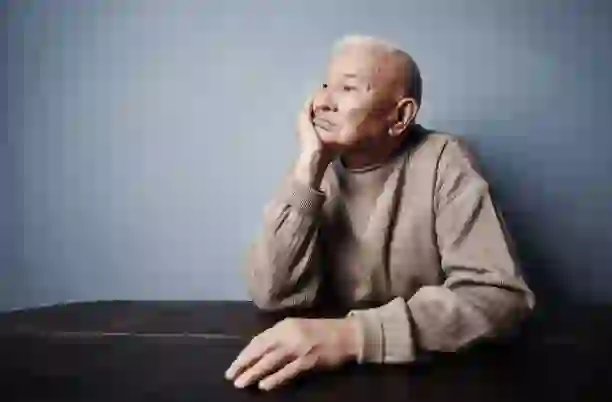

50% of U.S. Wealth Belongs to Boomers — So Why Are They Becoming Homeless?

Boomers. They’re sitting on a cool 50% of the wealth in the U.S., but not everything is rosy for this crowd. A deep dive into the numbers reveals a harsh reality–some boomers are hitting retirement with far less security than they bargained for. While the older half of the generation, born between 1946 and 1954, might be living it up in their paid-off homes, younger boomers are facing a different kind of reality. A growing number are falling into homelessness, and it’s a crisis that’s been decades in the making.

Retirement doesn’t have to be uncertain. Annuities can help you build a reliable income stream and enjoy stress-free golden years. Get a guaranteed 5.50% APY – the FastBreak™ annuity is a gift from you to future you.*

Yes, boomers are the wealthiest generation on paper, largely thanks to the rising value of their homes. But here’s the kicker: Most of that wealth belongs to the older boomers who snagged houses when prices were reasonable, back in the good old days when you could buy a place for the cost of a decent sandwich. The younger boomers? Not so lucky. They’re feeling the squeeze from skyrocketing home prices, job market instability, and a social safety net that has more holes than Swiss cheese.

Dennis Culhane, a social policy professor at the University of Pennsylvania, told The Wall Street Journal that we need to revamp the federal safety net. “We shouldn’t have elderly or disabled people living in poverty in one of the richest countries in the world,” he said.

Federal data paints a grim picture: over 20% of those facing homelessness in the U.S. last year were 55 or older. And guess what? This group is now the fastest-growing segment of the homeless population.

Culhane’s research digs even deeper, showing that younger boomers–those born after 1954–have made up around a third of the homeless population for years. This isn’t a new problem, but it’s one that has roots in the economic chaos of the 1980s.

So, why is this happening? Let’s take a walk down memory lane.

For younger boomers, their transition into adulthood was anything but smooth. They came of age during the 1980s–a time when affordable housing started disappearing faster than a stack of pancakes at a Sunday brunch. Culhane points out that they faced a housing market that was getting more crowded by the day, with prices climbing higher and higher. It wasn’t just the housing market that was rough, though. The job market wasn’t exactly rolling out the red carpet either.

And then, of course, there was the crack epidemic. Many in this cohort got swept up in that crisis, pushing them into homelessness, a situation that stuck with some as they aged.

Adding insult to injury, a lot of these younger boomers worked jobs that didn’t contribute to Social Security. Jobs in construction, demolition, and other casual labor gigs didn’t exactly offer a cushy retirement plan. That’s left many struggling without the safety net their older counterparts can lean on.

Chen Zhao, a senior economist at Redfin, sums it up well: “Miss a window by five or ten years, and you’re looking at a very different housing and labor market.” It’s not a stretch to say these younger boomers were dealt a tough hand.

Disclosures

*Annuity rates are subject to change at any time, and the rate mentioned may no longer be current. Please visit Gainbridge.io for current rates, full product disclosures, and disclaimer. Withdrawals above the 10 percent free withdrawal amount subject to a withdrawal charge and market value adjustment. FastBreak™ is issued by Gainbridge Life Insurance Company in Zionsville, Indiana. FastBreak™ is not a tax-deferred annuity; instead, it is taxed annually.

GOBankingRates maintains editorial independence. While we may receive compensation from actions taken after clicking on links within our content, no content has been supplied by any advertiser prior to publication.