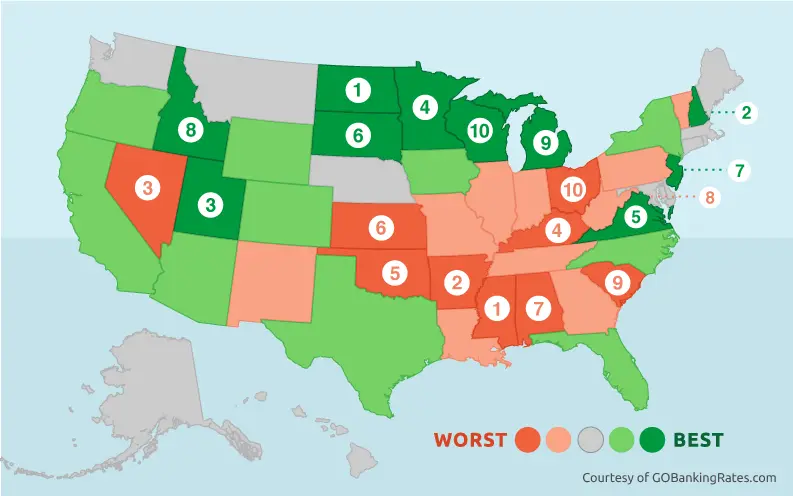

Map Illustrates the Most and Least Money-Savvy States

LOS ANGELES, Oct. 12, 2015 /PRNewswire/ ― North Dakota is the most money-savvy state while Mississippi is the least, according to GOBankingRates’ newest study evaluating financial smarts and resource availability of residents in each state. The leading personal finance website investigated all 50 states and the District of Columbia, ranking each on important factors of financial health: residents’ use of banking services, their saving and investing behaviors, and the availability of statewide financial education policies.1

To learn more about each state’s money savvy ranking, visit:

gobankingrates.comretirement/survey-10-money-savvy-states/

Key findings of the study include:

- Banking Services: Utah, Wisconsin and Montana performed best in this category, with households in these states more likely to have a checking and savings account and less likely to use alternative financial services.

- Saving and Investing: No. 1 most money-savvy state North Dakota ranked best in this category, with California and New York also scoring in the top ten.

- Financial Literacy: Texas and Georgia both tied for best in the financial education category, while Massachusetts, Connecticut, Arkansas and Kansas tied for worst with unfavorable statewide financial education policies.

“This study highlights a few concerning regional trends when it comes to money management skills among Americans,” said Casey Bond, editor-in-chief of GOBankingRates.com. “The southern region of the country clearly lacks the resources needed for residents to take an active role in their financial well-being, and illustrates a need for Americans living in this region to proactively take steps to improve their money habits.”

| 10 Most Money-Savvy States | 10 Least Money-Savvy States |

| 1. North Dakota | 1. Mississippi |

| 2. New Hampshire | 2. Arkansas |

| 3. Utah | 3. Nevada |

| 4. Minnesota | 4. Kentucky |

| 5. Virginia | 5. Oklahoma |

| 6. South Dakota | 6. Kansas |

| 7. New Jersey | 7. Alabama |

| 8. Idaho | 8. District of Columbia |

| 9. Michigan | 9. South Carolina |

| 10. Wisconsin | 10. Ohio |

1 For full details on the methodology, visit GOBankingRates.com.

About GOBankingRates

GOBankingRates.com is a leading portal for personal finance and consumer banking information, offering visitors the latest on everything from finding a good interest rate to strategies for saving money, investing for retirement and getting a loan. Its editors are regularly featured on top-tier media outlets, including U.S. News & World Report, Forbes, Business Insider, DailyFinance, Huffington Post and more. It specializes in connecting consumers with the best financial institutions and banking products nationwide.

Contact:

Roxy Barghahn, Media Relations GOBankingRates.comroxyb@gobankingrates.com 310-297-9233 x 202