6 Tax Cuts Included in Harris’ Economic Plan That Could Impact You in 2025

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

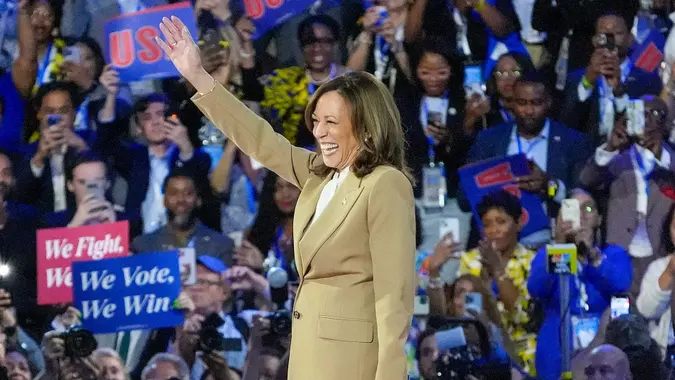

The 2024 presidential election is right around the corner and the race between Vice President Kamala Harris and former President Donald Trump is heating up. There are many issues facing working-class Americans and the state of the economy is top of mind for voters.

CNBC reported that Vice President Kamala Harris outlined her plan to create an “economic opportunity,” aimed at lowering the costs of housing, food, health care and child care.

She aims to tackle the financial strain of the average American family and provide financial relief where it’s needed most while cracking down on corporate greed.

“As President, I will be laser-focused on creating opportunities for the middle class that advance their economic security, stability and dignity,” Harris said, as reported by TIME.

If elected, here are the key measures that Harris plans to implement in her first 100 days in office.

Here are six financial policies and tax cuts that could impact you in 2025 if Harris wins the election this November, according to CNBC and TIME.

Enacting a Federal Ban on Corporate Price Gouging for Groceries

Under this new measure, the Federal Trade Commission (FTC) and state attorney generals would be empowered to handle issues related to grocery price gouging and be able to levy hefty fines against grocery chains that implement “excessive” price hikes. This key policy is in reaction to an overall 26% hike in grocery prices nationwide since 2019.

Constructing More Affordable Housing

The Harris plan focuses on building 3 million new homes nationwide over the next four years. The idea here is that creating a larger home supply should ease the current U.S. housing affordability crisis and make it more affordable for the average American family to buy a home. This would include an expansion of tax credits for developers who construct more affordable “starter homes” and a $40 billion fund for local housing solutions.

Banning Wall Street Investors From Buying Homes in Bulk and Hiking Rents

Wall Street first would be banned from buying housing in bulk only to resell homes at a premium to homebuyers. To add, Harris is proposing measures to stop data firms from hiking up lease rates for renters.

Offering $25,000 in Down-Payment Assistance to First-Time Homebuyers

Mortgage interest rates are still very high and even those who save for many years struggle to make a down payment on their first home. A first-of-its-kind measure would provide working families who have paid their rent on time for two years up to $25,000 in down-payment assistance toward buying their first home.

Expanding Prescription Drug Price Caps

The Harris economic plan seeks to expand the Biden Administration’s recently enacted $35 price cap on insulin medications not just for seniors on Medicare, but to all Americans. Additionally, there would be a limit on annual out-of-pocket prescription drug costs to $2,000 for all. The aim here is to further crack down on pharmaceutical companies, stamp out corporate greed when it comes to capitalizing on people’s healthcare needs, and put more money back in the pockets of Americans.

Expanding Child Tax Credits

The Harris plan highlights a new $6,000 tax credit for families with a newborn child for the first year of the child’s life. This will put more money back in the pockets of young families for things like diapers, cribs, car seats and more. The reality is that most families do not have access to paid family leave and are forced to choose between working to make ends meet or spending time with their children. An expanded tax credit should provide more financial breathing room to afford necessary expenses and make it financially possible to spend more time with family.

Editor’s note on election coverage: GOBankingRates is nonpartisan and strives to cover all aspects of the economy objectively and present balanced reports on politically focused finance stories. You can find more coverage of this topic on GOBankingRates.com.

Written by

Written by  Edited by

Edited by