Review: The Automatic Millionaire by David Bach

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

David Bach’s book The Automatic Millionaire has one of the most controversial titles of any personal finance book. The front cover makes claims that resemble a get-rich-quick infomercial: Follow one rule and become a millionaire…automatically. According to The Automatic Millionaire, anyone can secure a bright financial future in just one hour.

It sounds too good to be true, but most financial experts agree with its no-nonsense advice: Save money and “pay yourself first.”

Pay Yourself First

Bach’s philosophy hinges on the idea that human beings are–at their core–undisciplined, easily distracted and lazy. These are the reasons why most people fail at budgeting, but they’re also the reasons why the concept of paying yourself first works so well.

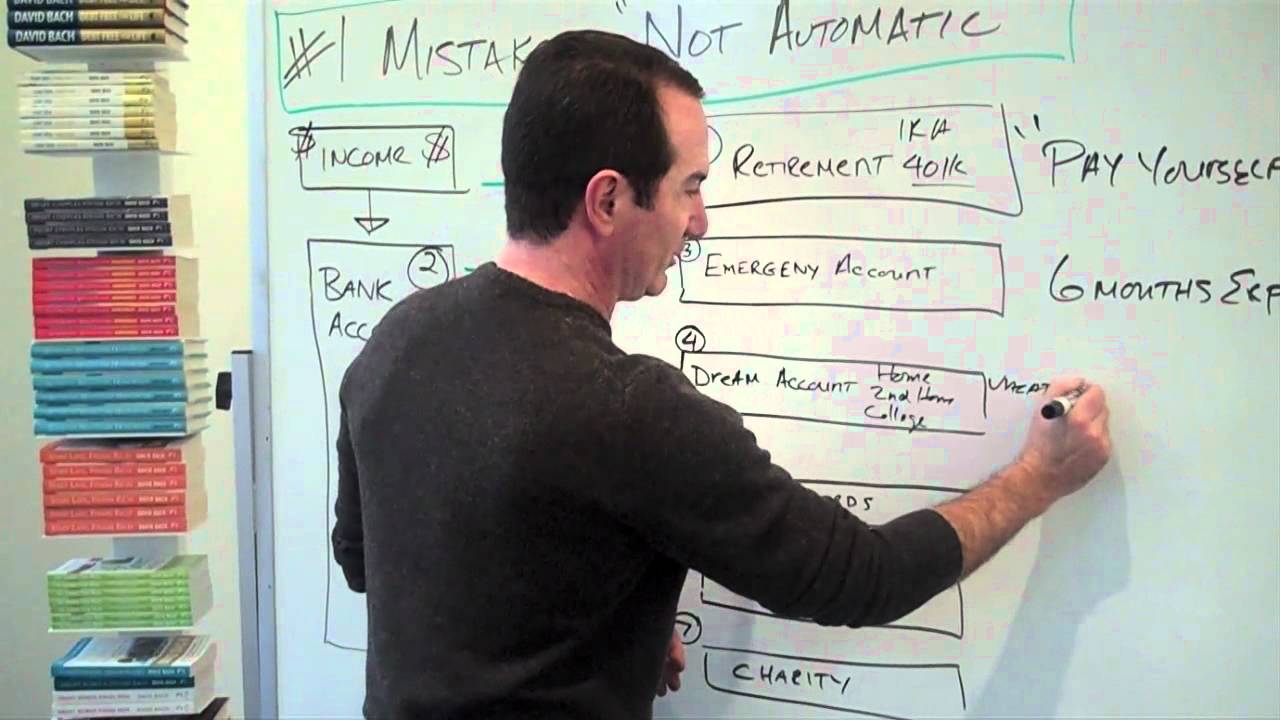

Paying yourself first is the reverse of budgeting. Bach’s method includes setting up multiple savings accounts (including maxing out your 401(k) if you can!) and making sure your money goes to all of your future goals before it even reaches your hands.

After learning the pay yourself first method, I set up an online savings account that I couldn’t access with my regular debit card. I also set up automatic transfers to that account each payday. With my hard-earned money squirreled away and out of reach, I wasn’t tempted to spend what I didn’t have and quickly built up a surprisingly large savings.

Did my lifestyle suffer with this method? Not at all. I didn’t miss the money because I never saw it.

Advice That Works for Anyone

I first read The Automatic Millionaire at the recommendation of a friend who had been through bankruptcy and was working to get his financial life back on track. Although our financial pictures were very different, I still found Automatic Millionaire just as applicable to my situation.

In the second chapter of the book, Bach introduces the “Latte Factor”–his term for everyday spending that keeps you from reaching your long-term goals.

Each person has their own Latte Factor that doesn’t necessarily come in the form of espresso. For me, lattes are a weekly treat that I would have a hard time giving up, but this chapter forced me to reevaluate other purchases like lunches out and online shopping, to figure out where I could come up with some extra bucks.

No matter where you’re starting from, David Bach truly believes that ANYONE can afford to pay themselves first.

The Automatic Millionaire: A Powerful One-Step Plan to Live and Finish Rich

Saving For Your Dreams

At age 26, saving for retirement seems like a distant and less-than-exciting goal. However, The Automatic Millionaire goes beyond retirement planning and includes a Dream Fund. The dream fund can be used for anything from a new laptop to an exotic vacation, anything that gets YOU excited about saving money and conquering your Latte Factor.

With The Automatic Millionaire, your money isn’t just going to boring things like retirement and mortgage payments (although by following this method, you’ll pay off your mortgage years early and retire a millionaire!). The plan includes the Dream Fund, a rainy-day fund and even charitable giving. It’s about enjoying your life today while building stability for the future.

David Bach explains the benefits of automating your finances

Written by

Written by