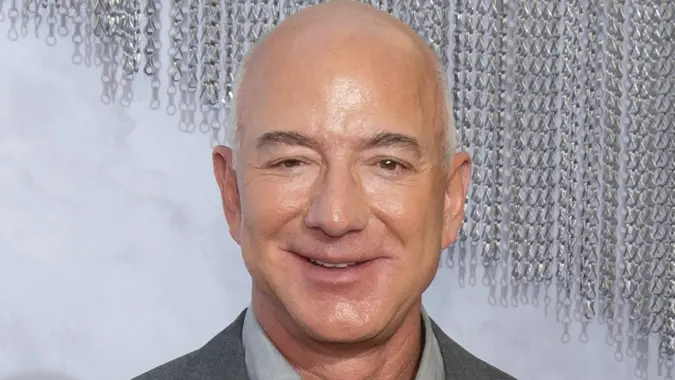

Jeff Bezos Cut His Tax Bill by $1 Billion — 2 Lessons for Everyday Americans

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

Moving states can sometimes pay off during tax season. This was certainly the case for Amazon founder Jeff Bezos, who saved an estimated $1 billion in taxes in 2024 by moving from Washington to Florida.

Since his move in early 2024, Bezos also sold an estimated $13.6 billion worth of Amazon stock, Forbes reported. This was the first time Bezos had sold stock since January 2022. Forbes noted that his pause coincided with Washington (where Bezos lived at the time) enacting a 7% levy on long-term capital gains of more than $250,000. Unlike Washington, Florida doesn’t have a state income tax, capital gains tax or estate tax.

Bezos first announced his move from Seattle to the Miami area in an Instagram post in November 2023. That year, Bezos spent $234 million for three mansions on Indian Creek, also known as Florida’s Billionaire Bunker. He also registered to vote and filed a registration of domicile in the state, which is the process of establishing a person’s permanent home for legal purposes.

In February 2024, Bezos sold $8.5 billion worth of Amazon stock, and an additional $25 million in March. The sale was completed in November for gross proceeds of an additional $5.1 billion. Had he remained in Washington, Forbes pointed out that his state capital gains tax bill would have amounted to $954 million.

So what can everyday Americans learn from his move? Here’s what you need to know.

State Taxes Can Impact Your Wealth

If you have significant investments, business income or high earnings, where you live can impact how much you keep.

For example, a 2024 report by personal finance site Self Financial noted that the average American pays about $524,625 in taxes throughout their lifetime. However, residents in some states pay more than others. New Jersey taxpayers, for example, paid the most ($987,117), while West Virginians paid the least ($358,407).

Moving to a Tax-Advantaged State Can Be a Smart Financial Move

Relocating to a tax-friendly state can potentially save you anywhere from 8% to 16% on your tax bill, MarketWatch reported, but that doesn’t necessarily mean it will be more affordable. There are other factors to consider when relocating besides whether the state has an income tax. Property and sales taxes, excise tax and home insurance can also affect the overall cost of living.

Andrey Yushkov, a senior policy analyst with the Center for State Tax Policy at the nonpartisan nonprofit Tax Foundation, explained to Money that those who typically benefit the most from moving to states with no income tax are high-income individuals like Bezos. Before relocating, Yushkov recommended looking at your individual circumstances, including “job opportunities, family considerations, climate, infrastructure, educational system” and local taxes.

Written by

Written by  Edited by

Edited by