Saving and Investing

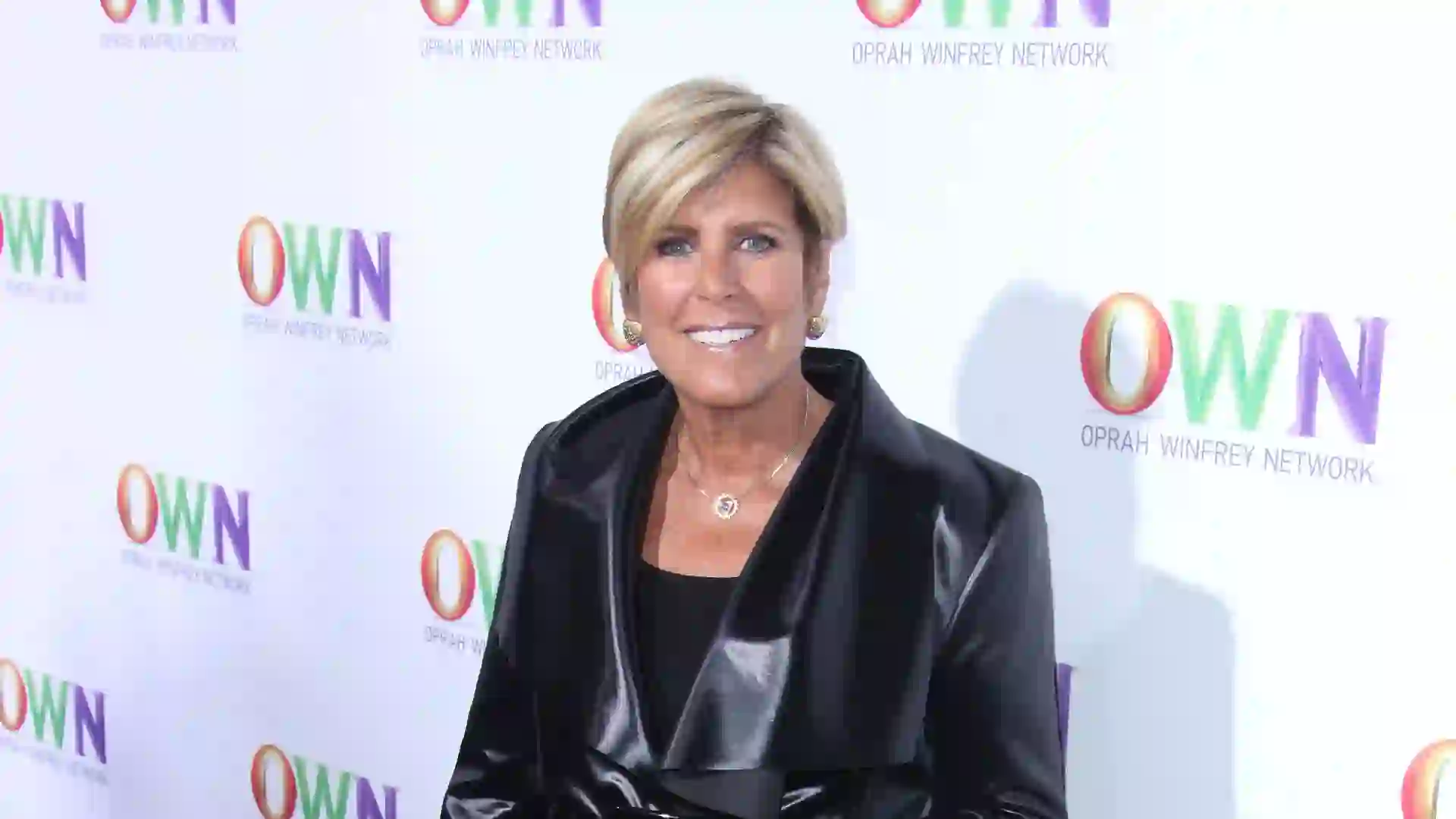

Suze Orman’s 5 Basic Money Rules To Get You on the Right Track

When it comes to your personal money management strategy, sometimes it’s best to get back to basics. Whether you are looking to improve your credit score, develop saving money habits or boost your financial literacy, there are many positive steps you can take to build wealth. Up Next: Suze Orman’s Top Tip for Building Wealth Is a ‘Very Easy One’ For You: 6 Things You Must Do When Your Savings Reach $50,000 Financial expert and bestselling author Suze Orman, who has an estimated net worth of about $75 million, is known for her easy-to-follow, no-nonsense money advice that can help…

Spending

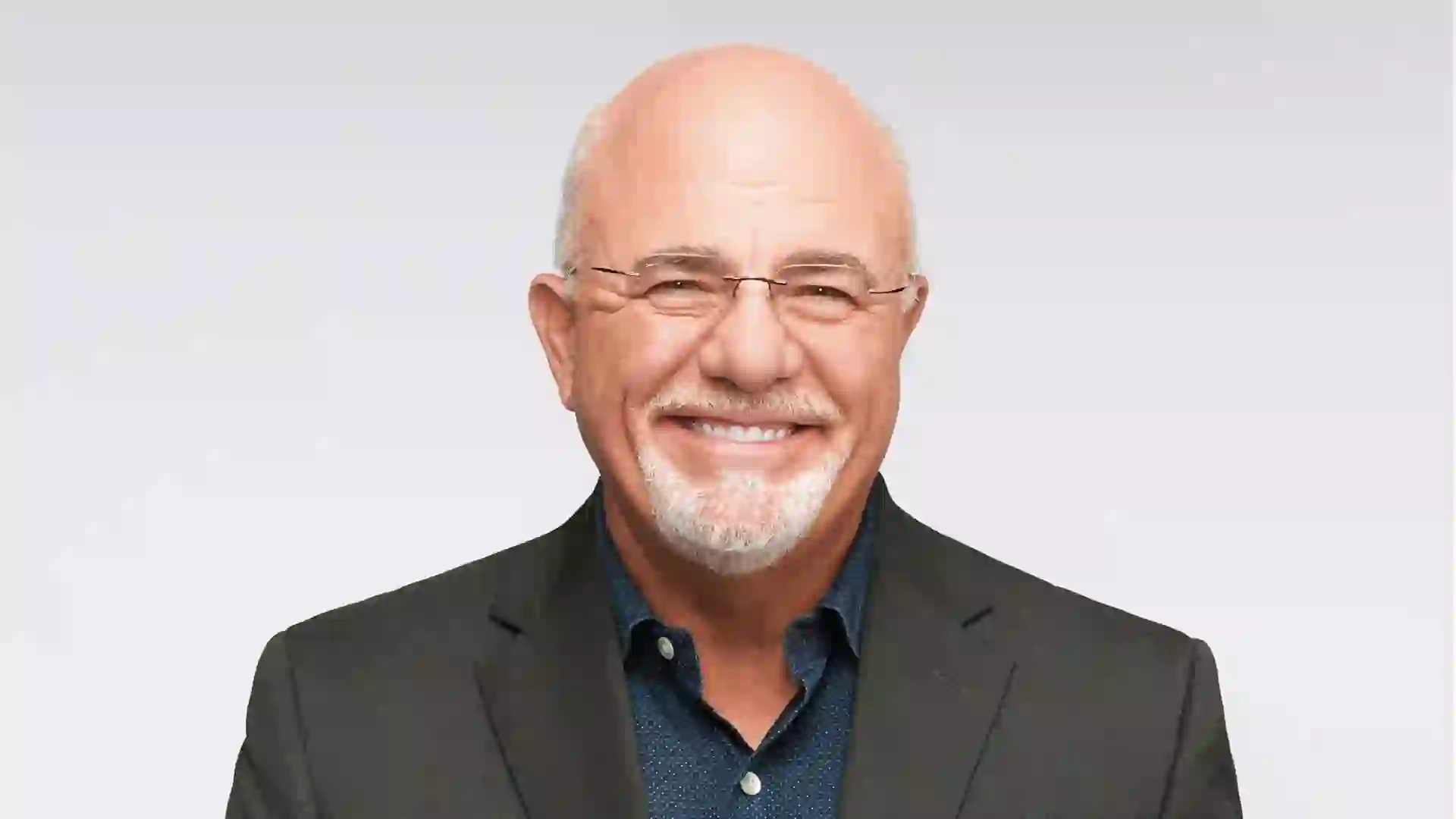

Dave Ramsey’s Best Basic Money Advice To Get You Started

Dave Ramsey is one of the best-known financial experts in the country. His straightforward money advice has helped countless people get out of debt and find financial freedom. The talk radio personality turned podcast host is also a New York Times bestselling author. Millions of people follow him for his proven techniques for taking control of your money. Check Out: Top Money Moves for Boomers, Gen X, Millennials and Gen ZRead More: 6 Genius Things All Wealthy People Do With Their MoneyA quick review of Ramsey Solutions can help you better prepare yourself to weather any financial hardships that may come…

Earning

5 Ways Your Side Gig Can Help You Escape Debt Forever

If you’re trying to pay off your debt, you’ve likely looked into side hustles to help you make extra money to contribute toward your payments. The good news is that there’s more to a side hustle than just making a few extra dollars, as the right gig can change other aspects of your life. Check Out: 6 Best ChatGPT Prompts To Find Your High-Income Side GigRead Next: 7 Unusual Ways To Make Extra Money (That Actually Work) What are the different ways that picking up a side gig can help you get out of debt and stay out of debt…

Borrowing and Protecting

4 Banking Scams That Might Target Your Money

There are many benefits to keeping your funds in a bank account, but one of the main reasons many people keep their money at a bank rather than under the mattress is the added security this provides. However, some scammers have come up with clever ways to access your bank account information or to get you to send them money from your secure accounts. Read More: 12 of the Most Valuable $1 Bills Still in CirculationDiscover More: How To Get $340 Per Year in Cash Back on Gas and Other Things You Already Buy Here’s a look at some of…