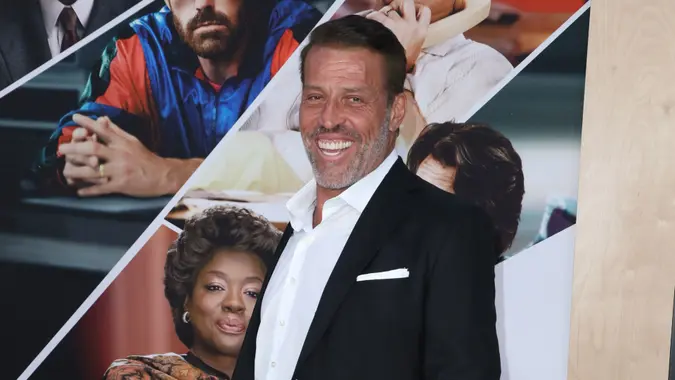

Tony Robbins: Should You Invest In an Annuity?

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

Annuities are fair game if you abide by Tony Robbins’ financial advice — at least some of them. The entrepreneur has been vocal in his belief that investing in one could serve as a solid source of retirement income.

When you buy an annuity from an insurance company, you make either a single payment or a series of payments. In turn, you either receive a lump-sum payout or a series of payments over time.

The three basic types of annuities are fixed, variable and indexed. A hybrid of these, Robbins has endorsed fixed index annuities.

A long-term investment, a fixed index annuity (FIA) ties your returns to the stock market, without directly investing your money. This means you have the potential to earn a high rate of return — if the index your fund is tied to performs well — but you don’t have to put your money at risk.

“In today’s economic environment, where returns for ‘safe capital’ are minuscule, FIAs can be a great alternative to other ‘safer money’ financial instruments,” Robbins wrote in a blog post.

He noted that many companies offer a benefit called a ‘lifetime income rider,’ which guarantees you’ll receive a certain amount of income for the rest of your life. He said this typically comes at an added cost.

When paired with the lifetime income rider option, “Many FIAs today offer the contract holder the opportunity to have their money grow at a guaranteed rate ranging from 5-7%,” Robbins wrote. “This balance is called the income account value, and while it cannot be accessed in a lump sum, it can be turned into a lifetime income stream whenever you choose, similar to a traditional pension plan.”

He wrote that people are often opposed to annuities in general for a variety of reasons, including a belief that they’re all associated with high fees. Variable annuities have numerous fees, he wrote, and they’re frequently grouped with fixed index annuities — often unjustly.

While Robbins does believe many fixed index annuities are a good investment, he emphasized in his blog post that this isn’t the case for every one of them. He noted that these products are only as good as the companies backing them, so it can be wise to seek out well-established insurance companies with a good reputation of keeping their financial commitments.

In another blog post, Robbins highlighted the importance of allocating assets into three buckets — a security bucket, a risk/growth bucket and a dream bucket. Defined as the bucket that gives you peace of mind in knowing the investment won’t cause you to lose your life savings, guaranteed annuities were one option he listed as a possibility for the security bucket.

Ultimately, Robbins wouldn’t advise you to invest in just any annuity. He clearly stands behind the fixed index annuity, but would advise you to do your homework to ensure you’re investing in a solid product that deserves your confidence.

Written by

Written by  Edited by

Edited by