3 Ways To Protect Your Money From Inflation, According to an Expert

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

Inflation may not be a four-letter word, but it can certainly feel like one. When prices rise faster than your paycheck, your savings shrink, and even the most confident investors start to worry.

High inflation chips away at your purchasing power and adds pressure to every financial decision, whether you’re trying to budget, save, or grow your money. So how can you protect your finances when it feels like inflation is working against you at every turn?

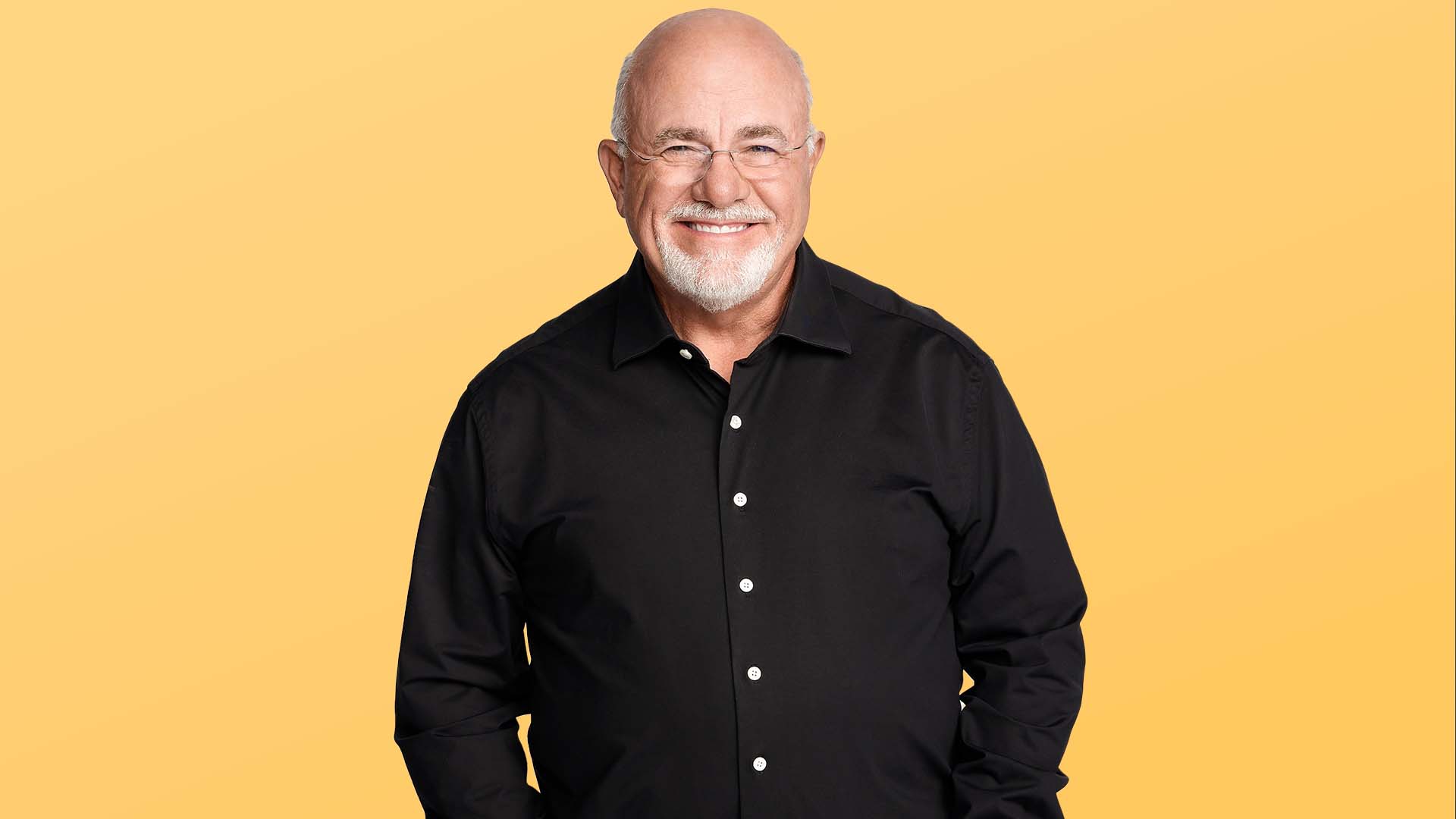

GOBankingRates spoke with Jason Brown — a stock market expert, options trader, and author of “Five-Year Millionaire” — as part of our Top 100 Money Experts series to get his take on how to protect your wealth in inflationary periods. Brown has lived through and overcome his own economic challenges — he went from sleeping in a sleeping bag on the floor of his childhood home in Detroit to becoming debt-free, mortgage-free, and one of the most respected voices in investing.

His advice? Don’t panic — get strategic.

Here are three moves Brown recommends when inflation is high and your buying power is under pressure.

1. Focus on the Bare Necessities

Remember that song that Baloo and his friends sang in “The Jungle Book,” “The bare necessities?” Turns out, they were onto something when they advised you to only focus on what you need. For Brown, one of the best ways to protect your money in a high inflation economy is to adjust your spending to prioritize — you guessed it — the bare necessities.

Brown recommends creating a spreadsheet and dividing your spending into three categories:

- Needs: “Food, shelter, utilities. These are non-negotiables.”

- Nice-to-haves: “Maybe you need a car, but not necessarily a brand-new Cadillac.”

- Wants: “New TVs, vacations, or jewelry — things you can live without.”

During periods of high inflation, Brown suggests prioritizing the first category and trimming or eliminating the rest.

“Consider eliminating anything in the want category while inflation is high,” he said. “You can look at your nice-to-haves and see where you can pivot or reduce spending. The goal is to ensure you have enough for your needs, because those have to be covered no matter how high inflation climbs.”

2. Be Strategic With Your Investments

High inflationary periods can make even the most financially savvy people hesitant to invest. But Brown cautions against overreacting.

“Don’t let fear reign,” he said. “There are plenty of companies out there with pricing power and operational efficiencies that can deliver strong returns, even in a high-inflation environment.”

For retirees or those with lower risk tolerance, Brown recommends guaranteed or low-risk financial vehicles.

“Look into CDs, bonds and other guaranteed investments that can beat or at least keep up with inflation,” he said.

For investors still actively building wealth, Brown suggests looking toward sectors with strong historical performance.

“Technology is one asset class that continues to outperform inflation and the market over time,” he said. “If you want to avoid individual stock picking, consider a tech-focused ETF like XLK or broader ETFs like the S&P 500.”

And for those more advanced in their investing knowledge, Brown points to options trading.

“You have the ability to protect your portfolio, bring in additional income from selling options, and use leveraged strategies that can beat inflation — when used correctly,” he said.

3. Don’t Panic — Think Long-Term

Inflation headlines have a way of making one’s blood pressure skyrocket in a way we probably wish our stock portfolios would. But Brown reminds us that the market, over time, has always recovered.

“Despite pandemics, recessions, and yes — even inflation — the market always goes up in the long run,” he said. “That’s why it’s important to think long term and stick with low-risk investments that align with your goals.”

For many, that could mean investing in ETFs or something like SPY, which tracks the S&P 500. Brown also recommends potentially using options strategies to hedge against downturns.

“Put options can act like ‘insurance’ during market dips,” he said. “And selling call options against your portfolio can be another smart way to generate income and offset inflation risk.”

More than anything, Brown wants people to resist emotional decision-making. “The key is having the right knowledge,” he said. “And letting that guide your decisions — not fear, panic, or uncertainty.”

This article is part of GOBankingRates’ Top 100 Money Experts series, where we spotlight expert answers to the biggest financial questions Americans are asking. Have a question of your own? Share it on our hub — and you’ll be entered for a chance to win $500.

More From GoBankingRates

Written by

Written by  Edited by

Edited by  Money Expert

Money Expert