Grant Cardone Breaks Down His Foolproof Wealth Creation Formula: ‘Most People Have It Incorrect’

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

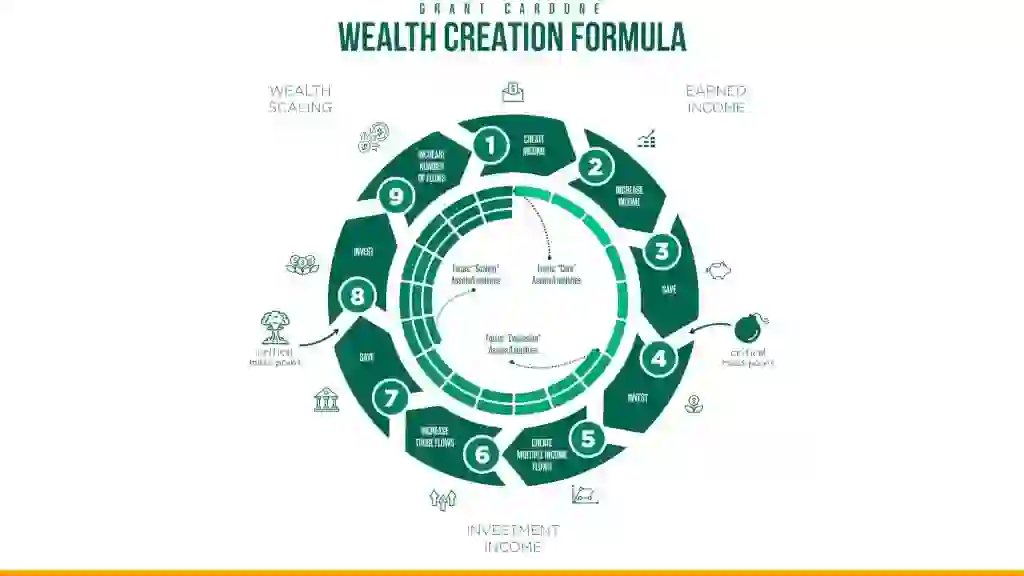

Grant Cardone has mastered the art of building wealth. The CEO of Cardone Enterprises and Cardone Capital currently owns and operates seven privately held companies and a portfolio of over $4 billion in multifamily properties. Now, Cardone is breaking down his proven methods in his upcoming book, “The Wealth Creation Formula.”

Cardone gave GOBankingRates a sneak peek into what his formula entails, and what most people get wrong about building wealth.

Grant Cardone’s Wealth Creation Formula

The first step in Cardone’s formula is to find a job where you can excel and earn income, and then look for ways to earn more income within that company.

“You don’t go get a second job. You don’t go sell stuff on the weekends,” Cardone said. “What you do is you figure out, if you’re a receptionist, how do I attach myself to some of the flow of income within the company?”

As your income increases, do not adjust your lifestyle.

“Start storing money in order to make investments in a third, passive income flow,” Cardone said. “You shouldn’t be buying a house, you shouldn’t be buying a car, you shouldn’t be paying off your debt right now. You shouldn’t be chasing any of that.

“All your attention should be on new income and starting to make new investments,” he continued. “In the beginning, what you’re doing is you’re improving the quality of your investments, not improving the quality of your life.”

Keep saving money until you have enough to invest in income-producing assets, such as multifamily real estate properties, and use profits from those investments to buy more assets, until you’re generating enough passive income to provide yourself with the lifestyle you desire.

The Big Mistake Most People Make

Cardone said that the biggest misstep many people make during the wealth-creation process is improving their lifestyle before building up their investment portfolio.

“People have the order incorrect,” he said. “You should improve the quality of your assets and investments first, and let those improve the quality of your life. Those investments, when they start paying off, that is what determines better clothes, a nice bag, a newer car.”

Cardone has followed his own advice.

“What most people do is they get a job, they reward themselves. I didn’t do that,” he said. “What I did is I got a job, and I got good at the job, and then I got great at the job. And then when I got great at the job, people paid me more money. When they paid me more money, I went and bought assets that would pay me more money, that would give me more income, like real estate investments.

“When my buddies were out buying BMWs and going on trips to Europe, I wasn’t doing that,” Cardone continued. “I didn’t improve the quality of my life, I improved the quality of my assets.”

Written by

Written by  Edited by

Edited by