Want to Avoid High Taxes? Retire in One of These 10 States

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

If you’re approaching retirement, you might be contemplating whether you should relocate to another city or even another state. As you compare home prices and cost of living expenses, don’t forget to include another important factor: taxes. In fact, you might want to move to one of the most tax-friendly states for retirees.

A new GOBankingRates study factored in several variables, including state taxes on Social Security benefits, sales taxes, income taxes and property taxes. It scored each factor comparatively and then weighted them to determine which states had a combination of factors that would be especially tax-friendly for retirees.

The results are illuminating. When you consider that many people move in retirement — whether it’s buying a vacation home, moving closer to family or just seeking out a warmer climate — knowing the difference in tax rates from state to state can be essential to planning a happy retirement. If you’re living in Minnesota but planning on buying a condo in Nevada to escape the winters, for example, the choice of which location to make your official residence could mean a difference of thousands of dollars a year on your tax bill.

One major takeaway from the study is that states with taxes on Social Security benefits ranked very low. Of the states that have taxes on Social Security income, 12 of them ranked in the bottom 15 least tax-friendly states.

Income taxes, likewise, made a big difference. Of the top 10 most tax-friendly states, only two have any state income taxes. Texas has no state income tax and fell outside the top 10, coming in at No. 20 due to its relatively high sales tax rate (8.19 percent) and property tax rate (1.62 percent).

Click to See: Where $100,000 Lasts the Longest in Retirement

Here are the 10 states that are the most tax-friendly for retirement:

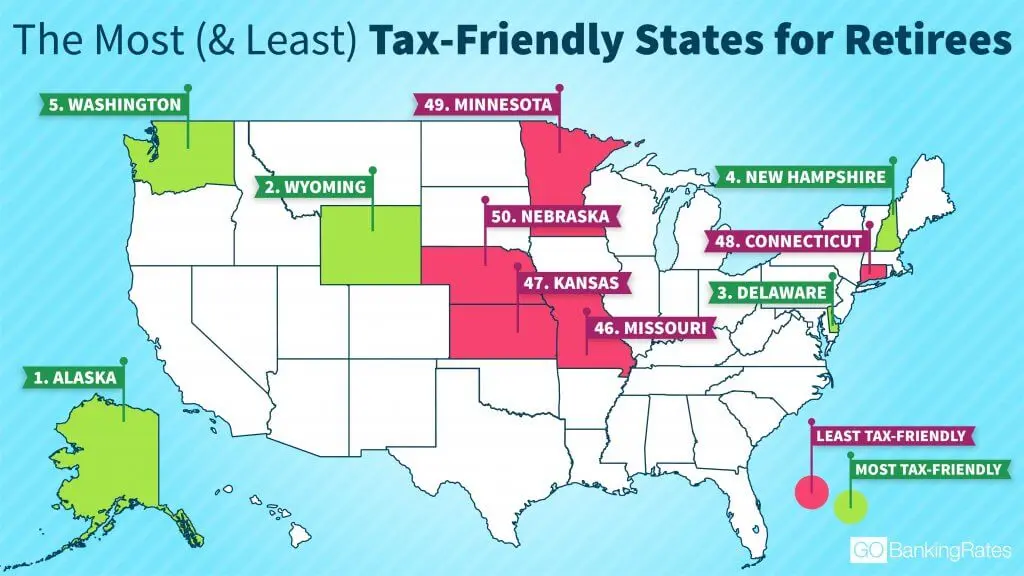

1. Alaska 2. Wyoming 3. Delaware 4. New Hampshire 5. Washington 6. Nevada 7. Florida 8. South Dakota 9. Tennessee 10. Hawaii

And here are the 10 states that have the steepest taxes hitting their retired residents:

50. Nebraska 49. Minnesota 48. Connecticut 47. Kansas 46. Missouri 45. Vermont 44. Rhode Island 43. New Mexico 42. West Virginia 41. Utah

Keep reading to see what a comfortable retirement will cost you in every state.

More on Retirement Planning

- Only 2% of Americans Passed This Retirement Quiz

- How Long $1 Million in Retirement Will Last in Every State

- Survey Finds 42% of Americans Will Retire Broke — Here’s Why

- Watch: How One Couple Retired in Their 30s to Travel in an Airstream RV

We make money easy. Get weekly email updates, including expert advice to help you Live Richer™.

Written by

Written by  Edited by

Edited by