Watching These 5 TV Shows Will Make You Smarter With Your Money

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

Television may get a bad rap for pushing mindless entertainment on viewers, but there are many popular television shows hosted by well-known personal finance experts remove the guesswork and provide practical, easy-to-follow guidance.

Ready to get your finances on track and increase your net worth? Here are five television shows that not only entertain, but can make you richer.

1. The Suze Orman Show – CNBC

Suze Orman‘s “tell-it-like-it-is” attitude is certain to give your personal finances a complete makeover. This financial guru connects with her audience and offers practical tips to help them achieve their life goals.

Suze Orman‘s “tell-it-like-it-is” attitude is certain to give your personal finances a complete makeover. This financial guru connects with her audience and offers practical tips to help them achieve their life goals.

Whether you need to pay down your debt or add to your retirement savings account, Suze Orman stresses the value of early planning, living within your means and creating an eight-month emergency cushion.

During her “Can You Afford It” segment, Orman closely examines each caller’s financial situation to determine whether they can afford a particular purchase — vacation, new home, home remodel, etc. Plus, she addresses a number of viewer questions and concerns via webcam. Tune in every Saturday night and she’ll motivate you to take a hard look at your own finances and make financial decisions based on logic, not emotion.

2. Money 911 – NBC Today Show

David Bach, one of the financial experts on Money 911, provides on-air answers to questions received by Today Show viewers. Bach tackles questions on topics, such as credit card debt, home appraisals, mortgages, investments and saving. He educates viewers on the difference between good debt and bad debt, and he preaches the importance of financial freedom through debt elimination. Learning how to live on less is Bach’s strategy for finishing rich.

David Bach, one of the financial experts on Money 911, provides on-air answers to questions received by Today Show viewers. Bach tackles questions on topics, such as credit card debt, home appraisals, mortgages, investments and saving. He educates viewers on the difference between good debt and bad debt, and he preaches the importance of financial freedom through debt elimination. Learning how to live on less is Bach’s strategy for finishing rich.

3. Clark Howard Show – HLN

Clark Howard believes that saving money and penny-pinching is the way to survive tough financial times. Always on the watch for the next best deal, Howard offers advice for scoring discounts on practically everything — vacations, mobile phone service, groceries and entertainment. His tips will make you think twice about paying full price. And once you master the art of comparison shopping, you’ll understand the connection between smart spending and personal wealth.

Clark Howard believes that saving money and penny-pinching is the way to survive tough financial times. Always on the watch for the next best deal, Howard offers advice for scoring discounts on practically everything — vacations, mobile phone service, groceries and entertainment. His tips will make you think twice about paying full price. And once you master the art of comparison shopping, you’ll understand the connection between smart spending and personal wealth.

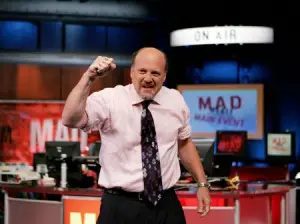

4. Mad Money – CNBC

One glimpse of Jim Cramer’s energetic, high-strung antics, and you may reach for the remote control. But if you can get pass his sound effects, the rants and yelling, Cramer offers practical advice for playing the stock market. He encourages diversification, discusses how to identify danger zones, as well as when to sell and buy. Cramer also offers his pick of potentially profitable stocks. Even if you don’t have a strong interest in the stock market, Mad Money is good entertainment. (Photo: WhizBang)

One glimpse of Jim Cramer’s energetic, high-strung antics, and you may reach for the remote control. But if you can get pass his sound effects, the rants and yelling, Cramer offers practical advice for playing the stock market. He encourages diversification, discusses how to identify danger zones, as well as when to sell and buy. Cramer also offers his pick of potentially profitable stocks. Even if you don’t have a strong interest in the stock market, Mad Money is good entertainment. (Photo: WhizBang)

5. Til Debt Do Us Part – MSNBC

Financial expert Gail Vaz-Oxlade takes couples therapy to another level. Each week she meets with a different couple and helps them through their toughest financial problem — consumer debt. There’s no sugarcoating as Vaz-Oxlade forces couples to come face-to-face with their balances and realize the long-term consequences of excessive spending.

Financial expert Gail Vaz-Oxlade takes couples therapy to another level. Each week she meets with a different couple and helps them through their toughest financial problem — consumer debt. There’s no sugarcoating as Vaz-Oxlade forces couples to come face-to-face with their balances and realize the long-term consequences of excessive spending.

Through a series of challenges, couples learn how to live on less and develop a financial recovery strategy. For couples who follow her advice, they receive a considerable sum to help pay down their debt balances. (Photo: CBC)

Written by

Written by