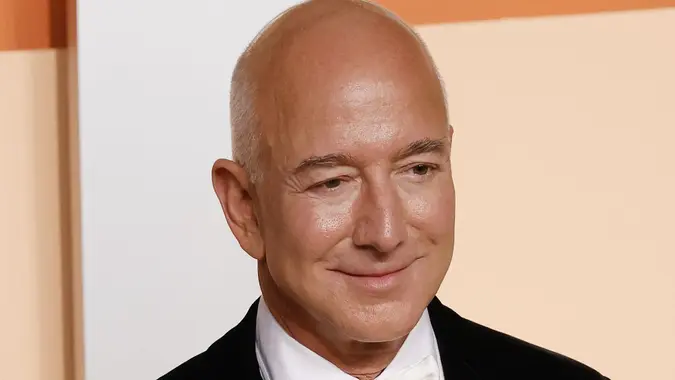

The Most Profitable Decisions in Jeff Bezos’ Career

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

Jeff Bezos is the No. 2 richest person behind Elon Musk. According to Forbes, his $213.9 billion net worth makes him one of only 14 centi-billionaires on earth.

As a younger man, he had a good job that paid good money, but he got rich — and then ultra-rich — through a series of decisions that diversified his income streams, expanded his business empire and squeezed his rivals.

These key business decisions steered Jeff Bezos’s journey to the top of the 1%.

Becoming His Own Boss

Bezos became the godfather of the e-commerce revolution in 1994 when he quit his hedge fund job and founded an online bookstore in his Seattle garage with what Bloomberg revealed in 2018 to be a $245,573 loan from his parents, Mike and Jackie Bezos.

Today, Amazon is worth more than $2 trillion and is the world’s No. 4 biggest company, which is a leader in everything from movie production to cloud storage. Forbes cites Bezos’s ownership stake at just under 10% of the company, which tallied $311.67 billion in gross profits in 2024 alone.

Expanding From Online Selling to Online Storage

Not satisfied with running the world’s largest e-commerce platform, Bezos launched the Amazon Web Services (AWS) division in 2006 to expand his operations into digital storage and IT infrastructure.

In 2023 Forbes reported that AWS had evolved into Amazon’s most profitable division. In October 2024, CNBC reported that AWS had reached its highest profit margin in at least a decade and tallied year-over-year growth for five quarters straight. The company’s third-quarter results showed $27.45 billion in revenue.

Focusing on Advertising

According to Statista, advertising is Amazon’s No. 3 most profitable division after retail (including third-party seller services) and AWS.

An eMarketer profile on the Amazon business model showed how its three-layer advertising structure keeps the division both profitable and resilient.

- Most of Amazon’s U.S. ad revenue comes from Amazon sellers purchasing cost-per-click impressions.

- Advertisers buy display impressions on Amazon’s demand-side platform (DSP) across Amazon’s retail properties and non-retail properties like IMDb TV and Twitch.

- Publishers use Amazon Publisher Services to access both Amazon and other supply-side platforms.

The publication wrote that Amazon’s three-tier structure has challenged “the Meta and Google duopoly” in digital advertising, grabbing 13.9% of the U.S. digital ad market in 2024 — still behind, but gaining on Meta’s 21.3% and Google’s 25.6%.

Relentlessly Expanding His Empire

Bezos has spent the 21st century acquiring various brands and companies, both independently and through Amazon.

- Whole Foods: $20 billion in annual net sales

- Blue Origin: $2.8 billion in annual revenue

- Zappos: $1.11 billion in annual net sales

- Twitch: $1.8 billion in annual revenue

- Goodreads: $35 million in annual revenue

- IMDb: $216 million in annual revenue

- Audible: $1 billion in net revenue

- Metro-Goldwyn-Mayer (MGM): $1.24 billion in annual revenue

- Ring: $750 million in annual revenue

Written by

Written by  Edited by

Edited by