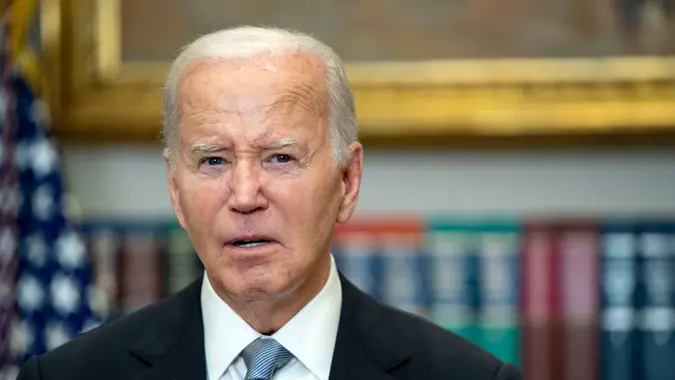

6 Things the Middle Class Couldn’t Afford During Joe Biden’s Presidency

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

Life has certainly grown more expensive in the U.S. over the last few years. A TruStage survey among middle-class Americans found that 61% felt the economy was on the wrong track toward the end of Joe Biden’s presidency. Eighty-seven percent listed inflation as a top concern.

So what couldn’t middle-income Americans afford, that they once could, in the wake of the Biden administration?

Starter Homes

The American dream of homeownership has never felt so out of reach.

“Housing affordability has emerged as a prominent crisis for the middle class,” noted real estate investor Michael Elefante.

Sure enough, median home prices soared 32.6% from the time Biden took office until the time he left, according to Zillow data.

Homeowners Insurance

Housing costs also got hit from another direction: Skyrocketing homeowners insurance premiums.

Data released by insurance platform Matic showed that homeowners who took out a policy in 2021 were paying 69% more by 2024. Not many people saw their paychecks rise by 69%, in contrast.

The surge in homeowners insurance rates has led many homeowners to forego insurance entirely — a dangerous proposition.

Used Cars

Remember when you scraped together money from side jobs as a student, to buy your first beater car?

That’s a lot harder today. Melanie Musson, a consumer finance expert at Clearsurance.com, said used car prices rose to dizzying heights over the last four years.

“You could pick up a beat up but reliable car for about $7,000, but now you need to be prepared to spend between $10,000 and $15,000,” she said.

Beef

Sure, hamburgers are named after a city in Germany, but they still feel as American as apple pie. Except many middle-class Americans can’t afford beef anymore.

Federal Reserve data shows the price of ground beef rising 41.4% during Biden’s presidency, and that says nothing of the price of a New York strip or filet mignon.

“Staple foods such as fresh produce and beef have seen so much inflation that many homes have changed their eating habits,” added Elefante.

Spa Treatments

Middle-class Americans used to be able to unwind at the spa after a long week of work. Musson has seen this firsthand: “In many cases, a treatment that used to cost $60 now costs $120.”

Massages, manicures, pedicures, hair treatments — all have shot up in cost. Many middle-class Americans have given up on these small luxuries and started doing their own treatments at home.

Handcrafted Coffees

Another minor luxury that many middle-class workers used to indulge in, specialty coffees from local cafes and coffee shops have also surged in cost.

“You used to be able to stop and grab an espresso drink for $5,” recalled Musson. “Now, you’re lucky if you can leave the coffee shop with a drink costing less than $10 in many cities.

“You might still pick up a handcrafted drink for a special treat, but for daily convenience items, it’s out of the budget for many in the middle class.”

The Bottom Line

Inflation doesn’t strike every product or service equally. Some have exploded in cost while others have only plodded upward. But cost of living has surged in the U.S. over the last four years, and doesn’t appear to be dipping again anytime soon.

Written by

Written by  Edited by

Edited by