When Will I Retire?

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

Figuring out when to retire isn’t just about picking a date — it’s about balancing your finances, lifestyle goals, and long-term security.

The best time to retire is when you’re financially prepared, emotionally ready to leave work, and confident your savings can support the lifestyle you want — whether that’s at 55, 65, or 70.

To find your ideal retirement age, you’ll need to look at your savings, income sources, and the kind of life you want to live once you leave the workforce. Here’s what to consider as you plan your retirement timeline.

What Is the Average Retirement Age?

Retirement can look different for everyone, but data gives us some general benchmarks. On average, men in the U.S. retire at about 64 years old, while women tend to retire slightly earlier at around 62. However, these averages don’t tell the whole story.

When it comes to Social Security, your full retirement age (FRA) depends on the year you were born. If you were born in 1960 or later, you’ll be eligible for full benefits at age 67. For those born before 1960, the FRA ranges from 66 to just under 67, depending on your birth year. Of course, these are just benchmarks — many people choose to retire earlier or later based on their health, finances, or how fulfilled they feel at work.

Keep in mind that while the average retirement age provides a useful reference point, the right age for you will depend on your unique financial and personal circumstances.

When Can You Retire? Here’s How to Tell

Figuring out when you can retire starts with a clear understanding of your current financial situation. Here are some recommendations to help you estimate your ideal retirement age:

Evaluate Your Savings

Calculate the total amount you’ve saved so far, including retirement accounts like 401(k)s, IRAs, and any other investments. How much you’ve saved will provide the foundation for estimating your retirement age.

If you’re still in your working years, check whether your annual contributions line up with your retirement goals.

Map Out Your Retirement Income

Retirement savings are just one piece of the puzzle. Factor in Social Security benefits, pensions, or any income from rental properties or other investments. You may even want to consider part-time work or side hustles, which can supplement your income in retirement as needed.

Adjust for Your Lifestyle Goals

Consider the type of life you want in retirement. Will you travel a lot, downsize, or live in a low-cost area? These choices will significantly affect how much you’ll need each year, therefore, how soon you can retire.

Use Retirement Calculators

Online tools, such as retirement calculators, can provide a clearer picture of retirement readiness by factoring in your current savings, ongoing contributions, expected rates of return, and future expenses. These tools can help define when you’ll have enough saved to safely stop working full-time.

Account for Key Expenses

Retirement planning isn’t just about how much you’ve saved, it’s also about how much you’ll spend. Big-ticket items like housing, healthcare, and debt can significantly impact your timeline. If you’re still paying off a mortgage or managing large expenses, you may need to hold off on retiring until those costs are under control.

How Much Money Do You Need to Retire Comfortably?

When it comes to retirement savings, financial experts commonly use a few general guidelines. These benchmarks can help you measure whether you’re on track:

Aim to Save 10-12 Times Your Final Salary

By the time you retire, many advisors suggest saving around 10 to 12 times your yearly salary. If you plan to retire at 65 with a salary of $80,000, this means you’ll need $800,000 to $960,000 in retirement savings.

Use the Four Percent Rule to Stretch Your Savings

The four percent rule states that you can withdraw four percent of your total savings every year to fund your retirement. For example, if you retire with $1 million saved, the rule suggests you can safely withdraw $40,000 annually, adjusting for inflation, throughout your retirement without running out of money.

Consider Inflation and Healthcare Costs

Don’t overlook inflation and rising healthcare costs — they can take a serious bite out of your retirement savings. Medical expenses tend to increase with age, and planning for those higher costs now can help you avoid financial stress later. Building in a cushion for future healthcare needs may mean saving more upfront.

Factors That Can Change Your Retirement Timeline

While financial preparedness is a big factor in your ability to retire, several other factors can influence when you retire:

Health Issues or Caregiving Responsibilities

Chronic health problems or the need to care for a loved one could push you to stop working earlier than planned. These situations can also increase costs, adding another layer of complexity to your retirement planning.

Job Satisfaction or Burnout

If you enjoy your job, you may decide to work longer, not just for the additional income but because you find purpose in work. On the flip side, if you’re burnt out, an early retirement might be more appealing, even if it requires stricter budgeting.

Hybrid Plans

Some people opt to keep working part-time or take on consulting or freelance opportunities in retirement. These options can provide financial benefits and meaningful engagement without the demands of a full-time job.

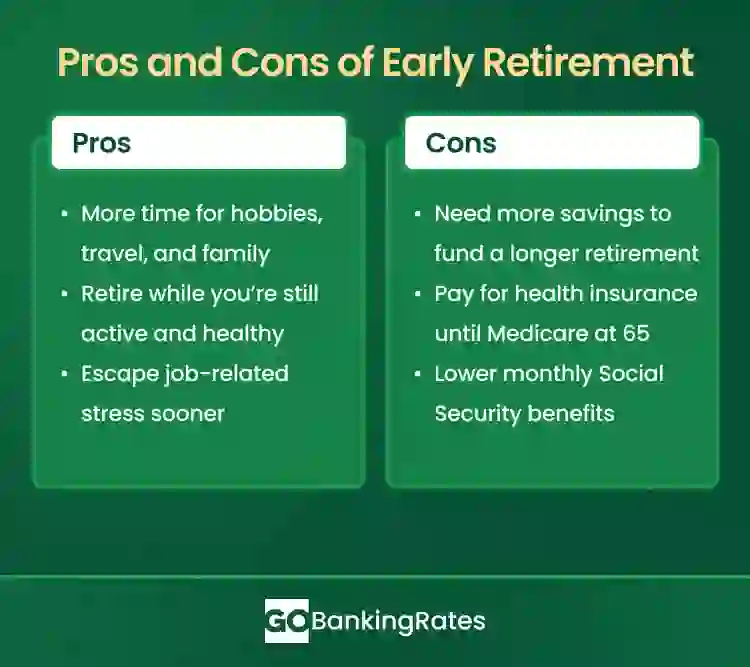

Should I Retire Early?

Deciding if you should retire early depends on your priorities and financial circumstances. Understanding the pros and cons can help guide your decision:

What About Delaying Retirement?

For some, staying in the workforce longer offers important financial and personal advantages. The extra working years give your investments more time to grow, reduce the number of years you’ll rely on your savings, and increase your monthly Social Security benefit into retirement, which maxes out if you wait until age 70.

Delaying retirement can also offer stability, especially if you’re concerned about healthcare costs or unsure whether your nest egg is large enough. Keeping employer-sponsored health insurance and avoiding early withdrawals can make a big difference over time.

But it’s not without trade-offs. Working longer means postponing the freedom to travel, rest, or spend more time with loved ones. And for some, the physical or emotional toll of continuing to work can outweigh the financial benefits.

How to Retire Early

If you’re eager to retire early, you’ll need a focused strategy. Here are a few tips:

- Max Out Retirement Accounts: Contribute the maximum to your 401(k) or IRA every year to take advantage of tax benefits and compounding growth over time.

- Lower Your Expenses: Create a budget that prioritizes saving. Cut back on discretionary expenses like dining out or frequent travel, and redirect that money to your retirement accounts.

- Pay Off High-Interest Debt: Reducing debt can free up more of your income for savings. High-interest credit card debt is especially important to eliminate.

- Consider Geoarbitrage: Living in a lower-cost location, whether in the U.S. or abroad, could dramatically reduce your living expenses and make early retirement more achievable.

- Part-Time Work in Retirement: Freelance or part-time gigs can supplement your savings and allow you to transition into full retirement gradually.

The Bottom Line

Your retirement age isn’t set in stone. It depends on your financial readiness and personal goals. The more you save and plan today, the more freedom you’ll have to decide when to retire. Use tools like retirement calculators, reduce your expenses, and maximize your savings to stay on track.

FAQ

- What is the average retirement age in the U.S.?

- The average retirement age is approximately 64 for men and 62 for women, but this can vary from person to person.

- How can I calculate when I can retire?

- Estimate your retirement age by analyzing your current amount of savings, income sources, and expenses, along with projections for those categories into the future. When you've calculated that you'll have enough to cover your expenses without a full-time job, you may be ready to retire.

- How much do I need to save to retire at 60 or earlier?

- You'll need about 10-12 times your annual salary. Be sure to include healthcare costs and a longer retirement period in your calculations.

- Does retiring later increase Social Security benefits?

- Social Security benefits increase for every year you delay claiming past age 62, up until your full retirement age or age 70. While you may decide to retire sooner, you can delay taking Social Security benefits until the age of 70 for a larger payout.

- Can I retire if I still have a mortgage?

- Yes, as long as your retirement income sources cover your monthly note. However, paying off your mortgage before retirement can reduce expenses and lead to a more comfortable budget in retirement.

Written by

Written by  Edited by

Edited by