62% of Americans Have Under $1,000 in Savings, Survey Finds

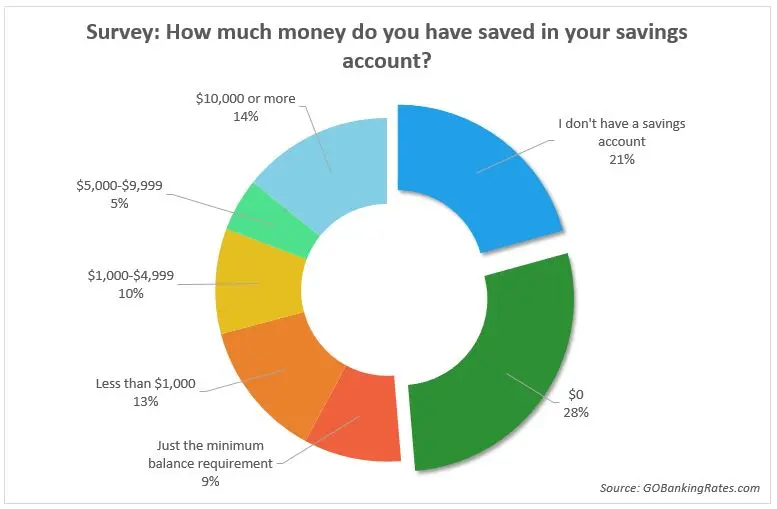

LOS ANGELES, Oct. 5, 2015 /PRNewswire/ ― Nearly two thirds of Americans have no more than $1,000 in their savings accounts1, according to a new report from leading personal finance website GOBankingRates.com. The report also finds that one in five Americans doesn’t even have a savings account.

GOBankingRates asked Americans, “How much money do you have saved in your savings account?” and collected demographic insights on a variety of answers relating to savings accounts and account balances.

To see the full survey findings, visit:

gobankingrates.comsavings-account/62-percent-americans-under-1000-savings-survey-finds/

“It’s troubling how many Americans aren’t thinking about long-term planning or retirement, with little to nothing stashed away in a savings account,” said Casey Bond, editor-in-chief of GOBankingRates. “Saving money is an uphill battle for many, but there are a number of simple ways people can consistently grow their nest egg over time, such as automating their savings. Even a small contribution is better than nothing at all.”

Additional insights include:

- Generation Xers (ages 35 to 54) are the most likely to have a savings account balance of $0.

- Of Americans who have money in their savings accounts, the most common (14.2 percent) balance is $10,000 or more.

- Men are 60 percent more likely than women to have a savings balance over $10,000 (16.4 percent to 10.4 percent, respectively).

- Young millennials (ages 18 to 24) are the most likely to have a savings account balance of less than $1,000, whereas seniors (65 and older) are most likely to have $10,000 or more.

Methodology: This survey and the findings above are the results of a Google Consumer Survey conducted by GOBankingRates from Sept. 11-13, 2015, with a nationally representative sample of 5,006 adults living in the United States and a margin of error within 1.70 percent. For the full methodology, visit GOBankingRates.com.

About GOBankingRates

GOBankingRates.com is a leading portal for personal finance and consumer banking information, offering visitors the latest on everything from finding a good interest rate to strategies for saving money, investing for retirement and getting a loan. Its editors are regularly featured on top-tier media outlets, including U.S. News & World Report, Forbes, Business Insider, Daily Finance, Huffington Post and more. It specializes in connecting consumers with the best financial institutions and banking products nationwide.

162 percent is a combination of the following survey responses: 28 percent responding “$0,” 21 percent answering “I do not have a savings account,” and 13 percent answering “less than $1,000.”

Contact:

Roxy Barghahn, Media Relations GOBankingRates.comroxyb@gobankingrates.com 310-297-9233 x202