What Are the 3 Credit Reporting Agencies and What Do They Do?

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

If you’ve ever heard the phrase “We need to check your credit,” your next question may be “What are the three credit reporting agencies?” The agencies are Equifax, Experian and TransUnion. These are the three credit reporting agencies in the United States that evaluate your creditworthiness.

Find out about how they work, what they do and what to look for in your credit report.

What Are the 3 Credit Reporting Agencies?

The three main credit reporting agencies in the United States are Experian, Equifax and TransUnion. These agencies are responsible for collecting information about your credit history through banks, various lenders and credit card companies.

With this information, they create your credit reports and update them regularly.

What Does Each Credit Reporting Agency Do?

Curious about what Equifax, Experian and TransUnion do? These agencies do all these tasks:

- Collect data. Data about your payments and credit accounts is collected.

- Create a credit report. The data generates a credit report.

- Share your credit report. When you apply for loans or try to rent an apartment, the agencies share your credit report.

- Calculate your credit scores. The agencies calculate your three-digit credit score. All three agencies will calculate for both models — FICO Score and VantageScore.

Do All 3 Credit Reporting Agencies Have the Same Information?

It is not enough to pull one credit report from one agency. Equifax, Experian and TransUnion will likely have slightly different credit reports. The difference happens because not all lenders report to all three agencies. Some lenders may report to all three, while others may report to only a couple.

When lenders make a decision to give you a loan, they will evaluate your credit report from more than one agency. This evaluation will decide whether to approve your application and what interest rate to offer you.

Key Takeaway

Want the entire picture of your credit? Review all three reports to get an accurate picture of your credit history.

How Do the 3 Credit Reporting Agencies Affect Your Credit Score?

The agencies are responsible for collecting data that determines your credit score. Your credit score is the three-digit number that determines your creditworthiness. These are the factors considered:

- Payment history

- Credit utilization

- Length of credit history

- Types of credit

- New credit inquiries

Comparison of the 3 Credit Reporting Agencies

Does each credit reporting agency monitor the same information? Take a look at this comparison table to see how Equifax, Experian and TransUnion differ.

| Feature | Equifax | Experian | TransUnion |

|---|---|---|---|

| Founded | 1899 | 1996 | 1968 |

| Market Focus | Consumer and commercial credit, data analytics | Global consumer and business credit | Credit reporting, fraud prevention, risk |

| What the Agency Tracks | Tracks credit data, employment and income information | Tracks credit accounts and payment history | Tracks traditional credit data (accounts and payments), rental history and specialty data |

| How Often Updated | Regularly updated | Frequently updated depending on lenders | Continually updated by lenders |

How To Get Your Credit Reports From All 3 Agencies

Do you have to pay for your credit reports from all three agencies? No.

The good news is you can receive one free credit report per year from each agency. Visit AnnualCreditReport.com to access and download your reports.

Pro Tip

Spread out your credit report requests throughout the year.

You can request Equifax at the start of the year, Experian five months later and TransUnion at the end of the year.

Using this strategy, you can monitor your credit throughout the course of the year.

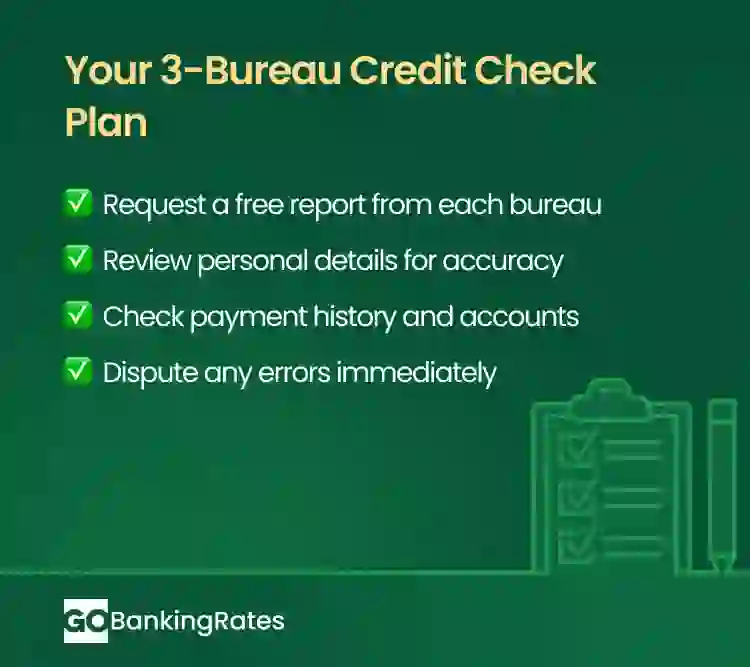

What To Look for When Reviewing Your Reports

Once you have your credit reports, what should you check? Take a look at this step-by-step guide to find out what you should review:

Step 1. Check your name and address. Make certain they are correct.

Step 2. Take a look at each account and ask yourself the following questions:

- Are the balances correct?

- Are the payments listed accurately?

- Are there accounts you don’t recognize?

Step 3. Review any negative items like bankruptcies, liens and collections. Ensure these items are accurate.

Final Take

Equifax, Experian and TransUnion are the three credit reporting agencies in the United States. They collect and maintain your credit history and ultimately decide your creditworthiness. You are entitled to one credit report from each agency every year. It is your responsibility to review and correct any inaccuracies.

FAQ

Here are the answers to some of the most frequently asked questions about the credit reporting agencies.- What are the three credit reporting agencies and why do they matter?

- Equifax, Experian and TransUnion are the three credit reporting agencies. These agencies collect and maintain your credit history reported by lenders. These agencies use this data to evaluate your creditworthiness.

- Do all three credit reporting agencies show the same information?

- Not always. Lenders may choose to report to one or two credit bureaus and not the third. The information may vary from bureau to bureau.

- Which credit reporting agency do most lenders use?

- It depends on the lender. However, Experian and Equifax are used for credit cards and auto loans. TransUnion is used for some loans and tenant screenings.

- How can I get my free reports from all three credit reporting agencies?

- You can get your free credit reports from all three major credit reporting agencies (Experian, Equifax and TransUnion) by visiting AnnualCreditReport.com.

Written by

Written by  Edited by

Edited by