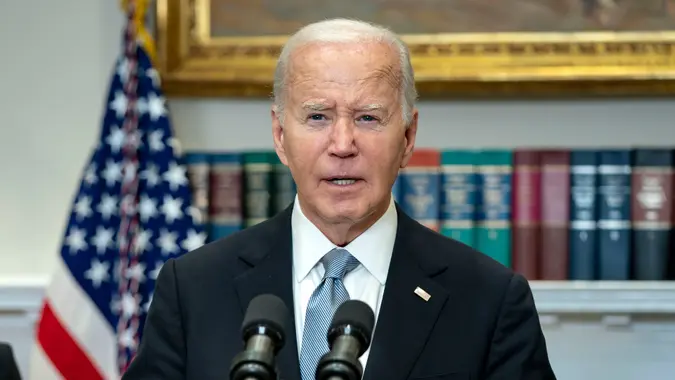

Here’s How Much the Definition of Upper Class Has Changed Since Joe Biden’s First Day in Office in 2021

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

How much do you think the upper class makes each year? Do you consider yourself upper class? The four years of former President Joe Biden’s term in office were a rollercoaster, from the COVID-19 pandemic and rampant inflation to skyrocketing home prices and nationwide job losses. These factors combined have moved the benchmark for what’s considered upper class more than you might think.

When people talk about the upper class, they refer to those who are well-off. This can mean they have a high salary, educational attainment and social status. This article will explore how much the definition of the upper class has changed since Biden’s first day in office in 2021 and the top contributing factors.

“Upper class has changed with the times, just like becoming a millionaire once sounded like a fantasy reserved for the ultra-elite,” said Bryan M. Kuderna, CFP, founder of Kuderna Financial and host of “The Kuderna Podcast.” “Since President Joe Biden’s first day in office in 2021, inflation has increased approximately 20% over four years. In other words, whatever salary was considered upper class in 2021 would need to be about 20% higher today to still be upper class.”

Next, find out the minimum salary required to be upper class this year.

The Upper Class: Then vs. Now

According to Pew Research, the upper class is defined as having a household income roughly double the median household income in the United States. In 2021, the U.S. Census Bureau reported the median household income as $70,784. Thus, anyone making over $141,568 would be considered upper class.

Things have changed quite a bit since Biden’s early days in office. The most recent income numbers from the U.S. Census Bureau show that the median household income in 2023 rose to $80,610. This means the upper class now has a household income of at least $161,220, representing a 13.88% increase.

Three Contributing Factors

The changing definition of the upper class can be attributed to three main components: inflation, wages and home prices. Here’s a look at each of these factors in more detail.

Inflation

Inflation is one of the top contributors to the change in the upper class. Everything from groceries to gas has become more expensive, meaning living comfortably requires a higher income. Inflation peaked at 9.1% in July 2022, the highest rate in over 40 years.

Although inflation is now mostly under control, the few years of high inflation have permanently altered what is considered the upper class.

Wages

When wages don’t rise at the same rate as inflation, they create a larger gap between the middle and upper classes. Between 2021 and 2024, the actual average hourly earnings for private-sector employees fell by 2.24%, FactCheck.org reported.

Instead of rising at the same rate as inflation, wages remained stagnant, resulting in less disposable income.

Home Prices

One of the main components of the American Dream is owning a home. Interest rates and home prices usually work in opposite directions. As interest rates increase, home prices decrease.

However, this hasn’t been the case over the past few years. Home prices remained high while interest rates rapidly rose, making it more difficult for the working class to purchase homes.

The Bottom Line

It’s not much of a secret that things have changed a lot since Biden’s first days in office. Inflation caused most things to cost more, housing prices have continued to rise, and wage growth has been lagging.

However, it’s also important to remember that what might be considered upper class is only a number. For some families, it will require more than others to feel truly comfortable financially.

Editor’s note on political coverage: GOBankingRates is nonpartisan and strives to cover all aspects of the economy objectively and present balanced reports on politically focused finance stories. You can find more coverage of this topic on GOBankingRates.com.

Written by

Written by  Edited by

Edited by