4 Ways a Harris Victory in November Would Be Good News for America’s Working Class

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

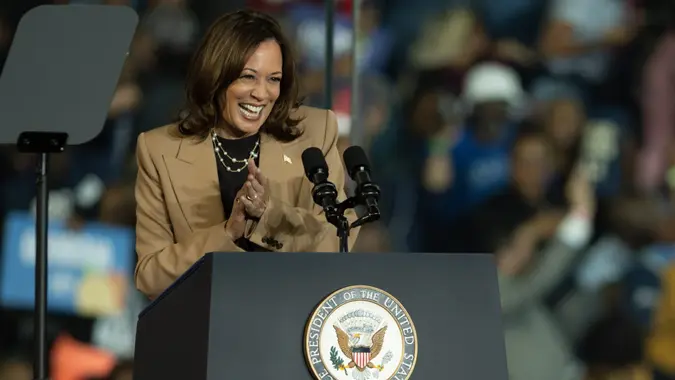

Vice President Kamala Harris and former President Donald Trump have both courted working-class voters during this year’s presidential elections.

With a platform focused on lowering the daily costs of most Americans, a Harris victory could signal significant improvements for millions of families struggling to make ends meet. Her policies aim to bridge economic and accessibility gaps to ensure that the American Dream remains accessible to everyone.

Here are four ways a Harris victory in November would be good news for America’s working class.

Strengthening Workers Rights

Harris has a history of supporting labor unions and worker protections. Her presidency could lead to policies that enhance labor rights, increase the minimum wage, remove taxes on tips and support efforts to close the wage gap among traditionally marginalized groups.

“Harris has made it a point to support unions and collective bargaining, which signals a key tenant of her economic policies to empower the working class to negotiate for better benefits and wages,” said Christopher Stroup, founder and president of Silicon Beach Financial.

Stroup explained, “One of her key proposals is to raise the federal minimum wage to $15 per hour, which is a move aimed at ensuring workers earn a living wage.”

A Progressive Tax Structure

Harris is expected to ease the financial strain on the working class by implementing a more progressive tax structure, where those with higher incomes pay a greater percentage in taxes.

“Under Kamala Harris, the tax system would be more fair for middle-class families while making the rich pay their fair share,” said Brian Derrick, co-founder of Oath, a political fundraising organization. “The Harris plan would increase after-tax incomes by almost 14% for low-income families and increase [the after-tax incomes] by 7% for the top 1% of income earners.”

Harris has also advocated for the expansion of the Earned Income Tax Credit (EITC) and Child Tax Credit (CTC) from $2,000 to $6,000 for families with newborn children, American Enterprise Institute reported.

“By increasing the amounts available through these credits, more money would be put directly in the pockets of working-class individuals and families,” Stroup said. “This could help offset living costs and provide critical financial support for retirees, especially for those living on a fixed income.”

Lower Grocery Bills

The average American weekly grocery bill rose from $142 in 2021 to $165 this year, according to Statista.

“Harris has discussed implementing price control measures for essential food items, especially those that have seen large price increases,” Stroup said. “Through collaboration with Congress to establish price caps on key food items like grains, dairy and produce, Harris may be able to help mitigate the impact of inflation on grocery bills.”

In addition, Harris may expand access to food cooperatives and community-supported agriculture programs that offer local produce at reduced prices, Stroup said. “By prioritizing and investing in these kinds of initiatives with local farmers, she may be able to establish more affordable options for retirees while ensuring that older adults have access to healthy food options without the burden of high costs.”

Reliable Social Security Payments

Social Security is in crisis, with fiscal analysts predicting the federal program faces a shortfall starting in 2035 if the president and Congress do nothing. The average retired American worker will see about $403 less in their monthly benefit if Social Security goes in the red, CNBC reported.

Harris hasn’t released specific details about how she would keep Social Security solvent, if elected. However, in a recent interview with AARP, Harris said she would make “billionaires and big corporations pay their fair share in taxes and use that money to protect and strengthen Social Security for the long haul.”

Editor’s note on election coverage: GOBankingRates is nonpartisan and strives to cover all aspects of the economy objectively and present balanced reports on politically focused finance stories. For more coverage on this topic, please check out 3 Ways a Second Trump Presidency Would Benefit the Working Class Financially.

Written by

Written by  Edited by

Edited by