Dave Ramsey Warns: This Common Habit Can Ruin Your Retirement

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

You might think investing just $100 a month is enough to retire comfortably — and in theory, it could be.

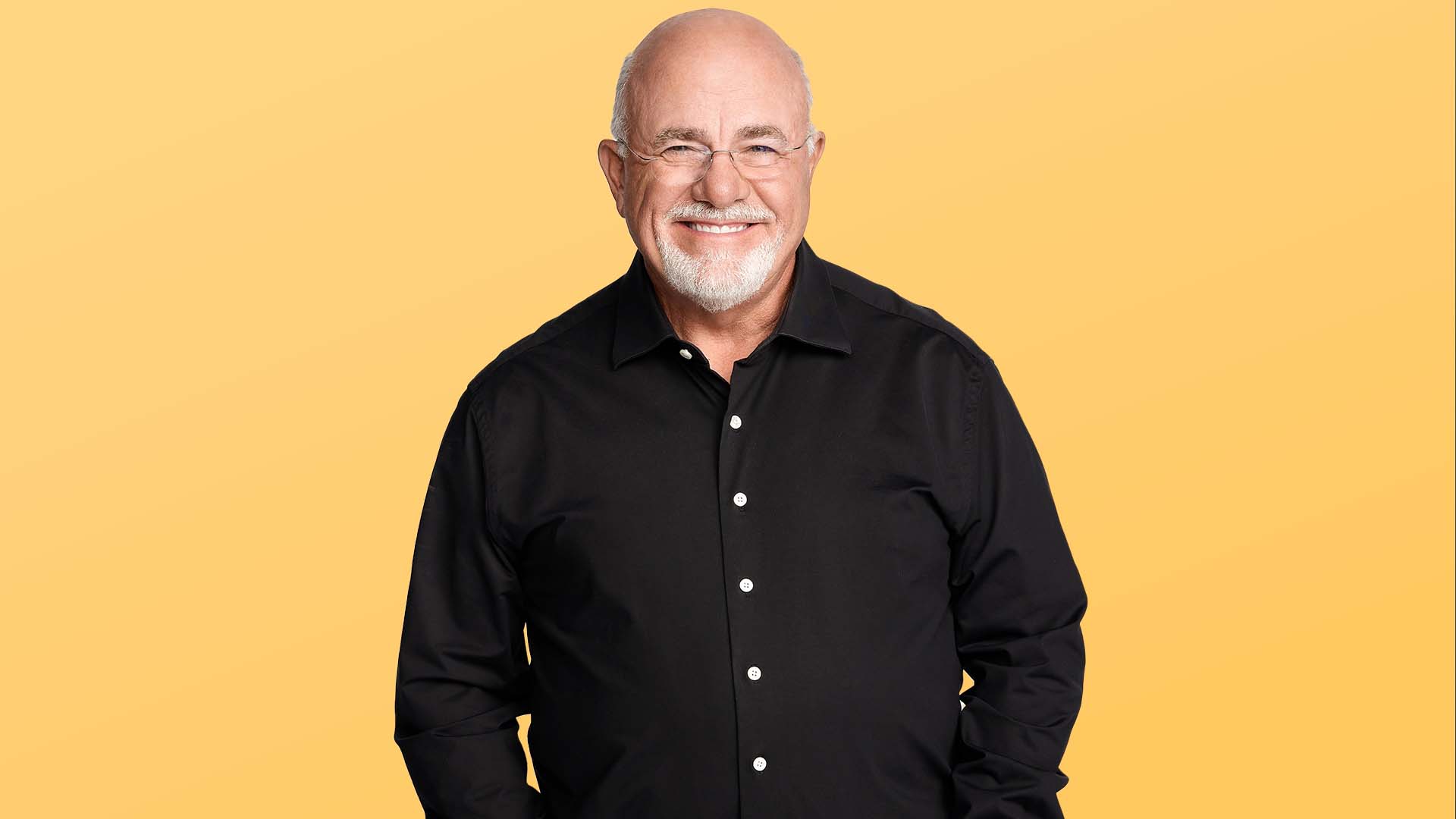

“If you invest $100 a month from age 25 to age 65 in a decent growth stock mutual fund, it will be $1,176,000,” money expert Dave Ramsey said in a recent YouTube video. “You retire a millionaire.”

However, even if you amass a healthy retirement nest egg, one common money habit could mean you still end up broke. Here’s what Ramsey said you need to avoid.

Your Retirement Savings Won’t Be Enough If You’re Carrying Debt

Ramsey noted that many people live above their means and carry debt with them into retirement.

“You can’t have a $750 F-150 payment,” he said. “You can’t have a student loan that’s been around so long you think it’s a pet.”

Keeping debt on a credit card is particularly problematic, Ramsey said. That’s because high interest rates work against you and for the financial institutions that profit from your poor behavior.

“You can’t just keep yourself in payments where all you do is work for the man,” he said. “All you do is work for these stinking banks that have better furniture and bigger buildings than you do. And the reason is you gave them all your stinking money, and you have no money because you gave it all to them.”

Ramsey called debt “the single largest blocker” to building real wealth.

“Debt has been so normalized in our culture that to even imagine living without it is unbelievable,” he said.

You Can’t Blame Your Debt on Inflation

Inflation has made everything more expensive, so it’s easier to get into debt, but Ramsey said this isn’t a viable excuse.

“Let’s be real clear here — the debt is not because of inflation,” he said. “The debt is because you wussed out and refused to cut your freaking lifestyle to offset inflation, because you’re still sitting in a line of 30 cars to buy an unbelievably expensive cup of coffee.”

Instead of living the same lifestyle and taking on more debt, the more responsible move is to cut down on expenses as costs rise.

“You’re in debt because you didn’t cut your spending when inflation hit,” Ramsey said.

Your Debt Will Eventually Catch Up to You

As Ramsey noted, your debt will eventually catch up to you — especially if you take it into retirement.

“If you think getting into debt to maintain your lifestyle is going to maintain your lifestyle, there’s an end to that,” he said. “It’s a boomerang — it comes back around, smacks you in the head and says, ‘Hey, dummy.'”

More From GOBankingRates

Written by

Written by  Edited by

Edited by