Tony Robbins: 3 Things To Do To Avoid Relying on Social Security in Retirement

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

Retirement: the beautiful time of life when you no longer have to work for your money. Instead, your money works for you. And if you’re already well on your way to retirement, congratulations.

Today, more Americans are retiring than ever before. According to the Alliance for Lifetime Income (ALI), 2024 marked the start of the “Peak 65 Zone:” the largest surge of retirement-age Americans turning 65 in U.S. history. Over 4.1 million Americans will turn 65 each year through 2027 — that’s more than 11,200 every day.

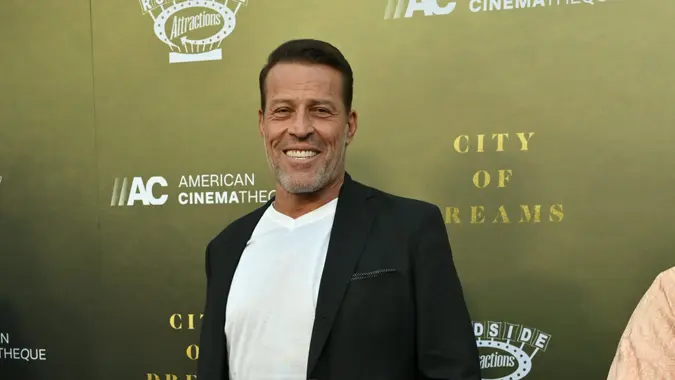

However, if you’re planning to retire soon, you don’t want to make any financial mistakes. Here are three things to do to avoid relying on Social Security in retirement, according to motivational speaker and financial expert Tony Robbins.

Participate In Your Employer-Matching 401(k) Plan

Robbins explains that Social Security was never designed to fully replace retirement savings. In today’s world, this is certainly the case as the increased average life expectancy continues to lead to longer retirements.

If your employer offers a 401(k) match, you must elect for it. For example, if you’re offered a 5% dollar-for-dollar match on your 401(k) contributions and you contribute 5% of your earnings, you’ll be making a 10% annual contribution. An employer match is essentially free money, so don’t leave it on the table.

Additionally, investing in an individual retirement account (IRA), perhaps in addition to your employer-sponsored 401(k) plan, can provide additional retirement savings.

Underestimating Your Future Healthcare Needs

One of the best things about turning 65? You become eligible to enroll in Medicare. However, Medicare doesn’t cover all healthcare expenses. This included expensive long-term care, which you’ll need to find separate insurance for if you want to avoid high monthly costs later in life.

Additionally, Medicare involves monthly premiums, deductibles, and prescription drug costs. In other words, expect to have additional medical expenses in retirement even though you enroll in Medicare.

Become a ‘Master Of Money’

Robbins says that with the right mindset, you can become a “master of money.” From his point of view, he believes that 80% of wealth is psychological while the other 20% is the mechanics of managing it.

“Money has no power by itself, only the power you give it,” his website states. “That’s why mindset — your ability to focus and the state you put yourself in — is the ultimate power.”

Maintaining a strong sense of financial self-discipline and ignoring the impulse of instant gratification is a key part of mastering money, and can mean the difference between financial security or financial disaster in retirement.

Written by

Written by  Edited by

Edited by