State Income Tax Rates in 2025 and 2026

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

State income tax rates vary widely across the U.S. and can impact everything from your take-home pay to your long-term financial goals.

State income tax is a tax levied by individual states on your earnings, separate from federal income tax. The amount you owe depends on where you live, how much you earn and how your state structures its tax system. States use this money to fund essential services like education, infrastructure and public safety.

This guide will help you compare state income tax rates in 2025 and 2026 so you can make more informed decisions.

What Are the Different Types of State Income Tax Systems?

There are three main systems: no income tax, a flat tax, or a progressive tax. Here’s how the three main types compare:

| System Type | How It Works | Example States |

|---|---|---|

| None | No personal income tax | Florida, Texas, Wyoming |

| Flat | Single rate applies to all income levels | Colorado, Illinois, Kentucky |

| Progressive | Rates increase with higher income levels | California, New York, Minnesota |

Most states use a progressive tax system, where your tax bracket increases if you earn a higher income. For example, someone earning $30,000 yearly may pay a lower rate than someone earning $100,000.

In flat tax states, however, everyone pays the same state income tax rate across the board, no matter how much income they earn.

Which States Have the Highest and Lowest Income Tax?

For 2025, the states with the highest top-income tax rates are California (13.3%), Hawaii (11%) and New York (10.9%), where the rich pay more.

Some states, like Arizona, Georgia and Illinois, charge a flat tax across all income levels. Meanwhile, nine states, including Florida, Texas and Washington, don’t tax income at all.

Understanding How State Income Taxes Work

Even if two states have similar tax rates, their rules about who pays and what’s taxed can vary widely.

Who Pays State Income Tax?

Whether or not you owe state income tax generally depends on your residency status and where your income was earned:

- Residents: Many states require full-time residents to pay state income tax on all income, even if some of it was earned in another state.

- Part-year residents: If you lived in one state for part of the year and moved to another, you’ll likely need to file taxes in both states.

- Nonresidents: If you work in a different state than where you live, you may owe taxes there, along with your home state.

How States Tax Non-Wage Income

Along with wages and salaries, many states also tax non-wage income, such as:

- Capital gains when you sell stocks or real estate.

- Interest and dividends that you earn from savings accounts or investments.

- Retirement income, including Social Security, pensions, IRA and 401(k) distributions.

That said, how states treat this income varies, with some states offering complete exemptions, especially for retirees. For example, Florida and Texas don’t tax individual income at all, including non-wage income.

States With No Income Tax

Nine states currently don’t tax earned income. A state with no income tax has to make up the difference elsewhere, like by charging higher sales, property or capital gains taxes. The cost of living or housing market could also be more expensive, offsetting their 0% state income tax rates.

So, just because a state doesn’t charge income tax doesn’t necessarily mean you’re going to save money overall. For example, even though Idaho doesn’t tax income, it still ranks 32nd in overall tax burden among the 50 states, according to the Tax Foundation.

States With Flat Tax Rates

Fifteen states impose a flat tax rate on their citizens. This includes Massachusetts, which imposes a 5% flat tax rate on long term capital gains from dividends, interest, wages, and other income, plus a 4% surtax for income above $1 million — adjusted annually for inflation.

Flat tax rates are typically simpler than progressive tax structures, but critics argue that it unfairly burdens low and middle-class taxpayers.

While some states have used the flat tax system for a long time, others have recently shifted from progressive to flat tax to make it easier for the government to predict incoming revenue and for citizens to estimate their tax liability.

States With Graduated-Rate Income Taxes

With graduated — or progressive — tax rates, most states have separate tax brackets that depend on how much you earn. The idea is that people in higher income brackets can afford to pay more taxes. However, more brackets can lead to more complexity.

Here’s how progressive state income tax rates break down by several brackets:

States with Up to 4 Brackets

- Alabama: 3 brackets — income range for single filers: $500 to $3,001; married jointly: $1,000 to $6,001

- Kansas: 2 brackets — single: up to/over $23,000; married jointly: up to/over $46,000

- Maine: 3 brackets — single: $26,800 to $63,450; married jointly: $53,600 to $126,900

- Mississippi: 2 brackets — single and married jointly: income over $10,001 taxed at flat 4.4%

- Montana: 2 brackets — single: up to/over $21,100; married jointly: up to/over $42,200

- North Dakota: 3 brackets — single: $48,475 to $244,825; married jointly: $80,975 to $298,075

- Ohio: 3 brackets — single and married jointly: $26,050 to $100,000

- Rhode Island: 3 brackets — single and married jointly: $79,900 to $181,651

- South Carolina: 3 brackets — single and married jointly: Varies by income level

States With 4 to 5 Brackets

- Minnesota: 4 brackets — single:40,100 to $265,051; married jointly: $40,620 to $330,411

- Nebraska: 4 brackets — single: $2,999 to $29,000; married jointly: $5,999 to $58,000

- New Mexico: 5 brackets — single: $5,500 to $210,000; married jointly $8,000 to $315,000

- Oregon: 4 brackets — single and married jointly: Varies by income level

- Vermont: 4 brackets — single and married jointly: Varies by income level

- Virginia: 4 brackets — single and married jointly: Varies by income level

- West Virginia: 5 brackets — single and married jointly: $9,999 to $60,000

- Wisconsin: 4 brackets — single and married jointly: Varies by income level

States With 6 or More Brackets

- Arkansas: 5 brackets — single and married jointly: up to $94,700

- Connecticut: 7 brackets — single: up to $500,001; married jointly: up to $1,000,001

- Delaware: 7 brackets (2.2% to 6.6%)– single and married jointly: up to $60,001

- District of Columbia: 7 brackets (4% to 10.75%) — single and married jointly: up to $1 million and up

- Hawaii: 12 brackets — single: up to $200,001; married jointly: up to $400,001

- Maryland: 8 brackets — single: up to $1 million+; married jointly: up to $1.2 million and up

- Missouri: 8 brackets — single and married jointly: up to $9,192 [1, 15, 38]

- New Jersey: 7 brackets — single and married jointly: up to $1 million and up

- New York: 9 brackets (4% to 10.9%)single and married jointly: Up to $25 million+

- California: 9 brackets (1% to 13.3%), plus 1% mental health surcharge on income over $1 million — single up to $742, 953; married jointly: up to $1, 485,906

States With the Highest Top Marginal Income Tax Rates

A marginal tax rate is the extra tax you pay on each dollar you earn above a certain income threshold — not your entire income. For example, if the top rate kicks in at $1 million, only the income above that amount is taxed at that rate .

The top marginal state income tax rate is the highest rate that a state can apply to individual income. As of 2025, here are the states with the highest top marginal state income tax rates:

- California: 13.3%

- Hawaii: 11%

- New York: 10.9%

- New Jersey: 10.75%

- Oregon: 9.9%

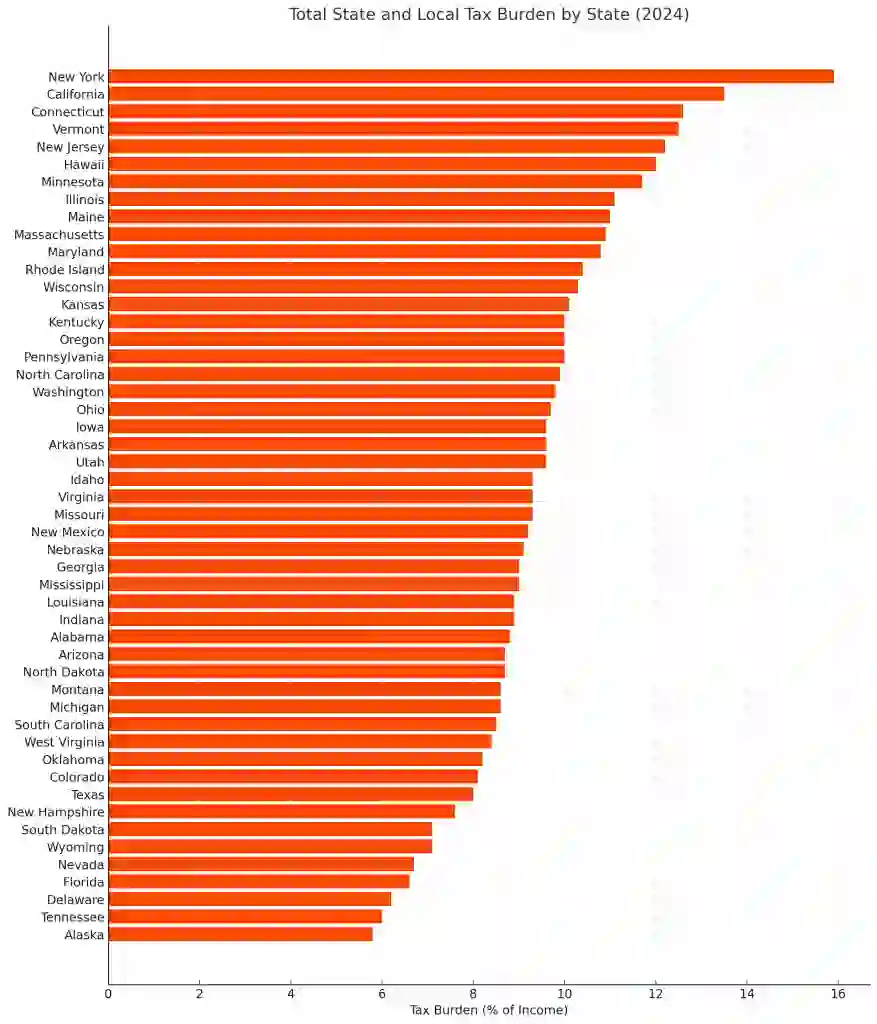

The top marginal income tax rate isn’t the same as a state’s overall tax burden. Remember:

- The top marginal rate is the highest percentage a state applies to taxable income above a certain threshold.

- A state’s tax burden, on the other hand, shows the total amount of taxes the residents pay — including income, sales, property and other state or local taxes.

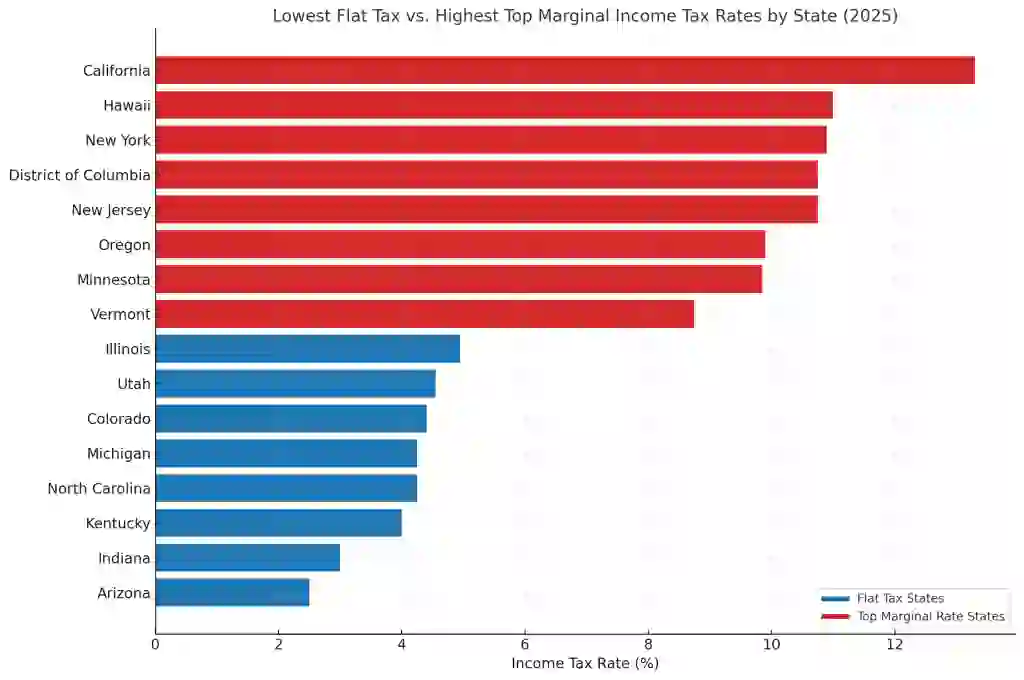

States with the Lowest Flat Income Tax Rates

Among the states that do have an income tax, the following have the lowest flat tax income rates for tax year 2025:

- Arizona: 2.5%

- Indiana: 3%

- Louisiana: 3%

- Pennsylvania: 3.07%

- Iowa: 3.8%

Here’s a comparison of the states with the lowest flat income tax rates and the states that have the highest top marginal income tax rates — from the last section:

State Income Tax Rates Comparison

Below is a table you can use to compare income tax rates across all 50 states. These rates typically apply to single filers, not married couples filing jointly. States with a range use progressive tax brackets, while single percentage values represent flat tax rates.

| State | 2025 Tax Rate | 2026 Tax Rate | Tax System Type |

|---|---|---|---|

| Alabama | 2% to 5% | 2% to 5% | Progressive |

| Alaska | No state income tax | No state income tax | None |

| Arizona | 2.5% | 2.5% | Flat |

| Arkansas | 2% to 3.9% | 2% to 3.9% | Progressive |

| California | 1% to 13.3% | 1% to 13.3% | Progressive |

| Colorado | 4.4% | 4.4% | Flat |

| Connecticut | 2% to 6.99% | 2% to 6.99% | Progressive |

| Delaware | 2.2% to 6.6% | 2.2% to 6.6% | Progressive |

| District of Columbia | 4% to 10.75% | 4% to 10.75% | Progressive |

| Florida | No state income tax | No state income tax | None |

| Georgia | 5.19% | 5.09% | Flat |

| Hawaii | 1.4% to 11% | 1.4% to 11% | Progressive |

| Idaho | 5.3% | 5.3% | Flat |

| Illinois | 4.95% | 4.95% | Flat |

| Indiana | 3% | 2.95% | Flat |

| Iowa | 3.8% | 3.8% | Flat |

| Kansas | 5.2% to 5.58% | 5.2% to 5.8% | Progressive |

| Kentucky | 4% | 3.5% | Flat |

| Louisiana | 3% | 3% | Flat |

| Maine | 5.8% to 7.15% | 5.8% to 7.15% | Progressive |

| Maryland | 2% to 5.75% | 2% to 6.5% | Progressive |

| Massachusetts | 5% to 9% | 5% to 9% | Flat |

| Michigan | 4.25% | 4.25% | Flat |

| Minnesota | 5.35% to 9.85% | 5.35% to 9.85% | Progressive |

| Mississippi | 4.4% | 4% | Progressive |

| Missouri | 2% to 4.7% | 2.0% to 4.7% | Progressive |

| Montana | 4.7% to 5.9% | 4.7% to 5.65% | Progressive |

| Nebraska | 2.46% to 5.2% | 2.46% to 4.55% | Progressive |

| Nevada | No state income tax | No state income tax | None |

| New Hampshire | No state income tax | No state income tax | None |

| New Jersey | 1.4% to 10.75% | 1.4% to 10.75% | Progressive |

| New Mexico | 1.5% to 5.9% | 1.5% to 5.9% | Progressive |

| New York | 4% to 10.9% | 4% to 10.9% | Progressive |

| North Carolina | 4.25% | 3.99% | Flat |

| North Dakota | 1.95% to 2.5% | 1.95% to 2.5% | Progressive |

| Ohio | 2.75% to 3.125% | 2.75% | Progressive in 2025 Flat, starting in 2026 |

| Oklahoma | 0.25% to 4.75% | 0% to 4.5% | Progressive |

| Oregon | 4.75% to 9.9% | 4.75% to 9.9% | Progressive |

| Pennsylvania | 3.07% | 3.07% | Flat |

| Rhode Island | 3.75% to 5.99% | 3.75% to 5.99% | Progressive |

| South Carolina | 0% to 6% | 0% to 6% | Progressive |

| South Dakota | No state income tax | No state income tax | None |

| Tennessee | No state income tax | No state income tax | None |

| Texas | No state income tax | No state income tax | None |

| Utah | 4.55% | 4.55% | Flat |

| Vermont | 3.35% to 8.75% | 3.35% to 8.75% | Progressive |

| Virginia | 2% to 5.75% | 2% to 5.75% | Progressive |

| Washington | No state income tax* | No state income tax | None |

| West Virginia | 2.22% to 4.82% | 2.22% to 4.82% | Progressive |

| Wisconsin | 3.5% to 7.65% | 3.5% to 7.65% | Progressive |

| Wyoming | No state income tax | No state income tax | None |

When Are State Income Tax Returns Due?

Most state income tax returns follow the federal deadline, which is typically April 15. However, a few states set their own deadlines, for example:

- Hawaii set its 2024 tax year deadline for April 20

- Virginia gives residents extra time, with returns due by May 1.

An extension on your federal tax return doesn’t automatically mean an extension on your state deadline.

Check your state’s official tax agency to find the most up-to-date information. You can find a full list of state tax agency websites on the Federation of Tax Administrators website.

Filing Taxes With Multiple State Income Tax Rates

Here are some common scenarios that could require multiple-state filing:

- You moved mid-year and earned income in both your old and new states.

- You work remotely for a company based in another state.

- You own rental property in a different state that generates income.

If you work remotely, check if your home state and your employer’s state have a reciprocity agreement. This could allow you to:

- Request that your nonresident state exempt you from your tax withholdings.

- Have your employer withhold taxes for your home state.

- Make estimated tax payments to your resident state.

If there’s no reciprocity agreement, you’ll have to file a nonresident return for your employer’s state and a resident return for your home state. However, you’ll usually receive a tax credit from your state of residence for any taxes you pay to any nonresident states.

An Example

If you live in California but earn $10,000 in Kansas, you’ll have to report the $10,000 in income to both states. Since Kansas taxes income under $15,000 at 3.1%, you would owe about $310. When you file with California, the state will also tax that $10,000, but you’ll get a credit for the $310 you already paid to Kansas, reducing how much you owe in California.

Here are some helpful resources you can use to help you when filing in multiple states:

- IRS Schedule CR: If you earn income in multiple states, you can use your home state’s specific form to claim a credit if you’ve already paid taxes in another state.

- IRS Form 1040-NR: If you’re not a U.S. resident but earned income here, whether through wages, investments or business income, you may need to file this form.

- Multi-state income tax calculator: Some free tools, like TaxSlayer, may help you estimate how much tax you owe across multiple states.

Planning for State Income Taxes

Knowing the difference between state and federal income taxes can serve you well when creating a budget or considering a move.

Remember, it’s always a good idea to consult with your tax professional if you have questions about your specific situation. They can also help you with potential deductions, credits and tax refund opportunities to maximize your savings.

FAQs About State Income Tax Rates

Knowing your state income tax rates goes a long way when judging your paycheck:- What states don’t have a state income tax?

- Nine states, including Texas, Florida and Tennessee, have no personal income tax.

- What’s the difference between a flat and progressive state income tax?

- Flat taxes apply one rate to all income; progressive systems increase rates as income rises.

- Which states have the highest state income tax rates?

- The states with the highest top-income tax rates are California (13.3%), Hawaii (11%) and New York (10.9%).

- Do state income tax rates change often?

- Yes, state income tax rates have changed often in several states. Some states have been reducing rates or shifting to a flat structure through legislation.

- If I move states, which state taxes my income?

- If you move states, both states may tax your income. You may need to file a part-year state return if you worked in both states.

- Can I pay income tax in more than one state?

- Yes. If you live, work or earn income in multiple states, you may need to file in each.

- Do all states follow the April 15 tax deadline?

- Most do, but some have different due dates. Always confirm with your state.

- How do state taxes affect my move?

- Moving to a lower-tax state can lower your overall tax burden, but consider property taxes, sales taxes and cost of living too.

Carley Clark contributed to the reporting for this article.

Editorial Note: This content is not provided by any entity covered in this article. Any opinions, analyses, reviews, ratings or recommendations expressed in this article are those of the author alone and have not been reviewed, approved or otherwise endorsed by any entity named in this article.

Writer Instructions

-

Primary Keyword: state income tax rates

-

Secondary Keyword(s) if applicable:

-

State tax rates comparison

Highest state income taxes

No state income tax states

Income tax brackets by state

State tax rates 2024

-

-

Word count: 1500

-

Inspo URL:

Income Tax by State: 2024 Rates and Brackets - NerdWallet

-

Must haves: (make sure these are 2025 related, NW piece is 2024, but use as format inspo)

-

Introduction: Overview of State Income Tax Rates

-

Briefly explain what state income taxes are and how they vary by state.

-

Mention that some states have no income tax, while others use progressive tax brackets.

-

-

Understanding How State Income Taxes Work

-

Offer a simple breakdown of how state income tax systems function, including flat taxes vs. progressive tax brackets.

-

Provide examples of states with each type, like Illinois (flat tax) vs. California (progressive tax).

-

-

States with No Income Tax

-

List the states that do not have an income tax, such as Texas, Florida, and Nevada.

-

Discuss the trade-offs, like reliance on other taxes (e.g., sales taxes or property taxes).

-

-

States with the Highest Income Tax Rates

-

Identify states with the highest income tax rates (e.g., California, New York, and Oregon).

-

Provide specific tax brackets for these states and offer examples of how income is taxed at different levels.

-

-

State Income Tax Rates Comparison Table

-

Include a clear, easy-to-read comparison table that shows tax rates across all states.

-

Provide side-by-side data for quick reference, including brackets, rates, and income thresholds.

-

-

How State Income Taxes Affect Taxpayers

-

Explain how state taxes influence taxpayers' take-home pay, particularly for residents in states with high rates or no income tax.

-

Discuss the tax implications of moving between states with different tax policies.

-

-

Filing Taxes with Multiple State Income Tax Rates

-

Provide advice for individuals who work or live in multiple states during the year, and how to file taxes accordingly.

-

Mention common tax credits or deductions for cross-state filers.

-

-

Conclusion: Planning for State Income Taxes

-

Summarize the importance of understanding state income taxes and how they impact financial planning.

-

Suggest readers stay updated on yearly changes to tax rates and laws.

-

-

- Tax Foundation. 2026. "State Tax Changes Taking Effect January 1, 2026."

- Tax Foundation. 2025. "State Tax Data."

- Tax Policy Center. "How Do State and Local Individual Income Taxes Work?"

- USA.gov. "State Taxes."

- Institute on Taxation and Economic Policy (ITEP). 2025. "The Pitfalls of Flat Income Taxes."

- AARP. "States Without an Income Tax."

- State of California Franchise Tax Board. "Do you need to file?"

Written by

Written by  Edited by

Edited by