5 Cities Where Millennials Have the Most Credit Card Debt

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

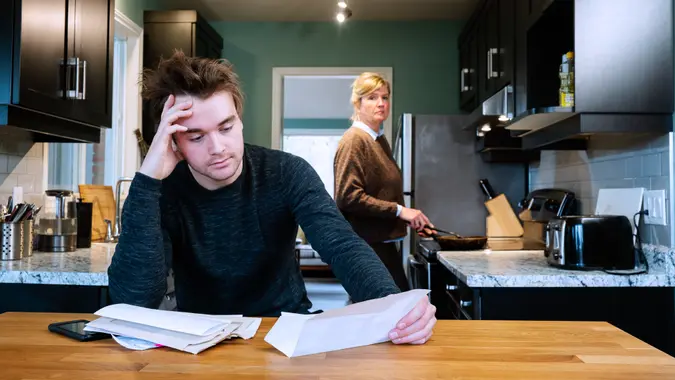

When it comes to money, millennials typically face a very specific set of challenges. Indeed, this generation is experiencing many milestones and many “firsts” in their lives — whether it’s a first job, marriage, the birth of a child or a first home. This can often translate into several simultaneous financial burdens, and in turn, it’s no surprise that 59% of millennials say they feel behind financially, according to a Credit Karma survey.

Because of this, it might not be surprising to learn millennials owe a median $4,372 in credit card debt, per a LendingTree study. Here are some details on millennials’ financial situation, including their debt and the cities where millennials have the most credit card debt.

Also see the five myths about debt that nobody should believe in 2024.

Millennials’ Financial Situation

“Millennials are now of the age where many are in prime parenting years,” said Austin Kilgore, analyst with the Achieve Center for Consumer Insights. “They account for most of the demand for daycare, after-school care and other childcare services that are in short supply and exceedingly expensive.”

Kilgore added that with daycare costing as much as a monthly housing payment in many markets, it’s easy to see why millennials may be taking on credit card debt to handle other financial obligations.

In addition, millennials are more likely than other generations to carry student loan debt, Kilgore said — something that is reflected in the LendingTree analysis.

Indeed, a startling 38.4% of millennials have student loan debt, with a median balance of $24,112.

“They’re also likely to be starting families, and may be recent homeowners,” Kilgore said, adding that many millennials may also be helping aging parents. “Pandemic-era government stimulus money wound down just as inflation took off. The result is an exacerbated financial situation for many millennials.”

Against this backdrop, it’s no surprise that 88.5% of millennials have credit card debt.

In addition, depending on where they live, this debt can reach $6,250, the LendingTree analysis found, with four out of the top five cities where millennials have the most credit card debt in the Northeast.

Here are the cities where millennials have the most credit card debt, according to the LendingTree study.

Bridgeport, Connecticut

- Median credit card balance: $6,250

- Percentage of millennials with credit card debt: 92.8%

- Median home price: $344,500

- Cost of living: 16% above the national average

Poughkeepsie, New York

- Median credit card balance: $6,032

- Percentage of millennials with credit card debt: 90.6%

- Median home price: $398,000

- Cost of living: 12% above the national average

Miami

- Median credit card balance: $5,712

- Percentage of millennials with credit card debt: 91.5%

- Median home price: $630,000

- Cost of living: 52% above the national average

New York

- Median credit card balance: $5,687

- Percentage of millennials with credit card debt: 91.9%

- Median home price: $825,000

- Cost of living: 78% above the national average

Worcester, Massachusetts

- Median credit card balance: $5,592

- Percentage of millennials with credit card debt: 91.5%

- Median home price: $427,500

- Cost of living: 11% above the national average

Why Do Millennials Have the Most Credit Card Debt in These Cities?

According to Debt.com chairman Howard Dvorkin, CPA, millennials carrying the most debt in these locations, particularly in the Northeast, is “likely tied to housing prices.”

“Many people might not have heard of Poughkeepsie, but it’s 12% more expensive to live there than the national average,” he said, citing ERI Economic Research Institute data. He added that Miami and New York are even worse, while Bridgeport is also costlier than the national average.

“Most of our money goes to food and shelter, so where you live determines how much you spend — and if you save,” Dvorkin said. “So there’s no mystery here. But don’t forget peer pressure. If you live in an expensive city, you’ll feel compelled to look successful so you can fit in. So you’ll spend even more money you don’t have.”

All median home price figures were sources from Realtor.com, and all cost of living figures were sourced from the ERI Economic Research Institute.

Written by

Written by  Edited by

Edited by