Here’s Why Having 2 or 3 Bank Accounts Isn’t Enough, According to Money Expert Martin Lewis

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

Although there are vast differences in the amount of wealth Americans have amassed, one thing almost everyone has in common is a banking relationship. Nearly 96% of U.S. households have a checking or savings account at a bank or credit union, according to the latest FDIC data.

Research from Consumer Affairs showed that the average consumer had a total of 5.3 accounts across financial institutions as recently as 2019, though many have only one or two.

More Bank Accounts Could Mean Better Money Management

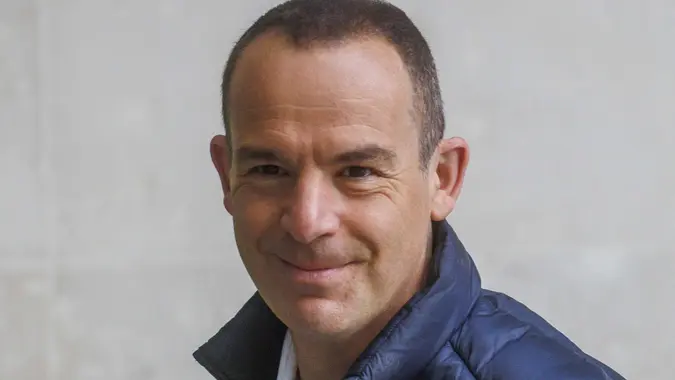

If you belong to the latter group, then financial guru Martin Lewis recommends adding more accounts. Lewis, founder of the UK-based MoneySavingExpert website, recently said on his podcast that you might benefit from having 10 accounts or more, The Express reported. He compared savings accounts to a “tower of champagne glasses” where you fill one glass and then move on to the next.

“The perfect way to save is you pour your money into the account that pays the most,” Lewis said. “It might be tax-free, it might be because it only allows a small amount. Once you fill that, you trickle down to the next level then trickle down to the next level.”

He conceded that this system is not necessarily for everyone — mainly because it requires hard work to stay on top of it.

“The biggest sin in savings is that most decent rates only last for a year or so and then you have to be on top of it to ditch and switch when it ends,” Lewis added. “It’s only for the type of people who will be constantly on top of it, maybe even modelling it through a spreadsheet to manage it well. Most people want a simpler solution with two, three, maybe four accounts at most but not going into 10 different accounts.”

Even if you don’t like the idea of juggling 10 different bank accounts, it’s still a good idea to have more than a couple. As Money magazine explained in a 2023 article, having additional accounts can give you access to various features you wouldn’t get with just one account.

You should have at least one checking account, although you might want to open more than one if you have different spending priorities. Beyond that, you should open multiple savings accounts dedicated to different financial goals. Savings options include traditional savings accounts as well as high-yield accounts, certificates of deposit and money market accounts.

Here are some of the advantages of having multiple bank accounts:

- It’s easier to track savings goals. If you have multiple savings goals, then it makes sense to have multiple savings accounts dedicated to each one. When you create a new savings account for each goal, you can easily monitor your progress.

- You can separate your spending accounts. It’s also a good idea to have dedicated spending accounts for different reasons (or people). For example, you might have a checking account dedicated to monthly bills and one dedicated to daily expenses. You might also have a shared checking account with your spouse and a separate account for your personal spending.

- You can keep personal and business expenses separate. If you run a side business, then the last thing you want to do is mix your personal and business expenditures. It’s a good idea to have a business checking account that’s separate from your personal account.

- It helps you stay on budget. Having multiple accounts can actually make it easier to stay on budget. For example, if you set monthly spending limits then you should only keep enough money in your spending account to cover those limits. Any extra money should be moved into other accounts.

Written by

Written by  Edited by

Edited by