States with the Highest and Lowest Auto Loan Rates (Infographic)

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

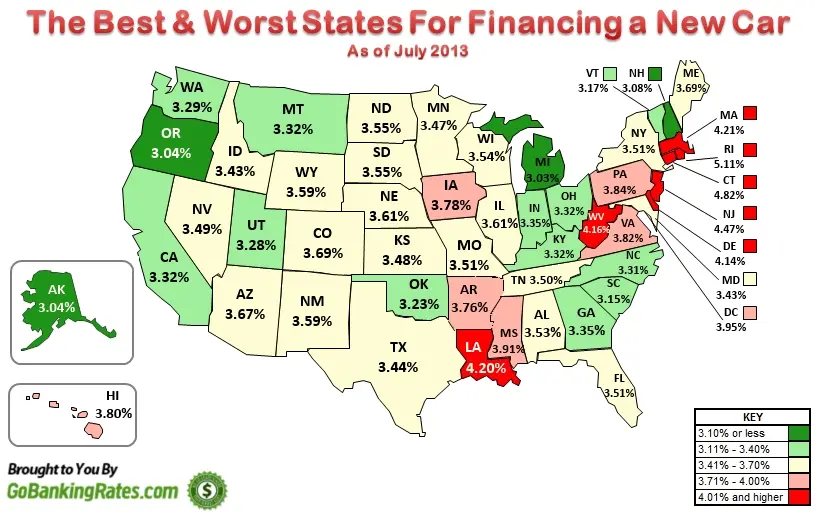

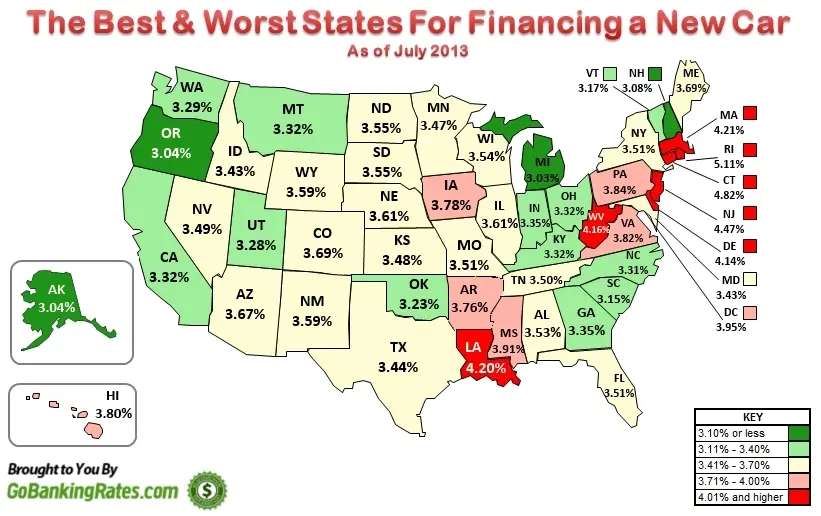

We recently performed a study of all the auto loan ratesoffered on new car loans throughout the U.S., averaging them by state to find out where it’s cheapest (and most expensive) to finance. Take a look at the map below to find out how your state compares to the rest of the nation.

See comprehensive breakdown and analysis:

10 Best States for Financing a New Car

10 Worst States for Financing a New Car

(click the thumbnail for a full version)

Share this Image On Your Site

Please include attribution to GoBankingRates.com with this graphic.

Rank: City, Average New Car Loan Rate (APR)

1: St. Louis, 2.95 2: Detroit, 3.20 3: Pittsburgh, 3.20 4: Los Angeles, 3.25 5: Philadelphia, 3.26 6: Baltimore: 3.28 7: Louisville, 3.34 8: Seattle, 3.36 9: New York, 3.39 10: Cincinnati, 3.40 11: Portland, 3.43 12: Norfolk, 3.43 13: Lexington, 3.49 14: Jersey City, 3.49 15: Newark, 3.49 16: Indianapolis, 3.51 17: Chicago, 3.54 18: Las Vegas, 3.56 19: Hialeah, 3.58 20: Saint Paul, 3.59 21: Boston, 3.61 22: San Bernardino, 3.64 23: Minneapolis, 3.65 24: Atlanta, 3.66 25: Sacramento, 3.67 26: Kansas City, 3.67 27: Chesapeake, 3.67 28: Nashville, 3.68 29: Washington, 3.69 30: Virginia Beach, 3.70 31: Boise, 3.70 32: Chula Vista, 3.73 33: San Diego, 3.74 34: Garland, 3.75 35: Orlando, 3.75 36: Cleveland, 3.75 37: Long Beach, 3.75 38: Milwaukee, 3.76 39: Irving, 3.77 40: Fresno, 3.78 41: Columbus, 3.78 42: Tampa, 3.78 43: Las Vegas, 3.78 44: Memphis, 3.79 45: Santa Ana, 3.79 46: Los Angeles, 3.80 47: Glendale, 3.80 48: Jacksonville, 3.82 49: Bakersfield, 3.83 50: Anaheim, 3.84 51: Fort Wayne, 3.84 52: Miami, 3.86 53: San Francisco, 3.86 54: Reno, 3.86 55: Henderson, 3.89 56: Arlington, 3.90 57: Oklahoma City, 3.91 58: St. Petersburg, 3.92 59: Anchorage, 3.93 60: Charlotte, 3.93 61: Houston, 3.94 62: Birmingham, 3.95 63: Colorado Springs, 3.95 64: San Jose, 3.96 65: Denver, 3.97 66: Dallas, 3.97 67: Lincoln, 3.98 68: Phoenix, 4.00 69: Durham, 4.01 70: Greensboro, 4.01 71: Scottsdale, 4.02 72: Mesa, 4.02 73: Oakland, 4.03 74: Austin, 4.04 75: Toledo, 4.05 76: Plano, 4.05 77: Baton Rouge, 4.05 78: Madison, 4.05 79: Tulsa, 4.06 80: Raleigh, 4.06 81: Irvine, 4.07 82: Aurora, 4.08 83: El Paso, 4.08 84: Omaha, 4.08 85: North Las Vegas, 4.09 86: San Antonio, 4.12 87: Chandler, 4.14 88: Lubbock, 4.17 89: Gilbert, 4.17 90: Tucson, 4.19 91: Wichita, 4.21 92: Fort Worth, 4.24 93: Corpus Christi, 4.30 94: Albuquerque, 4.34 95: Riverside, 4.40 96: Stockton, 4.69 97: Fremont, 4.76 98: New Orleans, 4.85 99: Buffalo, 4.88 100: Laredo, 5.25

Written by

Written by