How to Use Life Insurance While You’re Still Living

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

Life insurance provides financial security for designated beneficiaries when a policyholder dies, but some policies offer living benefits that can be valuable before their death.

For example, some kinds of life insurance allow insurees to sell their policies, take advantage of optional add-ons called riders or withdraw or borrow from a policy’s accumulated cash value, or use it to pay premiums or even supplement retirement income.

However, it’s important to understand the risks, drawbacks and potential impact on beneficiaries.

What Are Living Benefits?

Living benefits are features and conditions in select life insurance policies that allow policyholders to tap a portion of their policy’s value while they’re still alive under certain circumstances.

Living benefits are primarily associated with permanent life insurance policies, which cover policyholders for as long as they live, provided they pay their premiums, and include whole life and universal life as primary subcategories.

The following situations can qualify for living benefits:

- Chronic or terminal illness

- Disability

- Retirement

- Emergencies

- Education expenses

The other primary kind of life insurance is term life. These policies expire after a set time, typically 10 to 30 years. After that, the policy has no value and the holder is left with no coverage. Living benefits are rarer and more restricted with term policies and are available as riders you pay to add, and not as cash value that builds over time as with permanent policies.

Accessing Cash Value in Permanent Life Insurance

Permanent life insurance polices grow their accessible cash value over time in different ways depending on the policy type.

| Whole Life Insurance Policies | Universal Life Insurance Policies |

|---|---|

| – Guaranteed lifetime protection – Guaranteed benefit payouts as long as premiums are paid – Fixed premiums that never increase – Set-it-and-forget-it simplicity – Cash value grows tax-deferred and is available to access for any reason. – Dividends can accelerate long-term growth, pay premiums or be taken as cash. |

– Lower, more flexible premiums that policyholders can adjust with income or lifestyle changes – Fluctuating interest rates – More protection for your dollar, but protection can cease if the policy isn’t sufficiently funded. – Cash value growth is not guaranteed – No dividend payments. |

It’s important to understand the difference between cash value and death benefits.

| Death Benefits | Cash Value |

|---|---|

| The sum of money beneficiaries receive upon the policyholder’s death, which is typically a fixed amount specified in the policy.

In most cases, payouts are tax-free. |

The portion of your premium payments that grows within the policy over time, often earning interest and sometimes paying dividends.

The policyholder can access the cash value by making withdrawals, taking loans or surrendering the policy — but doing so can reduce the death benefit. The insurance company usually keeps any unused cash value but some policies allow it to be added to the death benefit. |

The age of the policy also plays a role as cash value grows differently at different stages.

| Stage of the Policy | Impact on Cash Value |

|---|---|

| Early Years | Cash value typically builds slowly in the beginning as policy costs and commissions negate growth. |

| Intermediate Years | As the policy matures, cash value growth begins to accelerate as interest and dividends compound. |

| Later Years | The most substantial growth comes in the policy’s later years, making mature policies a considerable financial resource. |

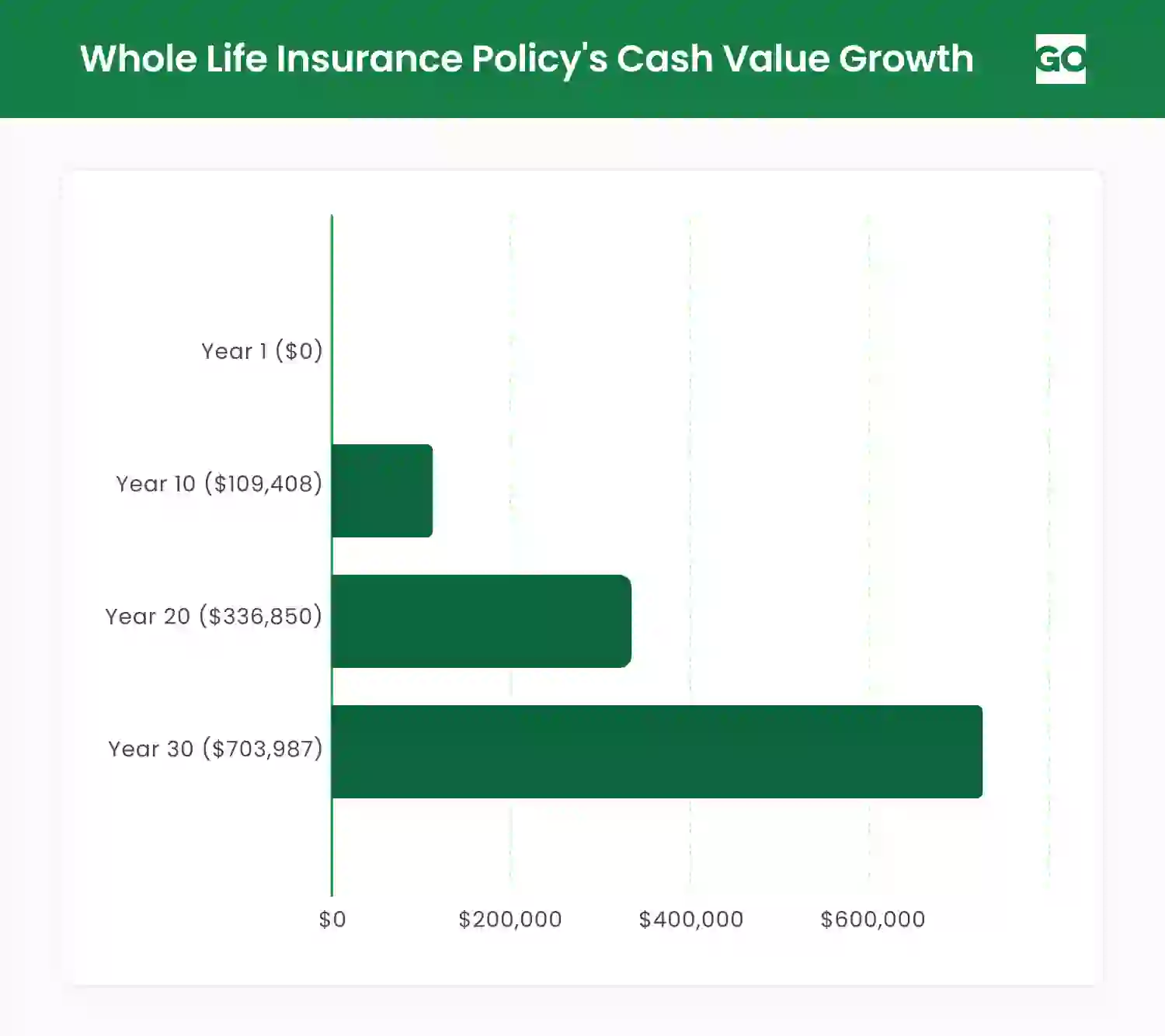

Here’s an example from Insurance and Estates of how a typical whole life insurance policy’s cash value grows over time, presuming annual premiums of $12,000.

Using Accelerated Death Benefits

Accelerated death benefits are add-ons, or riders, that give policyholders permission to tap part of their policy’s death benefit while they are still alive, particularly if they are diagnosed with a qualifying illness, disability or need, including:

- Terminal illness

- Critical illness

- Chronic illness

- Long-term care

Some policies offer accelerated death benefit riders for free, but even then, there’s usually a fee to access the funds. However, any money pulled from the policy as a living benefit will reduce the payout that beneficiaries receive upon the policyholder’s death.

Life Insurance Policy Loans

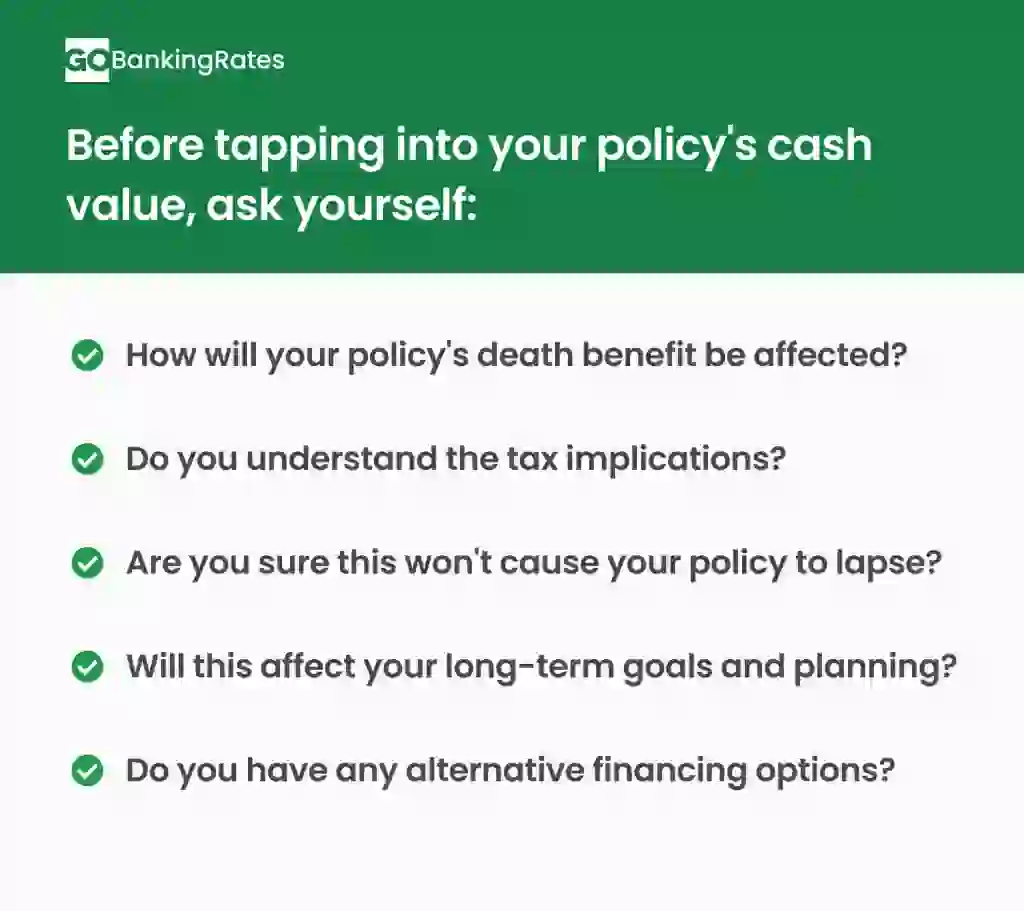

If you’ve paid in enough cash value to borrow from your policy, you can contact your policy administrator to take out a loan that you can use for any purpose, but remember:

- It’s critical not to overborrow — taking out too much could create a cash value deficit that causes the policy to lapse.

- You won’t pay income taxes on the amount you borrow — as long as you pay it back in time.

- The spread — the difference between the interest rate credited to your cash value and the interest rate being charged for the loan should be low, preferably around 1%.

- If you pay the loan back, your policy’s death benefit remains unchanged, but if you die before you repay in full, the outstanding balance will be deducted from your beneficiaries’ payout.

Surrendering Your Life Insurance Policy

Cashing out, or surrendering a policy, means canceling a policy and taking the policy’s cash value — but it isn’t free. The cash surrender value is the policy’s cash value minus surrender charges.

However, surrendering a policy means beneficiaries lose the death benefit and the policyholder forfeits access to the policy’s future growth. There’s a general industry consensus that surrendering a policy isn’t the best option in most situations. However, taking the money and running might make sense when a life insurance policy is no longer necessary because:

- You’re in good health.

- You paid off your mortgage and have no significant debt.

- You have enough income and investment wealth to support your household and dependents.

- You have no estate tax liability.

Living Benefits vs. Viatical Settlements

| Feature | Living Benefits | Viatical Settlements |

|---|---|---|

| Who keeps the policy | You | Purchased by a third party |

| When used | While facing illness or need | Usually during terminal illness |

| Outcome | Reduced death benefit | No policy left for heirs |

| Tax Implications | May be tax-free in some cases | May be taxable |

Pros and Cons of Using Life Insurance While Alive

Pros:

- Immediate access to funds during emergencies or illness

- Can supplement retirement income

- Helps with long-term care or large expenses

Cons:

- Reduces or eliminates the death benefit

- May create tax liabilities

- Could result in policy lapse if mismanaged

FAQ

- What types of life insurance let you access money while alive?

- Some permanent life insurance policies, like whole and universal, including indexed and variable universal, offer living benefits that most term life policies do not.

- Is withdrawing from my life insurance policy taxable?

- Withdrawals that exceed the amount you’ve paid into the policy can be taxable. Cashing out or surrendering your policy can trigger both taxes and fees.

- Can I use life insurance to pay for long-term care?

- Some policies allow you to pay for long-term care by utilizing riders or accelerated death benefits.

- What happens if I don’t repay a life insurance loan?

- If you don't make payments, the loan balance could grow to exceed your policy's cash value, in which case, your policy will lapse.

- Is it better to cash out or keep my life insurance?

- Experts and industry authorities like Guardian Life advise against surrendering your policy in most circumstances and recommend borrowing against it or withdrawing from it, instead.

Our in-house research team and on-site financial experts work together to create content that’s accurate, impartial, and up to date. We fact-check every single statistic, quote and fact using trusted primary resources to make sure the information we provide is correct. You can learn more about GOBankingRates’ processes and standards in our editorial policy.

- Insurance and Estates "Whole Life Insurance Cash Value Chart "

- SC DOI "What happens to the cash value in my policy when I die?"

Written by

Written by  Edited by

Edited by