What Is a Good Credit Score and Why Does It Matter?

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

A credit score is a three-digit number in a range from 300 to 850 that is determined by your credit history. Lenders use it to gauge your ability to pay back a loan. What is a good credit score? A good credit score is often considered to be 670 or higher, but it depends on the credit-scoring model used.

Your credit score is important because it impacts your bottom line. You may pay lower interest rates on loans, need to make smaller down payments on homes and cars and not be required to have a cosigner on your rental property.

Take a look at this guide to good credit scores and potential ways to improve the score to help save money for day-to-day transactions and significant purchases.

What Counts as a Good Credit Score?

While a “good” credit score is typically considered to be 670 and up, it’s important to know that there are several different credit scores. Good scores help you get lower interest rates, better credit card offers and easier approvals.

Here is the score range:

- 300-579: Poor

- 580-669: Fair

- 670-739: Good

- 740-799: Very Good

- 800-850: Excellent

The two main scores are the FICO score and the VantageScore, though the FICO Score is the preferred choice of most vendors. Many companies use one of these to determine creditworthiness.

To determine what is considered a good credit score, look at each type of credit scoring method. They each have their own algorithms.

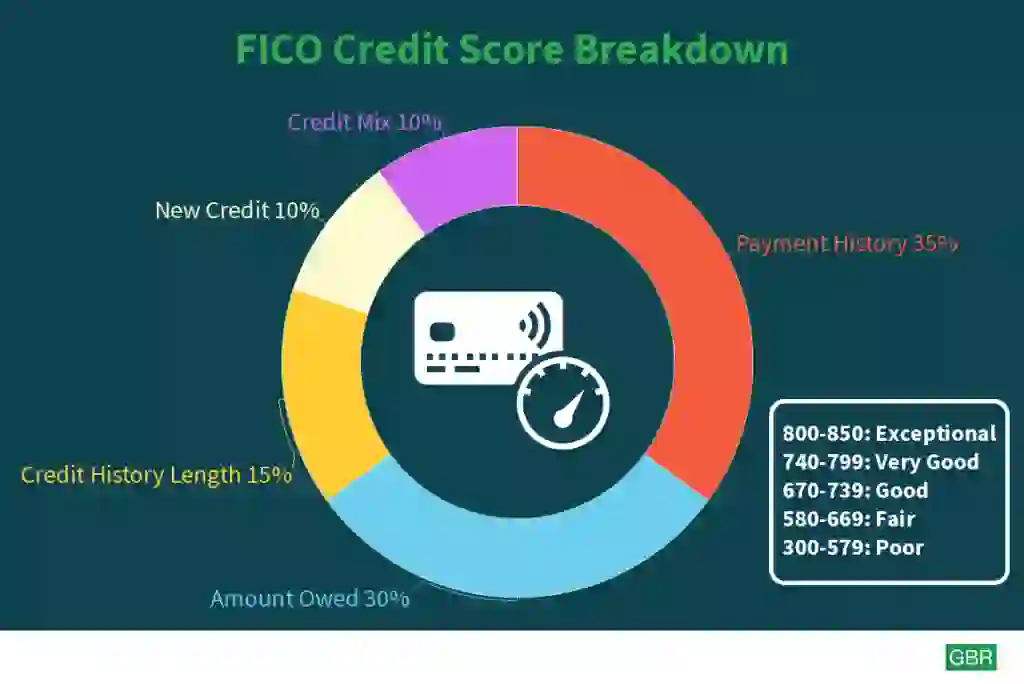

FICO Score Breakdown

FICO stands for Fair Isaac Corporation. It is one of the most common credit-scoring models today. Here’s the FICO Score scale to help you understand what’s considered a good FICO Score.

| SCORE | RATING | INDICATION |

|---|---|---|

| 800 or higher | Exceptional | Easy approval, lowest rates |

| 740-799 | Very good | Good chance of acceptance, lower rates |

| 670-739 | Good | Considered acceptable borrowers |

| 580-669 | Fair | Subprime borrowers with higher rates and less chance of approval |

| 579 or lower | Poor | Considered risky borrowers; lenders may require deposits to access credit |

VantageScore Breakdown

VantageScore bases individual credit scores heavily on payment history and outstanding balances. Here’s a look at the VantageScore scale.

| SCORE | RATING | INDICATION |

|---|---|---|

| 781-850 | Superprime | Easy approval, lowest rates |

| 661-780 | Prime | Good chance of acceptance, lower rates |

| 601-660 | Near prime | Considered acceptable borrowers |

| 300-600 | Subprime | Higher rates and less chance of approval |

Why Does a Good Credit Score Matter?

A good credit score is crucial in so many financial decisions. It makes it much easier to rent an apartment without the need for a cosigner, you can qualify for lower interest rates, and you will be approved for loans and credit cards. Some employers check your credit for certain jobs.

Ultimately, lower interest rates mean lower payments, and your bottom line will benefit.

What Factors Affect Your Credit Score?

Knowing the factors that can impact your credit score is important. This information can influence how you make adjustments to your financial habits. Here’s a breakdown of the factors:

- Payment History: The biggest factor that impacts your credit score is how timely you pay your bills.

- Credit Utilization: This is the second biggest factor. How much of your credit limit you use is a key factor in influencing your credit score.

- Credit History: How long have you had your credit? Older accounts help your score.

- Credit Mix: Having different types of credit like loans, credit cards and other accounts will impact your credit score.

- New credit inquiries: Limiting how often you apply for credit can help your credit score.

What Is a Good Credit Score at Different Ages?

Your age doesn’t directly impact your credit score, but what you do with that credit is what matters.

| Age Group | Typical Credit Score | Key Factors |

|---|---|---|

| Young Adults | 580-730 (Fair to Good) | Still building credit and limited history |

| Mid 20’s to 30’s | 670-799 (Good to Very Good) | Improving scores More responsible credit use |

| Retirement Age | 740-850 (Very Good to Excellent) | Longer credit use, History of payment record |

How to Improve Your Credit Score

Want to improve your credit score? The average American’s credit score in 2024 was 715. That is considered good under the FICO ranges, but what can you do to push it into the higher range? Here are a few strategies:

- Timely bill payment: Try not to miss a single payment on a bill.

- Maintain low credit card balances: Credit card balances need to be under 30% of your credit limit.

- Limit opening new accounts: Do not apply for too many accounts all at once.

- Keep old accounts open: It is good to have an ample credit history so that credit can be extended to you.

- Review your credit report: Check your credit report regularly and dispute errors if you find them.

Good Credit Score vs. Bad Credit Score — What’s the Difference?

How does a good credit score versus a bad credit score make a difference in your day-to-day transactions? Let’s take a look at a comparison table:

| Feature | Good Credit Score | Bad Credit Score |

|---|---|---|

| Loan Approvals | Easier loan approvals | Harder loan approvals |

| Credit card offers | Better credit card offers | Limited options on credit cards |

| Interest rates | Lower interest rates | Higher interest rates |

| Down payments | Lower down payment | Larger down payment |

| Cosigner needed | Not likely | Likely yes |

Final Take to GO

Factors that impact your credit are typically the same across all industries; they’re just calculated differently. Instead of focusing on different industries, focus on improving the factors as a whole. This will increase your chances of approval with any lender, as a good credit score opens the door for opportunities to have lower payments, lower interest, better jobs and housing, and more.

If you are denied credit, ask the loan company for specifics. By getting details about what factors it weighs the most heavily, you can create a targeted credit improvement strategy. The truth is that your credit score can impact your entire life. For example, a low credit score can:

- Prevent you from getting certain jobs and housing, as it can be seen as a sign of irresponsibility

- Lead to high interest rates on mortgages, car loans and other types of loans. This can mean you are paying double or more for a product compared to those with higher credit scores.

- Keep you from getting approved at furniture or appliance stores. When you desperately need a new fridge, you might find yourself paying steep prices through a rent-to-own store.

FAQs About Good Credit Scores

Here are some quick answers to frequently asked questions about credit scores.- What is considered a good credit score?

- A FICO score between 670-739 and a VantageScore between 661-780 are considered good.

- Is a 700 credit score good?

- A credit score of 700 is considered a good score under the FICO and VantageScore models.

- Can you get a loan with a fair credit score?

- Yes, you can get a loan with a fair credit score. However, you may pay higher interest rates, have stricter terms or need a cosigner.

- What's the fastest way to improve your credit score?

- You should avoid opening several accounts at the same time, pay bills timely, lower your credit card balances to 30% below your credit limit and review for errors in your credit reports.

Information is accurate as of March 18, 2025.

Editorial Note: This content is not provided by any entity covered in this article. Any opinions, analyses, reviews, ratings or recommendations expressed in this article are those of the author alone and have not been reviewed, approved or otherwise endorsed by any entity named in this article.

Our in-house research team and on-site financial experts work together to create content that’s accurate, impartial, and up to date. We fact-check every single statistic, quote and fact using trusted primary resources to make sure the information we provide is correct. You can learn more about GOBankingRates’ processes and standards in our editorial policy.

- MyFICO "What is a FICO Score?"

- VantageScore "About VantageScore"

- FDIC "Credit Reports and Credit Scores"

- USA.gov "Understand, get, and improve your credit score"

Written by

Written by  Edited by

Edited by