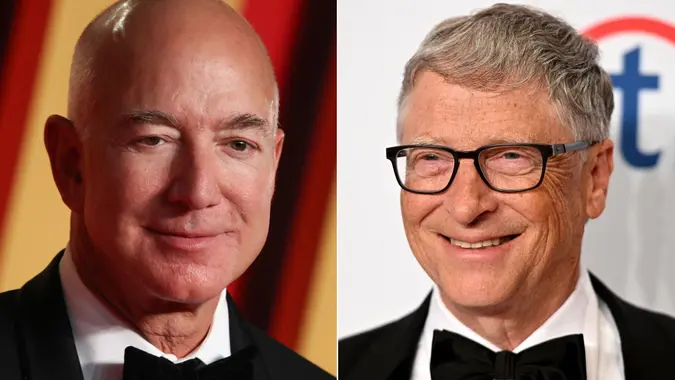

AI Company Backed by Bill Gates and Jeff Bezos Now Worth Billions — What Are the Investment Options?

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

Only seven years after its founding, AI-powered mining startup KoBold Metals has already built a value of nearly $3 billion thanks to investments from heavy hitters like Microsoft co-founder Bill Gates and Amazon founder Jeff Bezos.

If you want to invest in KoBold, there are a couple of options — as long as you’ve built up a lot of wealth yourself.

What Is KoBold Metals?

KoBold develops AI technologies that help mineral exploration companies discover deposits of cobalt, nickel, copper, and lithium, according to a profile on the Forge website. The company was founded in 2018 and is headquartered in Berkeley, California.

Much of its growth potential involves the electric vehicle market — specifically, the batteries that power EVs and require minerals such as lithium, copper, nickel and cobalt to work the right way.

Mining exploration requires “significant upfront investments,” and returns on those investments can take a decade or more, according to Access IPOs. KoBold’s AI-driven approach aims to make the process faster and more efficient.

Interest in KoBold’s technology is such that it has reached unicorn status thanks to the early backing of Breakthrough Energy Ventures, an investment firm founded by Gates that also counts Bezos among its investors. Other high-profile backers of KoBold include Andreessen Horowitz, Bond Capital, Mitsubishi and T. Rowe Price.

How To Invest in KoBold Metals

KoBold was valued at $2.96 billion as of early January 2025, Fortune reported. The company is not yet publicly traded and has no immediate plans to launch an IPO, though it could go public “in the next few years,” according to Benzinga.

This means the most direct way to invest in KoBold right now is as an accredited investor — and that takes a lot of financial firepower. Here are some of the qualifications to become an accredited investor, according to Forge:

- Have earned income above $200,000 (or $300,000 with a spouse or partner) for the past two years.

- Reasonably expect to maintain the same income in the current year.

- Or, have a net worth of at least $1 million, excluding your primary residence.

- Or, hold in good standing a FINRA Series 7, 65 or 82 license.

Access IPOs recommends monitoring pre-IPO investing platforms to find out about future availability of KoBold investing opportunities. If so, you can expect to pay “at least a $10,000” investment minimum. Among the notable platforms cited by Access IPOs are Hiive, Equitybee, EquityZen, Forge Global and Linqto.

You can also get an indirect piece of KoBold by putting your money with investment and venture capital firms that have stakes in the company. In this case, you’ll need to research which companies hold shares of KoBold and whether you can invest in those companies.

More From GOBankingRates

Written by

Written by  Edited by

Edited by