Supreme Court Fast-Tracks Trump’s Tariff Case: What the Decision Could Mean for Your Wallet

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

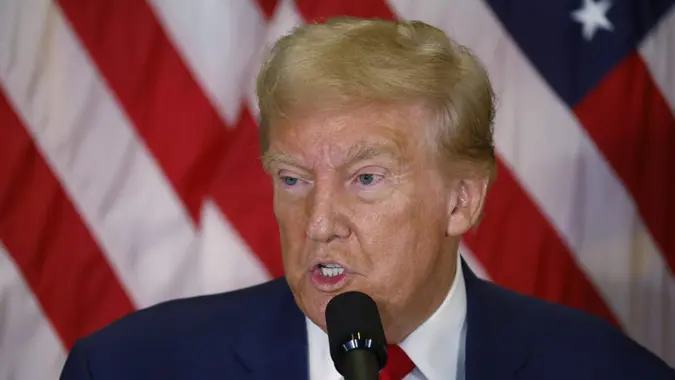

Ever since President Trump declared April 2, 2025, to be “Liberation Day,” in which he invoked the International Emergency Economic Powers Act (IEEPA) to enact a series tariffs against many of America’s trade partners, tariffs have been a controversial subject for the country.

They’ve even made it all the way to the Supreme Court, which will hear arguments about tariffs in coming weeks. Here are more details on the tariff case, as well as what that could mean for you.

Disagreement on Tariffs

The Trump administration has argued that the tariffs — or taxes — levied upon our trade partners will improve America’s trade deficit. Meanwhile, Trump’s opponents have stated that tariffs will only increase prices of imported items in America to an unaffordable degree.

In response to the “Liberation Day” tariffs, a number of small businesses and over 10 states sued over the tariffs, arguing that the president’s tariffs are illegal and not valid under the IEEPA, and that the power to tax via tariffs belongs to Congress alone. The U.S. Court of Appeals for the Federal Circuit agreed in a 7-to-4 ruling, stating that President Trump did not act lawfully, as reported by CNBC.

The Trump administration then appealed that ruling to the nation’s Supreme Court, and even asked the country’s highest court to fast-track the case.

An Accelerated Timeline

The Supreme Court has agreed to that hastened timeline and will hear the case in the first week of November. As with so many cases that come before the Supreme Court, Trump’s tariff case will likely carry serious implications for America.

Trump himself agreed. The president recently stated that if the Supreme Court were to strike down and negate his tariffs, such an act would “literally destroy” the U.S., as reported by The New York Times.

What Does It Mean for You?

While Trump sees the possible overturn of tariffs as a negative for the country, the Supreme Court invalidating Trump’s tariffs could be seen as a good thing for America’s finances — and yours.

“That would be a boost to the economy,” Alex Durante, senior economist at the Tax Foundation, told the Times. “[It] would be doing a tax cut. You would be undoing a tax increase, and you would provide relief to lots of businesses and consumers.”

Durante’s point is a valid one, as eliminating the tariffs would relieve a significant financial burden on American companies, much like a corporate tax cut — one worth potentially billions of dollars. However, it remains to be seen what companies would do with that money. As The New York Times noted, it isn’t likely that companies would return the funds to consumers in the form of lower prices.

That doesn’t mean consumers wouldn’t save money, though. According to Forbes, companies would not have to pass on higher costs to consumers if the tariffs were ruled against.

Ultimately, all eyes will be on the Supreme Court to see what the future of these tariffs will be and how it’ll impact Americans.

Editor’s note on political coverage: GOBankingRates is nonpartisan and strives to cover all aspects of the economy objectively and present balanced reports on politically focused finance stories. You can find more coverage of this topic on GOBankingRates.com.

Written by

Written by  Edited by

Edited by