The Best Way To Keep Your Finances in Order When You Have an Irregular Income

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

Maybe you’ve always dreamed of having your own business. Or perhaps you found the upside to being downsized and started that freelance hustle to pay the bills. Regardless of how you found yourself doing your own thing, you’re now relishing the wins and embracing the struggles of working for yourself — like the fact that your income isn’t exactly consistent.

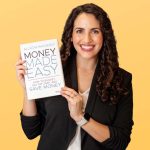

Jessica Moorhouse knows what that feels like. She’s an accredited financial counselor, sought-after money expert, TV personality, and speaker — and she’s also self-employed. So she knows how to make budgeting and financial planning work when income isn’t consistent.

As part of GOBankingRates’ Top 100 Money Experts series, she shared her top rules for budgeting outside the box.

Understand Your Situation and Its Challenges

You may be your own boss, but you can’t handle your financial challenges like a boss if you don’t understand the unique situation that small business owners and self-employed people face. Moorhouse emphasizes that the biggest challenge is the unpredictability of income, especially when bills and expenses are predictable.

It’s important to recognize that most small businesses have high and low seasons. Once you learn the ebbs and flows of your business, planning becomes much easier.

“Sometimes you’ll be working around the clock because there’s high demand for your services or products, and sometimes you’ll have weeks or months with low or no income,” she said. “At the start, it can be hard to balance everything and feel like you’ve got some form of financial security.”

Build That Emergency Fund

One of Moorhouse’s first rules may not surprise you: build an emergency fund. She recommends saving six to nine months of living expenses, plus additional funds for essential business costs.

While you’re saving, she encourages adopting “an abundance mindset because that will help you view your money with a solutions-focused lens.”

Find an Organizing Strategy

Tracking income and expenses is always smart — but it’s especially critical for people with irregular incomes. Moorhouse advises using budget spreadsheets to map out your cash flow and ensure you maintain a financial buffer.

“The key is to have a decent buffer account so you still have cash on hand when you’re waiting to be paid or business is slow, or at the very least some form of credit, like a line of credit, that you can lean on when you need to,” she said.

Spot Your Income Patterns

As your business grows, Moorhouse suggests looking for patterns that can help you budget more effectively. When have you been so slow you could watch cobwebs form? When are you so busy that you wish cloning was an option? Familiarize yourself with these trends.

“This will give you a better sense of what to expect and provide ideas on how to build in some fail-safes with your business,” she said.

She also cautions about clients who consistently pay late.

“It might be time to implement a deposit or late fee–or even cut ties with difficult clients,” she said.

Don’t Make the Leap Without a Cushion

Sometimes, life happens, and you’re pushed off the diving board from a regular 9-to-5 job into the deep end of full-time freelancing. But if you’re considering making the leap on your own, Moorhouse stresses building a financial cushion first — the same amount you’d target for your emergency fund.

“The easiest and quickest way, of course, is to find low-interest credit you can lean on when needed,” she said. “But if you want to avoid debt, the key is to steadily put cash aside into a savings account until you reach your cushion goal. That’s what I did before leaving my last job, and it gave me a great sense of security during my first year on my own.”

This article is part of GOBankingRates’ Top 100 Money Experts series, where we spotlight expert answers to the biggest financial questions Americans are asking. Have a question of your own? Share it on our hub — and you’ll be entered for a chance to win $500.

Written by

Written by  Edited by

Edited by  Money Expert

Money Expert