Social Security: 2023 COLA to Rise 8.7% for its Biggest Gain in Four Decades

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

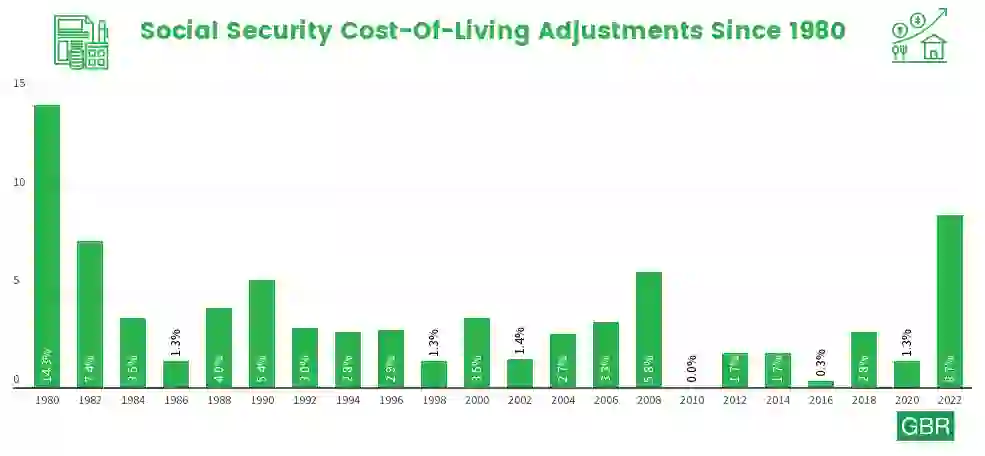

As expected, the Social Security Administration on Thursday announced its biggest annual cost-of-living adjustment (COLA) in more than four decades, with Social Security recipients set to get an 8.7% boost to their 2023 monthly payments.

The announcement was made following the U.S. Department of Labor’s latest Consumer Price Index (CPI) report, which showed that overall inflation in September rose 8.2% from the previous year.

On average, Social Security benefits will increase by more than $140 a month in 2023, the SSA said. The 8.7% COLA will begin with benefits payable to more than 65 million Social Security beneficiaries in January 2023. Increased payments to more than 7 million SSI beneficiaries will begin on December 30, 2022.

The 2023 COLA is the biggest annual increase since the 11.2% adjustment in 1981. Over the past 40 years, the next highest COLA was this year’s 5.9% bump — only the second time during that span that the COLA rose above 5%.

The 2023 adjustment should go a long way toward helping seniors deal with skyrocketing inflation, said David Freitag, CLU, a financial planning consultant and Social Security expert with MassMutual.

“When the Social Security COLA increases at a small amount like 1% to 2.5%, people do not really see the value of a cost-of-living adjusted retirement income stream,” he told GOBankingRates in an email statement. “However, when you have back-to-back increases like 5.9% and 8.7% it is easy to see how very valuable this adjustment is to support the lifestyle of retirees. For most retirees, their Social Security income is one of very few guaranteed sources of income that automatically adjusts for a rise in the cost of living.”

According to research published by Motley Fool, one in five married retired couples and 45% of single retirees depend on Social Security benefits for more than 90% of their income in retirement.

This year, seniors have benefited from a COLA formula that has come under criticism in the past. The COLA is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) rather than the Consumer Price Index for the Elderly (CPI-E).

Many senior advocates say the CPI-E would be a better measurement because it provides a more accurate means of calculating Social Security COLAs, according to the National Committee to Preserve Social Security and Medicare.

But 2022 has been one of the rare years when the CPI-W calculation might work out to the benefit of Social Security recipients.

“Unlike in most previous years, the CPI-E has actually been a little milder than the CPI-W,” Matthew Frankel, a certified financial planner and contributing analyst at The Motley Fool,” said in an email to GOBankingRates. “So, while in most years the way COLAs are calculated isn’t necessarily beneficial for seniors, the 2023 COLA could actually help seniors out even more than the headline number indicates.”

More From GOBankingRates

Written by

Written by