How Owning a Home Will Change Your Taxes

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

A home is one of the largest purchases you’ll ever make. Fortunately, incurring such a huge debt allows for tax savings. Most types of homes qualify for tax-related benefits: condos, co-ops, single-family homes, apartments or townhouses, mobile homes and even second homes. However, in order to take advantage of tax-related benefits as a homeowner, you have to itemize your deductions, which isn’t always the best option for everyone.

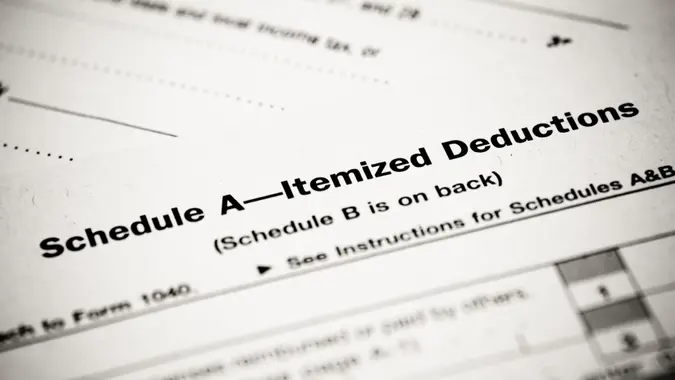

Related: 17 Home-Buying Mistakes That Hurt Your Wallet

Itemized deductions include state and local income or sales taxes, mortgage interest, personal property and real estate taxes and charitable donations. Whenever your itemized deductions exceed your standard deduction, you should itemize. The standard deduction is the amount the government lets you deduct from your income, based on your filing status. When filing your 2020 tax return, these are the standard deductions that apply:

- $12,400 for taxpayers who are single or married but filing separately

- $18,650 for heads of households

- $24,800 for married couples who file joint returns

If you live in a state without state income taxes and low property taxes, chances are itemizing — instead of claiming the standard deduction — may not make much sense unless you donate tons of money to charity.

What Can I Deduct?

The quickest way to find out if you can deduct mortgage-related expenses is to complete an online interview using the IRS’s Interactive Tax Assistant. You’ll be able to find out if you can deduct amounts you paid for mortgage interest, points, mortgage insurance premiums and other expenses related to your mortgage.

According to the IRS, the interview takes about 12 minutes and you’ll need the filing status, basic income information and estimated total of the amounts you paid for mortgage interest, points and mortgage insurance premiums for both you and your spouse. You can find this information on Form 1098, which is available from your mortgage lender.

Guide: What Is a Tax Deduction and How Does It Work?

Mortgage Interest Tax Deduction

The biggest home-related tax break is the mortgage interest tax deduction. If you bought your home before Dec. 15, 2017, you may deduct mortgage interest if your total mortgage amount does not exceed $1 million. If your mortgage debt was incurred after Dec. 15, 2017, you may deduct interest as long as your total mortgage amount is no greater than $750,000. In both instances, you may deduct the entire amount of mortgage interest you paid in a given year, which you can find by referencing Form 1098.

This means that if in the first year of owning your home, your interest payments on your mortgage total $10,000, you would then be able to subtract $10,000 from your adjusted gross income for that year. Then, depending on what marginal tax bracket you are in, you can determine your savings. For those in the 12% bracket, this would mean an effective tax break of $1,200 (because you would have paid $1,200 more in taxes without the mortgage interest tax deduction).

Property Taxes

A second important deduction is for property taxes. The majority of state and local tax authorities base property taxes on the value of the local homes. You can deduct property taxes on the home you live in and any other real estate you own. The total deduction amount allowed for all state and local taxes, including property taxes, is $10,000. To claim a property tax deduction, you’ll need to record the amount on Schedule A, Line 5c of Form 1040.

Check Out: 15 Commonly Missed Tax Deductions

Points

Points are generally used to get a slightly better interest rate on a loan. The IRS allows you deduct this expense in the year that it is incurred, as long as you meet its requirements, which include: Your loan must be for the purchase of your main home, the payment of points has to be a standard business practice in your area and the points have to fall within an established range. To claim points, you’ll need to itemize your deductions and record the amount on Schedule A Line 8a or 8c of Form 1040.

Mortgage Insurance Premiums

Mortgage insurance premiums were set to expire at the end of 2020 but have been extended as part of the COVID-19 relief legislation that took place in December. In some cases, mortgage insurance premium payments can be deducted if you itemize, as long as the mortgage insurance is provided by the Department of Veterans Affairs, the Federal Housing Administration, the Rural Housing Service or private mortgage insurers in connection with a mortgage for the purchase of your main home.

However, if your adjusted gross income is more than $100,000, or $50,000 if you are married and filing separately, the amount you can deduct will be limited. You won’t be able to make any deductions if your adjusted gross income is greater than $109,000, or $54,500 if you are married and filing separately.

Mortgage Insurance: Here’s How It Works

A Few Things You Can’t Deduct

While all these potential savings might make you feel a little giddy, don’t get too excited. Limits apply to the deductions you can make, and there are a few things for which you will have to bear the full cost.

You can’t deduct your mortgage payments or property hazard insurance premiums, even though coverage may be required by your home loan. A few other residential expenses you won’t be able to deduct include homeowners association dues, any additional principal payments, depreciation of your home, general closing costs and local assessments to increase the value of your neighborhood.

More From GOBankingRates

- 19 Effective Ways To Tackle Your Budget

- Are You Spending More Than the Average American on 25 Everyday Items?

- 30 Important Money Habits for Your Financial Future

- Guns and 32 Other Things You Definitely Do NOT Need To Buy During the Coronavirus Pandemic

Cynthia Measom contributed to the reporting of this article.

Written by

Written by