How To Reclaim Overpayments on Tips Today

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

Millions of tipped workers are still seeing income tax withheld on their tips, even though a recent federal law changed how tip income is taxed, according to the IRS.

For many workers, this means they may no longer owe federal income tax on a portion of their tips, even if money was taken out of their paychecks as usual. The good news is that overpaid taxes are not lost. Here’s how to reclaim overpayments on tips today.

What Happened

Employers withheld federal income tax on tip income throughout 2025 because payroll systems had no mechanism to apply the new tax deduction in real time, said tax attorney Chad Cummings of Cummings & Cummings Law.

“The deduction under IRC Section 224 reduces taxable income, which means the tax withheld on those tips was too high and the excess comes back as a refund,” Cummings said.

In addition, although the One Big Beautiful Bill Act (OBBBA) became law in July 2025, the IRS allowed employers to keep standard payroll and W-2 reporting.

“Every dollar of tip income hit your paycheck at your full marginal rate,” Cummings said. “That overwithholding is yours to reclaim when you file your 2025 return.”

Why It Matters

For many tipped workers, income tax was taken out of every paycheck in 2025 even though they may not owe that tax once they file, according to federal tax guidance cited by Fidelity.

That can add up over the course of a year, especially for workers who rely on tips as a large share of their income, Cummings said.

“A server who earned $30,000 in qualified tips and falls in the 22% bracket recovers up to $5,500 in federal income tax,” he explained. “That money was withheld from every paycheck and sits with Treasury until you file.”

How To Reclaim It

The only way to get that money back is to claim the deduction when filing a 2025 tax return. If workers do nothing, the overwithheld income tax stays with the IRS.

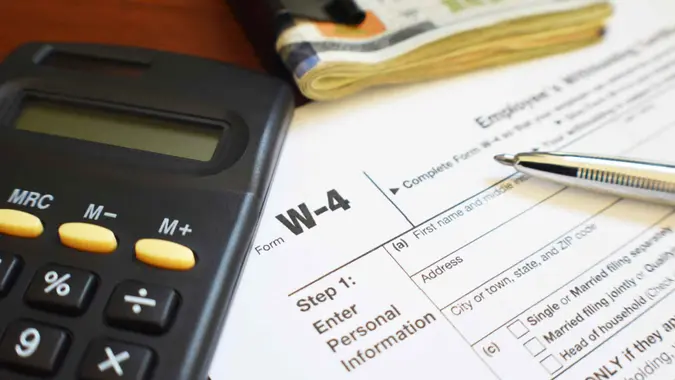

Cummings said workers claim the deduction when filing their 2025 return using the new Schedule 1-A and their documented tip income. This includes tips reported on a W-2, personal tip records or other employer-reported tip amounts. The deduction is limited to $25,000 and begins to phase out for higher-income earners.

What To Know

To qualify, workers must be able to show their occupation appears on the IRS-designated list and that reported tips match what appears on their W-2.

Mismatches can delay refunds and may require a corrected W-2. This deduction applies only to federal income tax. Social Security and Medicare taxes on tips still apply, and state income taxes may still be owed.

“Do not wait until to file your 2025 return,” Cummings said. “The IRS is already accepting return filings, and they process refunds on a first-in-first-out basis, and a backlog of tip-deduction claims from millions of service workers will strain processing capacity. File electronically with direct deposit.”

More From GoBankingRates

Written by

Written by  Edited by

Edited by