Expert Reveals the One Thing Student Loan Borrowers Get Wrong About Taxes

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

If you’re one of the 42 million Americans who have student loan debt, you could be missing out on a key tax rule this season that helps increase savings.

Between evolving repayment programs and changing tax polices, it’s not surprising there’s confusion. According to an expert there’s one big mistake that can impact how much you owe or get back in taxes.

How the Student Loan Interest Deduction Really Works

The biggest mistake student loan borrowers make at tax time is misunderstanding how the student loan interest deduction actually works — or forgetting to claim it altogether, according to Peter Diamond, a federally licensed tax expert with 20 years of experience who has prepared over 5,000 tax returns.

“Many borrowers assume that deducting student loan interest is a dollar-for-dollar tax credit, but it isn’t,” he explains. “A deduction reduces your taxable income, not your tax bill directly and that distinction matters.”

Diamond gave the example of deducting $1,000 in student loan interest in the 22% federal tax bracket. “Your real tax savings are about $220, not $1,000,” he explained.

While it’s still meaningful, expectations should match reality.

Income Limits Could Disqualify You

Another factor take note of is income limits that phase out eligibility, which can surprise higher earners who assume they automatically qualify.

“Because of this, some borrowers either miss the deduction entirely or misunderstand why they can’t claim it,” Diamond said.

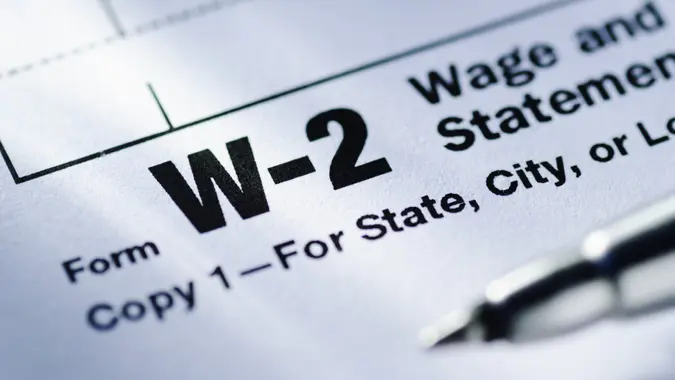

Every legitimate deduction is worth claiming, even if the benefit is smaller than people expect. “Make sure you receive your Form 1098-E from your lender, verify eligibility based on income limits, and include it when filing,” Diamond said. “While it won’t eliminate your tax bill, it’s one of those incremental advantages that add up over time — and smart taxpayers don’t leave money on the table.”

The Smartest Ways To Use Your Tax Refund

Wondering how to utilize your tax refund to stay on track financially? There are a few things you can do, according to Marc Butler, financial advisor and author of “Master Your Money, Secure Your Future.”

“Use it as an opportunity to pay off high-interest credit card debt, boost emergency savings, or invest,” he said. “Doing one or more of these actions will ensure your tax refund doesn’t just disappear, but instead becomes a tool for building financial security and confidence.”

If you do get a refund, saving 80% of it is typically recommended, according to Eric Mangold, CWS, founder of Argosy Wealth Management. “This way, you get a small splurge while also saving for your own future,” he said. “It’s not super exciting, but it sure can make an impact on your wealth building.”

More From GoBankingRates

Written by

Written by  Edited by

Edited by