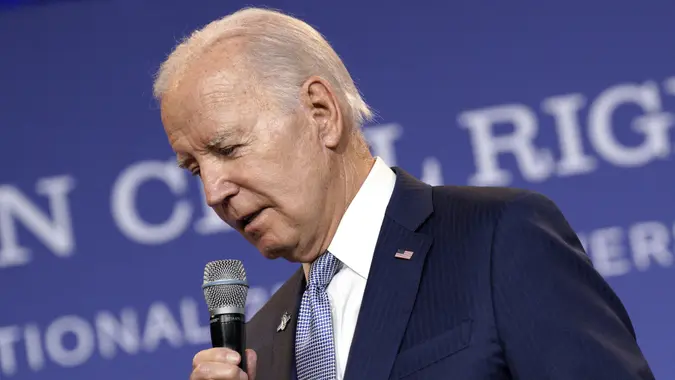

These 6 Things Cost More Now Than When Biden Was Elected — Is He To Blame?

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

The Biden administration has embraced “Bidenomics” as part of his plan to bolster the economy. But critics claim that Biden’s economic policies have left the country in a worse position than before.

Prices have risen by 3% from a year ago, compared to 9.1% in June 2022. Biden’s team claims that lower inflation rates are proof that his policies are working, AP News reported, but Republicans say Biden is still to blame for the cost of groceries, utilities, gas, housing and more.

Groceries

Americans saw the largest increase in food prices since the 1980s. Food prices generally increase about 2% annually, but they shot up 11% from 2021 to 2022, reported the U.S. Government Accountability Office (GOA). Inflation was the biggest contributor, but the GOA also mentioned things like global disruptions to the food supply chain that have made an even greater impact.

Prices are expected to grow more slowly in 2023, but may still grow above the historical average of 2%. “When you look at the forecast for this year’s prices, they’re predicted to increase anywhere from 5 to 10%, and probably settle around 8%,” said GAO’s Steve Morris, an expert in agriculture, during a podcast. “So, they’re still going to be really high.”

Utilities

Nationwide, electric bills increased by 5% on average in 2022, the largest annual increase in residential electricity spending since the U.S. Energy Information Administration (EIA) began calculating it in 1984. For the first three months of 2023, the average monthly electric bill was $133. The EIA said the increase was primarily driven by extreme temperatures and higher fuel costs for power plants.

While many blame Biden for higher utility bills, Austin American-Statesman pointed out that rising prices are more closely tied to natural gas prices than Biden’s climate change decisions.

Gasoline

Gas prices have dropped significantly since last year. The national average is $3.80 per gallon, down from $4.19 a year ago, per AAA data. According to FactCheck.org, U.S. presidents have little control over what consumers pay at the pump. The EIA said gas prices are mainly affected by the price of crude oil, refining costs, distribution and marketing costs and taxes.

Home Prices

The most recently recorded median existing-home sales price was the highest price ever recorded by the National Association of Realtors, reaching $410,200 in June. This is up from $295,300 in June 2020.

Higher home prices are largely because of the shortage of housing supply. When interest rates dropped in 2020, buyers flooded a housing market already dealing with very limited inventory. This created more competition in the housing market and pushed up home prices.

Mortgages

Mortgage interest rates dropped to 2.66% for a 30-year fixed-rate mortgage in Dec. 2020, a historic low, according to data from Freddie Mac. Since then, interest rates have hovered around 7%. Interest rates have fluctuated wildly since Biden took office. However, inflation, economic growth, the Federal Reserve’s monetary policy and the bond and housing markets are the main factors that drive interest rates.

Rent

Rent prices skyrocketed 15% nationwide between 2020 and 2022, The Washington Post reported, but rent growth is finally back to pre-pandemic norms. Some are quick to point the finger at Biden for rising rents, but Politico reported the surge in housing inflation was because of “owners’ equivalent rent,” which measures what landlords could charge to rent out their homes.

Written by

Written by  Edited by

Edited by