What Can Biden Do His Final Weeks in Office To Ease Inflation and Boost the Economy?

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

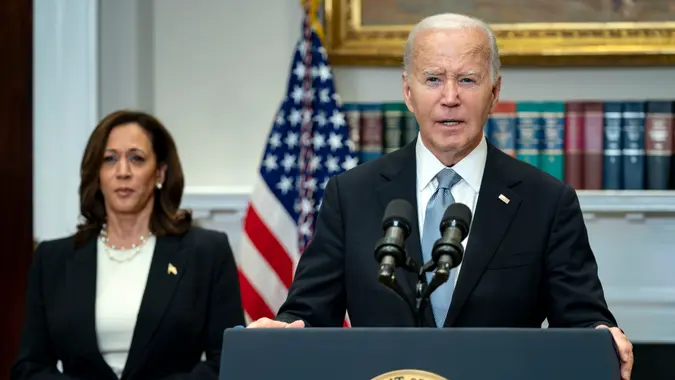

President Joe Biden has entered into the final weeks of his administration, but the urgency to reduce rising costs and revive economic growth remains paramount.

With President-elect Donald Trump returning to the job, Biden has a chance to cement his legacy with bold moves to ease financial burdens on American families. Below are some actionable steps he can take, based on expert opinions and current data supporting them, to boost the economy.

Expand Tax Credits for Immediate Relief

Tax credits are perhaps among the best ways to present immediate financial relief to American families. “We know that expanding tax credits like Child Tax Credit or Earned Income Tax Credit would put money directly into the hands of consumers,” said Shirley Mueller, founder of VA Loans Texas.

This is important because inflation robs purchasing power, and prices have risen over 20% since Biden took office while wages stagnated.

The Inflation Reduction Act (IRA) passed in 2022 already laid the groundwork for such initiatives by reducing energy costs and providing new revenue streams. Under this framework, if Biden can boost tax credits, he could directly remove the financial pressure on middle- and low-income families.

Accelerate Infrastructure Investments

Biden should accelerate investment in infrastructure projects so that he can take on job creation and economic stability. According to Mueller, “Doubling down on job creation programs tied to infrastructure and clean energy investments” is something that matches the continued work under the Bipartisan Infrastructure Law. Not only does this legislation modernize America’s infrastructure, but it creates jobs across a variety of sectors.

Giving Americans more jobs in his final weeks in office is as easy as fast-tracking infrastructure projects. New data from the White House shows ocean shipping prices are down over 70% from their peak as supply chains have been better managed. Biden could fast-track infrastructure projects to immediately generate jobs and increase long-term economic resilience.

Address Supply Chain Bottlenecks

Danny Ray, founder of PinnacleQuote, said economic pressure to reduce inflation can be mitigated by addressing ongoing supply chain woes. He suggested increasing domestic energy production or offering incentives to build renewable energy projects, which could immediately lower energy costs for households and businesses.

Since assuming office, the Biden administration has worked to strengthen supply chains — and it’s necessary to continue efforts to do so. The White House fact sheet notes that there are currently fewer than 20 container ships waiting to dock at U.S. ports, down from over 150 at peak congestion.

Biden can smooth price volatility as he leaves his final weeks as president by investing in domestic production capabilities and strengthening logistics infrastructure. This would help ensure the smooth running of critical sectors.

Implement Targeted Fiscal Policies

Biden has actively pledged to make costs less fiscally burdensome on families as he has slammed opposing economic plans that would aggravate inflation. In the last weeks of his administration, he can reinforce his stance through targeted fiscal measures. Also important for stimulating demand in our economy is expanding tax credits targeted at fiscal policies.

Ray suggested that giving middle- and lower-income familiestemporary tax relief would directly put more money into consumers’ hands. That makes sense since economic analysis has shown that more disposable income results in more consumer spending. According to the Bureau of Economic Analysis, U.S. GDP stands at close to 70% of consumer spending.

On that account, it is possible to increase disposable income with tax relief measures and drive total economic activity. This would be a big opportunity for Biden to be a hero and stand out, especially at a time when households are struggling to pay for rising costs on limited savings rates.

Strengthen Trade Policies To Protect Domestic Industries

Additionally, he should review trade policies to tighten already-existing powers aimed at defending American industries from unfair competitors, namely in an era of renewed geopolitical tensions. Raising tariffs on some imports will help the administration protect domestic investments related to the IRA and other key legislation, the administration said.

The Treasury Department, in a recent report, noted these actions are intended to fight artificially low-priced exports from strategic competitors like China that hurt U.S. jobs and businesses. Reinforcing these trade policies will allow Biden to level the playing field for American workers even as we build a more resilient economy.

Editor’s note on political coverage: GOBankingRates is nonpartisan and strives to cover all aspects of the economy objectively and present balanced reports on politically focused finance stories. You can find more coverage of this topic on GOBankingRates.com.

Written by

Written by  Edited by

Edited by