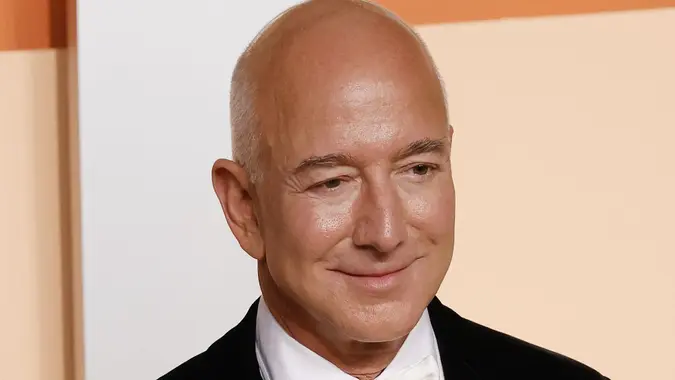

What Regular Investors Can Learn From Jeff Bezos’ Venture Capital Bets

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

Jeff Bezos made his fortunes with Amazon, but the billionaire also diversified into other companies, putting a lot of capital into early-stage startups. Some of them went bust, but others have returned his investment many times over. He was one of the first investors in leading companies like Google, Twitter, Airbnb and Uber.

Bezos has shifted his attention to AI robotics as he seeks new opportunities to multiply his money. The Amazon founder recently invested in Physical Intelligence, a robot startup that’s located in San Francisco.

Investors can learn valuable lessons from Bezos’ venture capital bets. These are some of the highlights.

Pay Attention to Trends

Artificial intelligence has been front-and-center for a few years. Nvidia’s ascent to a $3 trillion market cap put the industry on many investors’ radars. Many AI stocks have performed well over the past 2 to 3 years, especially chipmakers.

That’s some important context for Bezos’ pivot into AI robotic investments. Artificial intelligence is still in its early innings, and the technology’s potential extends well beyond asking ChatGPT a bunch of prompts.

Robots and self-driving cars are two of the many possibilities that AI enables. Bezos has seemingly recognized the opportunity, and made a bunch of investments in the industry. If one of his investments becomes a massive success, it could quickly multiply his money and make up for any that fall short.

Be Willing To Change Your Investments

Jeff Bezos made a lot of money in his early venture capital years by investing in companies that capitalized on the internet. Google, Twitter and Airbnb are some of his most notable early investments.

While the internet still presents opportunities for billion dollar companies to emerge from startup ideas, the industry has become more competitive. It’s more difficult for a new social network to stand out since choices like Facebook, Instagram, YouTube and X command a lot of attention.

Likewise, Google has established such a lead in the online searching industry that an upstart search engine company is less likely to gain traction. The investments that worked when Bezos was getting started don’t have the same long-term potential right now. That is likely part of the reason Bezos is shifting his attention to AI startups.

Smaller Companies Can Produce Higher Returns

Trillion-dollar companies can still produce solid returns for investors, but smaller companies have more upside. That’s because startups currently have very small slices of the pie, and some of these same startups operate in industries with total addressable markets that are well over $1 billion.

Retail investors who can’t access venture capital opportunities can look at small-cap companies in the stock market. While investing in these stocks requires more research, they can produce outsized returns for patient investors. That’s why some people talk about finding “the next Nvidia” and prioritizing companies with small market caps.

Investors should check if a company is reporting rising revenue and net income growth rates. That’s a good sign of an asset that can outperform the stock market. Other variables like a stock’s valuation, industry and long-term catalysts also impact overall performance.

Take a Long-Term Approach

Venture capitalists must take a long-term approach, as some of their investments are illiquid for a few years. Retail investors should only invest money into a stock if they feel comfortable about holding onto it for several years.

Jeff Bezos only made strong returns on his early investments because he had to hold them for many years. Some investors panic during market uncertainty and sell off when the broader market declines. Selling winners at low prices isn’t a recipe for long-term success. If you feel like your portfolio is too risky, you may want to trim it. However, you shouldn’t view your portfolio as too risky just because of a correction.

Diversify Your Holdings

Jeff Bezos hasn’t put all of his eggs in one basket. He spreads his venture capital funds across many opportunities. Some of the companies he invests in end up going bankrupt. However, getting a few good investments allows him to generate significant returns that outpace the losses from his bad investments.

Retail investors can follow this approach by investing in ETFs and diversifying into individual stocks. Putting all of your wealth into a single stock is quite risky, but diversification offers more safety in case your top position loses market share.

More From GOBankingRates

Written by

Written by  Edited by

Edited by