How to Get a Business Loan With Bad Credit

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

Entrepreneurs with shaky credit can get a business loan, but their options are different than they would be with a more attractive score.

Business credit scores are important to lenders because — just like personal credit scores — they represent your risk of default. However, they also reflect the business’s financial health.

Here are your funding options if you’re an entrepreneur whose business credit is lower than it should be.

Understanding Bad Credit & Its Impact on Business Loans

Lenders look at both the personal and business credit scores of loan applicants, and bad credit on either or both can affect your eligibility and your rate

What is Considered Bad Credit?

Multiple entities generate credit scores, each of which uses unique scoring models with different numerical rating systems.

Personal Credit

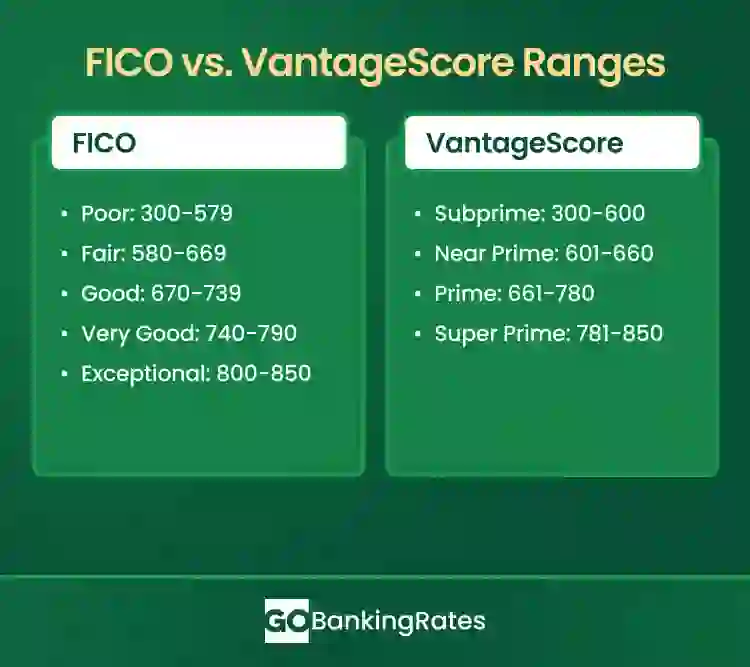

Personal credit scores are based on payment history, credit utilization, credit mix, age of credit and new credit. FICO is the most widely used personal credit scoring system, but some lenders also use the VantageScore model. Both have a range of 300-850.

Business Credit

Business credit scoring models weigh many of the same factors as personal credit scoring algorithms. However, they also consider factors like your business’s size, debt, bill payment history and industry risk. The three main scoring models — including Equifax, which focuses on business payments — use a numerical range of 0-100.

| Dun & Bradstreet Paydex Score | Experian Intelliscore Plus | Equifax Payment Index Score |

|---|---|---|

| High risk: 0-49 Moderate risk: 50-79 Low risk: 80-100 |

High risk: 1-10 High-medium risk: 11-25 Medium risk: 26-50 Medium-low risk: 51-75 Low risk: 76-100 |

Payments 120+ days past due: 1-19 Payments 91-120 days past due: 20-39 Payments 61-90 days past due: 40-59 Payments 31-60 days overdue: 60-79 Payments 1-30 days past due: 80-89 On-time payments: 90-100 |

How Bad Credit Affects Loan Eligibility

Bad credit is as detrimental to business owners as personal credit is for everyday borrowers — and for many of the same reasons. Bad credit can lead to:

- Loan rejections

- Higher interest rates

- Stricter terms

- Lower loan amounts

- Additional collateral requirements

Types of Business Loans Available for Bad Credit

| Loan Type | Best For | Typical Requirements | Interest Rates |

|---|---|---|---|

| Business Term Loans | General business expenses | Collateral or strong cash flow | Higher due to risk |

| Business Lines of Credit | Ongoing working capital needs | Revenue-based eligibility | Variable |

| Invoice Financing | Businesses with unpaid invoices | B2B businesses | Moderate |

| Merchant Cash Advances | Businesses with high credit card sales | Consistent daily revenue | Very high |

| Equipment Financing | Buying business equipment | Asset-backed loan | Competitive |

| SBA Microloans | Startups and small businesses | Strong business plan | Lower than traditional loans |

How to Improve Your Chances of Getting Approved

Here’s how to increase your approval odds if your business credit is less than stellar.

Build Your Business and Personal Credit Scores

The following steps can improve your personal and business credit scores–lenders consider both when making lending decisions.

- Pay down existing debt.

- Correct errors on credit reports.

- Separate business and personal finances with a business credit card and bank account.

- Pay outstanding invoices and bills.

- Register your business as an LLC or corporation.

- Keep your credit utilization under 30%.

- Avoid applying for too many loans or lines of credit simultaneously.

Offer Collateral or a Personal Guarantee

You can reduce your risk level as a borrower to entice skeptical lenders by pledging collateral to back the loan, including assets like real estate, vehicles, equipment, or inventory. You might also consider offering a personal guarantee, which holds you personally liable for paying back the loan even if the business defaults. However, this can be risky because the lender can pursue your personal assets — including your home, savings or vehicles — if your business is unable to repay the loan.

Work with a Co-Signer or Business Partner

Adding a co-signer as a guarantor can dramatically increase your odds of getting a business loan if your credit is shaky. However, if you default, you leave your co-signer on the hook.

You might also take on a business partner with good credit who has better approval odds.

Show Strong Business Finances

Lenders like to see detailed financial statements chronicling a business’s history of sound financial health, including:

- Solid cash flow

- Revenue stability

- Assets

- Minimal liabilities

- Logical repayment and debt-management structures

- Profitability

- Positive financial projections

How to Apply for a Business Loan with Bad Credit: Step-by-Step Guide

Here’s how to apply for a business loan, even if your credit is poor.

- Check your personal and business credit scores.

- Scour your personal and business credit reports for errors and challenge any mistakes you find.

- Gather all pertinent financial documents, including revenue reports, profit/loss statements, proof of payments, tax returns and bank statements.

- Compare lenders and shop around for loan options from large banks, local banks, credit unions and online lenders.

- Prepare a thorough and detailed business plan to demonstrate the purpose of the loan and your ability to repay.

- Submit your applications and negotiate the terms.

Best Lenders for Business Loans with Bad Credit

Community banks and credit unions are more likely to work with low-credit applicants than big corporate banks.

Some online lenders specialize in business loans and lines of credit. They’re known for fast funding, low fees and limited paperwork, and a willingness to work with below-prime borrowers if their business performance is strong, including:

- OnDeck

- BlueVine

- Biz2Credit

- Fora Financial

You might also consider crowdfunding platforms like Kiva, which offer microloans with no credit or time-in-business requirements.

Written by

Written by  Edited by

Edited by