What Is a Credit Report and How Do You Read It?

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

Your credit report provides a record of how you’ve managed your debt obligations, as reported by your creditors to the credit bureaus. Each report includes details such as:

- Types of accounts — credit cards, loans, mortgages, etc.

- Current and historical balances

- Credit limits

- Payment history

- Accounts in collections

- Public records related to your debts, including liens, foreclosures, bankruptcies, civil suits and judgments against you

Your credit report combines all your credit history information into one document. Credit reports are compiled by the three nationwide credit reporting agencies — Experian, Equifax and TransUnion. Each agency sells its credit bureau report to your future lenders, landlords, employers and others who have a stake in an individual’s creditworthiness.

How Do I Read a Credit Report?

Federal law allows you to request a free copy of your credit report once every 12 months from each of the three major credit bureaus. You can check all three at once or space them out every four months.

While your credit report provides detailed financial information, it does not include your credit score. However, many credit card issuers and financial institutions offer free access to your credit score.

Below is a look at what information you’ll find on your credit report.

Personal Information

Your personal information isn’t used to calculate your credit score, but it’s important that it’s correct. Errors could cause someone else’s accounts to appear on your credit report, which may lower your score and indicate possible fraud or identity theft.

Some personal details you’ll see on your credit report include your name, current address and Social Security number.

Credit Account Details

Your credit report lists each account, showing details like the following:

- Account status: Open, negative or closed

- Account type: Revolving line of credit, installment loan, etc.

- Account balance: Monthly balance, high balance and revolving credit limit or initial installment loan amount

- Credit bureau: The reporting agency for the account

- Payment history: Number of times payments were 30 days, 60 days, 90 days or 120 days late

In addition to looking over your credit accounts, you can use the information to determine your credit limits and utilization ratios.

For example, if you have a combined revolving credit limit of $10,000 and $2,000 in revolving account balances, your credit utilization ratio is 20%.

Credit Inquiries

Inquiries refer to when a legitimate business requests your credit report. Inquiries can be “hard” or “soft.”

- Soft inquiries: When your credit report is pulled by someone other than a prospective lender. This could be when a company pulls your credit score on its own to see if it wants to extend a promotional offer or if it is checking your score when you’re already a customer. Soft inquiries have no effect on your credit score, so checking your own score won’t hurt it.

- Hard inquiries: When your credit score is pulled because you have applied for new credit, such as a new credit card, car loan or mortgage. Unlike soft inquiries, hard inquiries can have a small negative impact on your score.

Public Records and Negative Information

This section of your credit report lists events like bankruptcies, liens, foreclosures and judgments, which are public records. The public records are limited to finance-related records, so criminal arrests and convictions aren’t included. Generally, this information stays on your credit report for several years.

Credit Report Summary and Score Factors

Your credit summary gives a quick overview of your accounts, balances and any missed payments. While you can review all the details in your credit report, the summary highlights key information at a glance.

All of the factors on your credit report impact your credit score. But some factors hold more weight than others. The most important factors include:

- Your payment history

- Amounts owed

- Length of credit history

- New credit

- Credit mix

For example, a history of on-time payments can help boost your credit score. Conversely, a history of late payments can bring your credit score down.

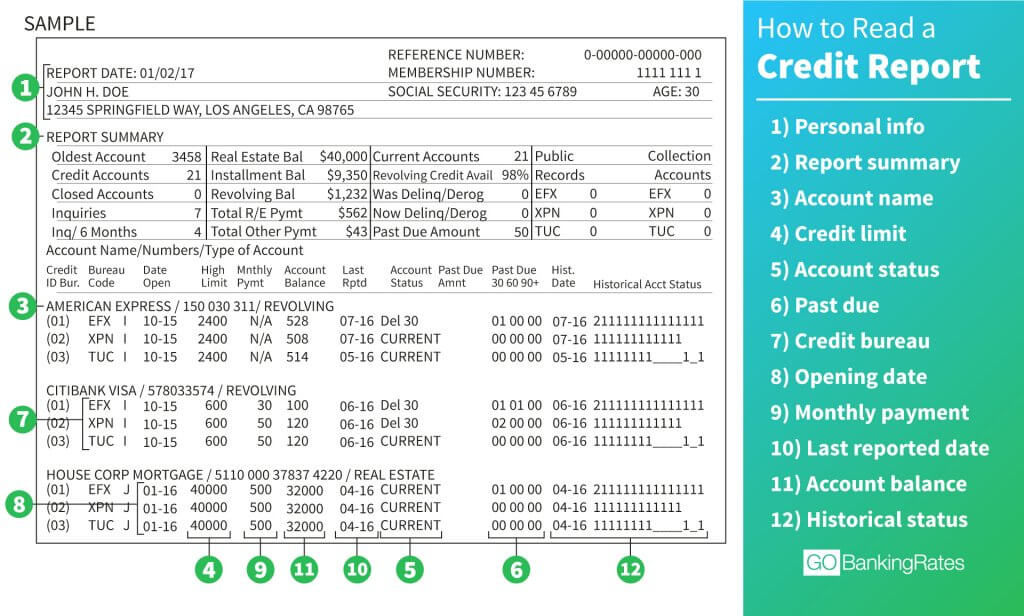

Example of a Credit Report

Below is an example of how a credit report is structured. Use this as a reference when reviewing your own credit report.

Why Is Your Credit Report Important?

Your credit report plays a big role in your financial life. It impacts more than just loan approvals — it can affect housing, employment and even insurance rates. Here’s how:

- Loan approvals: Lenders review your credit report when deciding whether or not to offer you a loan and what loan terms they are willing to offer you.

- Rental applications: Some landlords consider your credit before leasing you a home.

- Job opportunities: Employers may review your credit before offering you a job.

- Insurance rates: Insurers could consider your credit when determining premiums.

Ultimately, a good credit score based on a solid credit report can make your life easier. On the other hand, a credit report riddled with negative information can make your life more difficult.

How To Spot Errors and Dispute Mistakes on Your Credit Report

Both the credit bureau and the creditor reporting the information are responsible for ensuring that the information is correct. To maximize your rights under federal law, you’ll want to contact both to report errors and fix your credit report as quickly as possible.

Write To the Credit Bureau

Credit bureaus must investigate any items you question, usually within 30 days. The Federal Trade Commission even has sample forms you can use to get started.

Follow these steps to file a dispute by writing a letter to the credit bureau reporting the information:

- Include your name and address in the letter to the credit bureau. Also, identify each piece of information you believe to be incorrect and why you dispute the information.

- Request that the incorrect information be corrected or removed from your credit report.

- Make a copy of your credit report and highlight or circle the information you are disputing.

- Make copies of any evidence that supports your claims, and include those copies, not the originals, with your letter.

- Make a copy of the packet of information you are sending, then send your letter and attachments via certified mail so you can document what you sent.

Write To the Creditor

You should also write to the creditor who is reporting the incorrect information to the credit bureaus. If the creditor continues to report the same information in the future, it must let the credit bureau know you are disputing it.

Follow these steps to file a dispute by writing a letter to the creditor:

- Identify each piece of information you believe to be incorrect and why you dispute the information.

- Request that the incorrect information be corrected or that the creditor stop reporting the incorrect information to the credit bureaus.

- Make copies of any evidence you have to support your claims and include those copies, not the originals, with your letter.

- Make a copy of the packet of information you are sending, then send your letter and attachments via certified mail to the creditor’s address listed on your credit report.

FAQ

Here are the answers to some of the most frequently asked questions about reading credit reports.- What is a credit report, and why is it important?

- A credit report includes information about your credit accounts, like an auto loan or credit card. It's important because the information on your credit report is used to create your credit score, which impacts many areas of your financial life.

- How do you read a credit report step by step?

- Start by looking at your personal information to confirm it's correct. From there, you can look at each credit account and the information included to confirm accuracy.

- How can I get a free copy of my credit report?

- You can get a free copy of your credit report at AnnualCreditReport.com.

- What should I do if I find an error on my credit report?

- If you find an error on your credit report, you should contact the credit bureau and the creditor to correct the mistake as soon as possible.

- How often should I check my credit report?

- If possible, review your credit report on a quarterly basis. At the very least, review your credit report on an annual basis.

- Does checking my own credit report hurt my credit score?

- No, checking your own credit report won't hurt your credit score.

- What's the difference between a credit report and a credit score?

- A credit report includes detailed information about your credit usage. In contrast, a credit score is a three-digit number based on the information found in your credit report.

Michael Keenan and Valerie Rind contributed to the reporting for this article.

Our in-house research team and on-site financial experts work together to create content that’s accurate, impartial, and up to date. We fact-check every single statistic, quote and fact using trusted primary resources to make sure the information we provide is correct. You can learn more about GOBankingRates’ processes and standards in our editorial policy.

Written by

Written by  Edited by

Edited by