What Credit Score Do You Start With If You’ve Never Had Credit Before?

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

You don’t start with a credit score at all.

That’s right — if you’ve never had a credit account reported to the major credit bureaus, you don’t have a score yet. Credit scores aren’t automatic, Instead, they’re calculated based on how you manage credit over time.

Once you open your first credit account — like a credit card or loan — and it’s reported to the bureaus, it usually takes about six months of activity to generate a score.

What Your First Credit Score Might Look Like

- Initial scores typically fall between 500 and 650. This depends on how responsibly you manage your first account(s).

- It’s very rare to start at the lowest (300) or highest (850).

- Responsible habits — like on-time payments and low balances — push your score up quickly in the first year.

How Credit Scores Work From Scratch

So what goes into building a credit score once you get started?

Meet the Big Three: The Credit Bureaus

There are three major credit reporting agencies:

- Equifax

- Experian

- TransUnion

Each one collects information about how you borrow and repay money and they generate reports that lenders use to assess your creditworthiness.

The Score Range

Credit scores typically range from 300 to 850. The higher your score, the more favorably lenders see you.

What Makes Up Your Score

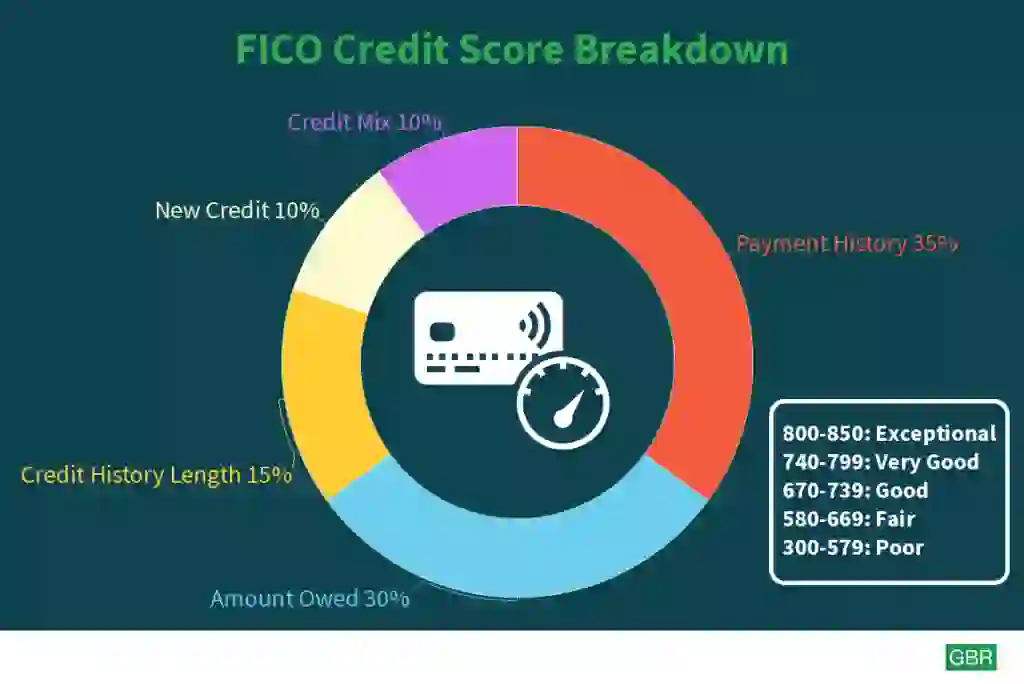

Your credit score is calculated using several key factors, especially under the FICO scoring model:

- Payment History (35%): Have you paid your bills on time?

- Credit Utilization (30%): How much of your available credit are you using?

- Length of Credit History (15%): How long have your accounts been open?

- Credit Mix (10%): Do you have different types of credit (e.g., credit card + loan)?

- New Credit Inquiries (10%): Have you applied for a lot of new credit recently?

3 Easy Ways To Build Your Credit From Zero

Even if you’re starting from scratch, building credit doesn’t have to be complicated. Here are three beginner-friendly ways to get going:

1. Get a Secured Credit Card

This is one of the safest, most effective ways to begin your credit journey.

- You deposit money upfront — usually $200-$500 — as your credit limit.

- Use the card for small purchases and pay it off each month.

- Over time, this activity gets reported and helps establish your score.

Tip: Choose a card that reports to all three credit bureaus. Look for one with no annual fee and the option to upgrade to an unsecured card.

2. Pay Bills on Time (Yes, Even Rent!)

Timely payments are the single most important part of your credit score.

- Some services, like Experian Boost, allow you to report rent, utilities or phone bills to help build your history.

- Even one missed payment can hurt your score, so stay consistent.

3. Become an Authorized User on Someone Else’s Card

If you have a trusted friend or family member with a solid credit history, ask if you can be added to their credit card account.

- You don’t have to use the card — just being on the account can help you build credit.

- Make sure their card reports authorized users to the bureaus and that they pay on time.

What Affects Your Starting Credit Score?

Your first score isn’t random — it’s shaped by the types of accounts you open and how you use them.

Key Factors That Impact Your Initial Score:

- Type of account: A student loan or secured card may affect your score differently based on repayment terms.

- Payment behavior: Late payments can drag down your score fast.

- Credit utilization: Using too much of your available credit (over 30%) can hurt your score.

- Number of accounts: Opening several accounts at once might make you seem risky to lenders.

How Long Does It Take To Build a Good Credit Score?

Once your first account is reported and active, it takes about six months to generate a score. From there:

- Good credit (700-749): Usually takes 12-18 months of responsible use.

- Excellent credit (750-850): Can take several years, depending on your credit mix and consistency.

- Average U.S. FICO score: Around 717.

Final Take to GO

You don’t start with a credit score at all — but the moment you begin using credit responsibly, you’re on your way to a strong score. Your first score will depend on your habits, not your age.

If you’re ready to build credit, start small and smart. Open a secured card, pay on time and stay under your credit limit. It may take a few months to see results, but the payoff — better rates, easier approvals and long-term financial freedom — is worth it.

Want to build credit fast? Explore how to improve your credit score today.

FAQ

Here are answers to some frequently asked questions about credit scores.- Do you start with a credit score of zero?

- No. You don’t have a score until you have a credit activity. Once you open an account and it’s reported, your first score appears in about six months.

- Can you have a credit score before you turn 18?

- Not usually. You need to be 18 to open credit in your own name. However, becoming an authorized user on someone else’s account can help start your credit history earlier.

- What is the average starting credit score?

- Most first-time scores fall between 500 and 650, depending on how you manage your first account(s).

- Does your first credit card automatically give you good credit?

- Not automatically. It depends on how you use it. Pay on time, keep your balance low, and your score will grow.

- Not automatically. It depends on how you use it. Pay on time, keep your balance low, and your score will grow.

Caitlyn Moorhead contributed to the reporting for this article.

Information is accurate as of June 9, 2025.

Editorial Note: This content is not provided by any entity covered in this article. Any opinions, analyses, reviews, ratings or recommendations expressed in this article are those of the author alone and have not been reviewed, approved or otherwise endorsed by any entity named in this article.

Our in-house research team and on-site financial experts work together to create content that’s accurate, impartial, and up to date. We fact-check every single statistic, quote and fact using trusted primary resources to make sure the information we provide is correct. You can learn more about GOBankingRates’ processes and standards in our editorial policy.

Written by

Written by  Edited by

Edited by