How To Invest in Sports Teams Without a Fortune

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

In many cases, investing in sports teams requires you to be an accredited investor, meaning you have to earn a certain amount of income or have at least a $1 million net worth, not including your primary home. Accredited investors can invest in sports teams through private equity funds.

But that type of investing isn’t accessible for all investors. For now, investing directly in sports teams through a private equity company is not in the cards for everyday investors.

However, there are ways for everyday to invest in sports teams. Read on for more details on a couple of different ways everyday investors can invest in their favorite teams.

Also see how rich your NFL team is.

Sports-Related Stocks

If you have a brokerage account, you can purchase shares of publicly traded companies that manage or own sports teams.

Here are a few you could consider.

- Madison Square Garden Sports Corp. (MSGS): Traded on the New York Stock Exchange (NYSE), Madison Square Garden Sports Corp. owns and operates the New York Knicks and the New York Rangers.

- Manchester United (MANU): Soccer fans can buy shares of the company, which earns its revenue from ticket sales, merchandise and broadcasting rights for the Premier League Manchester United team. It’s also traded on the NYSE.

- Atlanta Braves Holdings (BATRA): According to the Atlanta Braves Holdings website, Atlanta Braves Holdings owns Braves Holdings, the owner of the Atlanta Braves MLB team. It also owns assets and liabilities affiliated with the stadium. The Series A stock trades on the Nasdaq exchange.

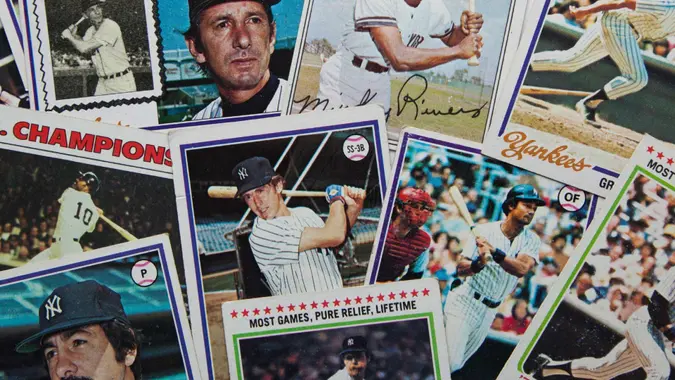

Sports Memorabilia

Aside from stocks, you can consider alternative investments as a way to indirectly invest in a sports team. For example, investing in sports memorabilia can be a great way to not only show you’re a fan of a sports team but also be able to profit from its merchandise.

There are many types of sports memorabilia to choose from — think autographed goods, trading cards, jerseys, championship rings and historical artifacts to start. If you can get your hands on a rare and coveted item, you can profit on its appreciation when you sell it.

According to Kiplinger, sports collectibles are now in the “big leagues” of investing, with the auction house Sotheby’s dedicating a week to sports memorabilia in 2024. As reported by Barron’s, predictions have the sports memorabilia market reaching $227.2 billion by 2032 — an increase from $26.1 billion in 2021.

Consider Your Risk Tolerance and Goals

Whether you invest in sports teams through memorabilia or publicly traded companies, it’s important to do your research. You need to make sure that you can afford to invest the amount you want and that you understand there are always risks involved.

When investing in memorabilia, for example, investors should be careful about acquiring authentic items, consider how the item will be stored and be aware of pricing changes. An investor could end up spending more than the sticker price for the item itself to preserve the item and could lose more money by paying fees to an auction house when they want to sell.

As for investing in sports teams through publicly traded companies, you may experience much more volatility with those stocks compared with investing in, say, the S&P 500.

These types of investing may be better suited for those looking to build long-term wealth. Before you start researching memorabilia you want or opening a brokerage account, think carefully about what your financial goals are and how investing in sports teams can help you get there.

Written by

Written by  Edited by

Edited by