When Should I Refinance My Car?

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

Car loan refinancing is when you take out a new loan for a vehicle that you’re already financing. You would use the new loan to pay off the old loan. This can be a good move if you’re able to get better terms on the new loan than you had on the old one.

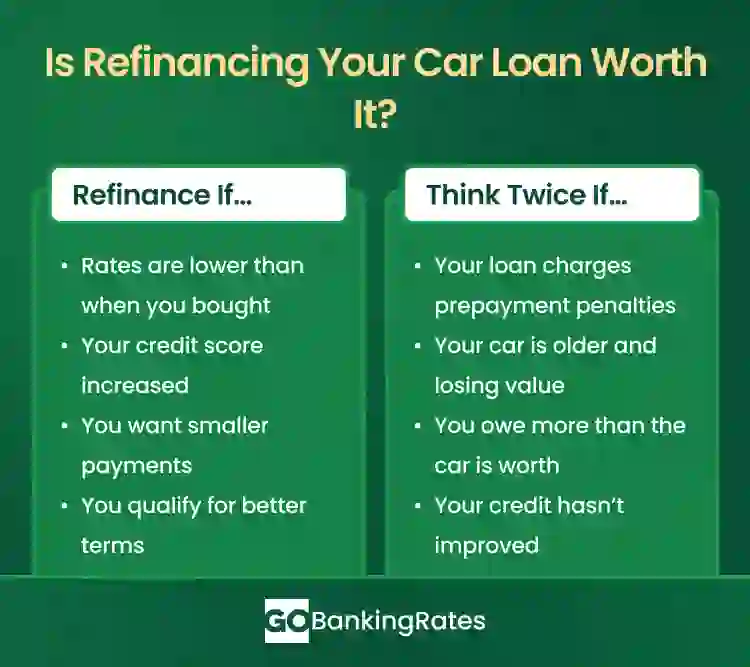

When Should You Refinance Your Car Loan?

Here is when you should consider refinancing:

Interest Rates Have Dropped

Lenders base the interest rates they offer you on a few factors, but a big one is the rates set by the federal reserve. When those are lowered, you may be able to get lower rates on loans.

Your Credit Score Has Improved

Another big factor in what the rates you’re offered is your credit score. If your credit score has improved since you first took out the loan, you might be able to refinance for lower rates.

You’re Struggling with High Monthly Payments

There are a few ways that refinancing can help you lower your payments. If you can secure a loan with lower interest rates, you’ll pay less each month. You can also extend the term of the loan and lower your monthly payments.

You’re Offered Better Loan Terms

If you financed your car from the dealership and didn’t have a chance to shop around, you might be able to get better terms through a bank or credit union.

How to Refinance a Car Loan Step-by-Step

Here’s what you need to do to refinance your car loan:

- Check your credit score: This will help you know what kind of lenders you can apply for.

- Compare lenders and offers: See what kind offers you can get from banks and credit unions.

- Calculate the savings: Make sure you understand how much the new offers can save you after interest and any fees.

- Gather your documents: Lenders usually ask you to show details about your car and the current loan. They will also want to look at your credit history.

- Submit your application: Make sure you correctly fill out every field to prevent any delays in processing your application.

- Finalize the loan: Follow the steps to pay off your old loan and finish setting up a new loan.

Alternatives to Refinancing Your Car

If refinancing isn’t the right choice for you or you can’t get approved for better interest rates, you can also:

- Negotiate with your current lender for better terms

- Make extra payments to help you save money

- Trade in your vehicle for a more affordable option

FAQ

- How soon can you refinance a car loan?

- There is no limit to when you can refinance your car. However, refinance can come with fees, so you want to make sure you’re not negating your savings by refinancing too often.

- Does refinancing a car hurt your credit?

- No. When you refinance, you pay off your original loan. The credit bureaus view this positively.

- What credit score do you need to refinance a car?

- It’s possible to be approved to refinance at many different credit score levels. However, you will get the best rates if you have Good or Very Good credit.

- Can you refinance a car loan with bad credit?

- It’s possible to find a lender that will approve your refinance with bad credit. However, the interest rates may not be low enough to be worthwhile.

- Is there a downside to refinancing a car loan?

- Although refinancing generally saves you money in the long run, you will probably have to pay fees up front.

Written by

Written by  Edited by

Edited by