What Is a 403(b) Plan and How Does It Work?

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

A 403(b) is a tax-advantaged retirement plan offered to certain public employees and nonprofit workers. The advantage is that contributions are typically made on a pre-tax basis, similar to 401(k) plans, meaning the cash goes into the account before the IRS taxes it. Each dollar you contribute is one you can deduct from your taxable income, reducing your obligation to the IRS.

Additionally, the money grows tax-deferred until you begin making withdrawals in retirement, at which point the IRS taxes your distributions as ordinary income. For many teachers, healthcare workers, and nonprofit employees, this makes a 403(b) one of the most accessible ways to build long-term retirement savings.

Who Can Open a 403(b)?

A 403(b) plan isn’t available to everyone — it’s limited to people who work for certain employers in the public and nonprofit sectors. Eligible participants often include:

- Public education employees. Teachers, professors, librarians, and administrative staff at public schools, colleges, and universities.

- Healthcare professionals at nonprofit hospitals. Registered nurses, physicians, occupational therapists, and medical assistants.

- Nonprofit workers. Employees of 501(c)(3) organizations such as directors, case managers, and other staff.

- Religious leaders. Clergy and other employees of religious organizations.

- Certain government employees. Workers in qualifying state or local government roles.

How Does a 403(b) Work?

Employees enrolled in 403(b) plans choose a contribution — either a specific dollar amount or a percentage of their salary — to be automatically deducted from their paycheck and deposited into the account. Some employers offer matching contributions.

Those contributions are then automatically invested in mutual funds or annuities. Earnings and investment gains grow without being taxed until you withdraw the money in retirement.

403(b) Contribution Limits for 2025

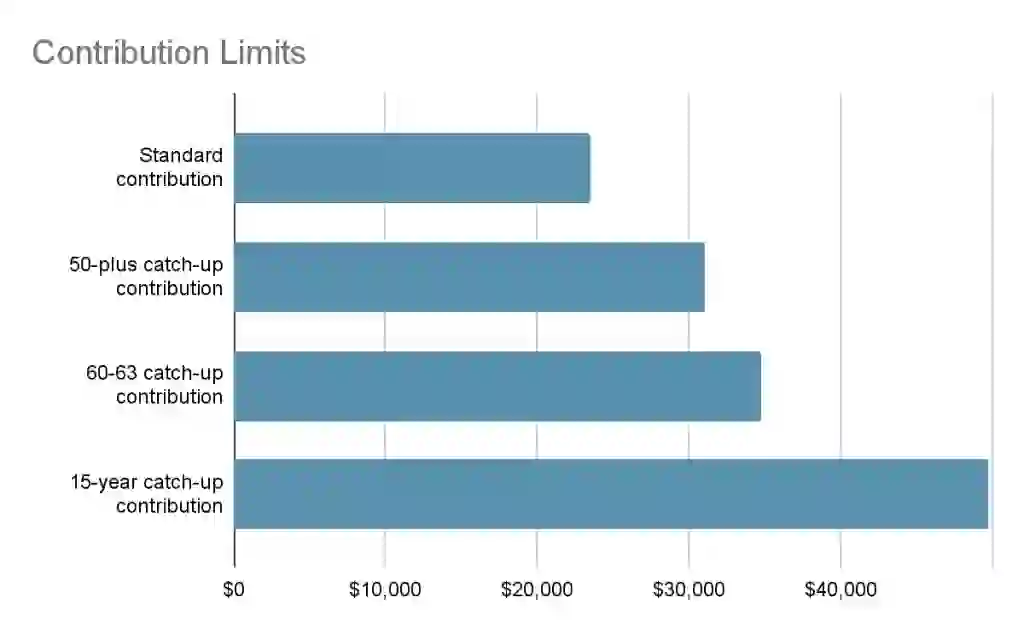

For 2025, the standard 403(b) contribution limit is $23,500. On top of that:

- Age 50+ catch-up: Savers age 50 and older can contribute an extra $7,500, bringing their total to $31,000.

- Age 60-63 special catch-up: If your plan allows, you can contribute up to an additional $11,250 during those years, raising the total to $34,750.

- Employer contributions: When you add in employer contributions, the combined cap rises to $70,000 in 2025.

There’s also a lesser-known provision:

15-year service catch-up: Some plans let long-term employees with at least 15 years of service contribute up to $15,000 more over their lifetime. To qualify, your past contributions must average less than $5,000 per year.

403(b) Investment Options

Most plans limit their investment choices to pre-selected annuities and mutual funds. While investment options vary by employer, they tend to be more restricted compared to 401(k)s.

There are benefits and drawbacks to both types of investments that you should consider before making a decision. Here’s a look at the pros and cons of mutual funds vs. annuities.

| Strengths and Drawbacks | Annuities | Mutual Funds |

|---|---|---|

| Pros | • Guaranteed income with predictable payments, often for life • Tax-deferred growth and principal protection • No contribution limits |

• Professionally managed • Diversified holdings • High liquidity |

| Cons | • Higher commissions and fees • Fixed payments may lose value to inflation • Can be complex and confusing |

• Less tax-efficient than ETFs • No guaranteed returns • No control over specific holdings |

Pros and Cons of a 403(b) Plan

Like the annuities and mutual funds they contain, 403(b) plans, themselves, have benefits and drawbacks.

Like the annuities and mutual funds they often include, 403(b) plans come with both advantages and limitations.

| Benefits | Drawbacks | |

|---|---|---|

| Key Features | • Tax advantages help your savings grow faster • Generous contribution limits, especially with catch-up options • Potential for employer contributions |

• Fewer investment choices compared to a 401(k) • Some plans may not be covered by ERISA protections • Many plans carry high fees |

Comparing 403(b) and 401(k) Plans

Both 403(b) and 401(k) plans help you save for retirement with tax advantages, but they’re designed for different types of workers and come with distinct features. A 403(b) is typically offered by nonprofits, schools, and religious organizations, while a 401(k) is common in the private sector. The table below highlights the main differences — from who can open each plan to the investment choices, employer matching rules, and legal protections that apply.

| Feature | 403(b) | 401(k) |

|---|---|---|

| Who Offers It | Nonprofits, schools, churches | Private companies |

| Investment Options | Annuities, some mutual funds | Wide variety |

| Matching | Sometimes | More common |

| ERISA Coverage | Not always | Usually yes |

Rules for 403(b) Withdrawals and Penalties

Like 401(k)s and IRAs, 403(b) withdrawals are taxed as ordinary income after age 59½. Early withdrawals may incur a 10% IRS penalty, plus taxes, and required minimum distributions (RMDs) begin at age 73.

Not all 403(b) plans allow early withdrawals, but those that do typically limit them to hardship exemptions that meet the IRS’s strict standard of “an immediate and heavy financial need.” In addition, some plans permit participants to borrow from their account balance. Any 403(b) loan must follow IRS rules on loan amounts, repayment schedules, and interest — making it important to understand the requirements before tapping your account.

The Bottom Line

A 403(b) plan can be a powerful retirement savings tool for teachers, healthcare workers, nonprofit employees, clergy, and other eligible workers. While investment choices may be more limited than those in a 401(k), the tax benefits, generous contribution limits, and potential for employer matches make it a valuable option for long-term financial security.

Understanding the rules — from contribution limits to withdrawals and loans — will help you maximize the advantages of your plan and avoid costly mistakes, ensuring your savings are working as hard as you do.

FAQ

- Can I roll over a 403(b) into another retirement account?

- Yes, you can roll over a 403(b) — or transfer the funds without withdrawing them or triggering a tax event — to an IRA or a new employer's 401(k). However, the account must have matching tax treatment. For example, a pre-tax 403(b) must be rolled into a traditional, pre-tax IRA or 401(k), and Roth 403(b)s must roll over into after-tax Roth IRAs or 401(k)s.

- What happens to my 403(b) if I change jobs?

- When you leave your job, your contributions and any vested employer contributions — the portion you fully own after meeting service requirements — remain yours. You can leave the account with your former employer, roll it into an IRA, transfer it to a new employer’s plan, or cash it out, though the last option usually triggers taxes and penalties and is rarely advisable.

- Is a 403(b) better than a 401(k)?

- They are similar in terms of structure and tax treatment, but each has its pros and cons. 401(k)s typically have lower fees and more investment options than 403(b)s. However, 403(b)s have more generous contribution limits.

- Can I have both a 403(b) and a Roth IRA?

- Yes, and maintaining both can be a savvy retirement strategy because Roth IRAs are more flexible in terms of penalty-free early withdrawals and 403(b)s allow far greater contributions.

Written by

Written by  Edited by

Edited by