What Is an Annuity? How It Works, Types, Pros and Cons

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

If you’ve ever wondered what is an annuity and whether it belongs in your retirement plan, here’s the short answer: It’s a financial product, usually sold by insurance companies, that turns your money into a guaranteed stream of income — either right away or in the future. For many retirees, annuities offer stability, predictable cash flow and protection from outliving their savings.

They’ve been gaining attention in recent years. A 2025 survey by the Employee Benefit Research Institute found that 70% of Americans want a lifetime income product, yet fewer than 1% actually own an annuity. That gap often comes down to confusion about how they work, which we’re about to clear up.

Fixed vs. Variable vs. Indexed Annuities at a Glance

| Feature | Fixed | Variable | Indexed |

|---|---|---|---|

| Returns | Guaranteed rate | Based on market performance | Linked to a market index (S&P 500) |

| Risk | Low | Moderate to high | Low to moderate |

| Fees | Low | High (avg. 1.28% annually for variable annuities) | Moderate |

| Best for | Stability | Growth potential | Balanced growth and protection |

How Do Annuities Work?

An annuity is essentially a contract between you and an insurer. You pay either a lump sum or installments, and the company agrees to pay you back in regular installments, usually monthly, quarterly or annually.

Annuities have two phases:

- Accumulation phase: You pay into the annuity, and your money grows (tax-deferred) based on the type of annuity you choose.

- Payout phase: The insurer starts sending you payments, either for a set period or for life.

Pro Tip: Payments from a $100,000 single-life annuity for a 65-year-old average around $650 to $700 per month.

Is an Annuity Right for You?

Whether an annuity is right for you depends on the following factors:

- Liquidity: Do you have enough liquid assets so you won’t have to withdraw from your annuity early?

- Guaranteed income: Are you in need of a guaranteed income for life?

- Locking in your money: Are you ok locking up your money for a specified term?

It’s important to note that most annuity buyers aren’t ultra-wealthy. They earn a median household income of around $64,000, and 80% make under $100,000 a year.

Types of Annuities Explained

There are several different annuities to consider. Here’s a breakdown of your options:

1. Fixed Annuities

- How it works: Pays a guaranteed rate of return for a set time.

- Pros: Predictable income, principal protection.

- Cons: Lower returns that might keep pace with inflation.

- Best for: Retirees who want a steady, low-risk income.

2. Variable Annuities

- How it works: Tied to investments in mutual fund-like subaccounts.

- Pros: Potential for higher returns and tax-deferred growth.

- Cons: Market risk and higher fees (1.28% average annually), which can eat into returns.

- Best for: Investors comfortable with risk who want growth potential.

3. Indexed Annuities

- How it works: Returns are linked to a market index with a floor (minimum return) and cap (maximum gain).

- Pros: Some market growth potential and downside protection.

- Cons: Capped returns may limit gains during strong markets.

- Best for: Conservative investors seeking a balance of safety and growth.

Immediate vs. Deferred Annuities

| Retirees needing a quick income | Immediate | Deferred |

|---|---|---|

| Payout Start | Within 12 months | Years later |

| Purpose | Income now | Growth now, income later |

| Best for | Retirees needing quick income | Pre-retirees building future income |

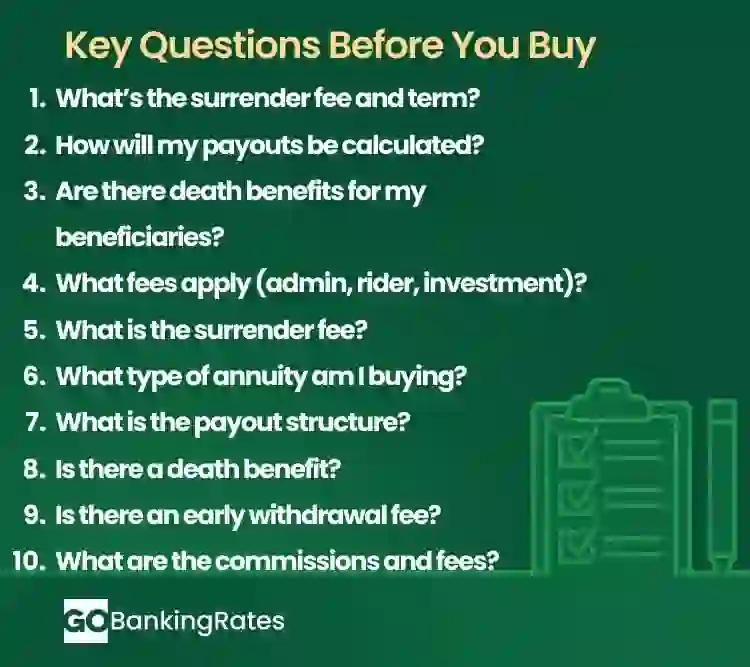

How to Buy an Annuity Safely

You can purchase an annuity from the following:

- Insurance agents: These agents may represent one or more insurers and will likely earn commissions on their sales.

- Fee-only advisors: These are advisors who often don’t earn a commission and will guide you toward a product that fits with your financial strategy.

- Brokers. Brokers can offer several annuity products.

Pros and Cons of Annuities

Annuities can be a great addition to your financial plan, especially for retirement, but they come with some baked-in downsides. Here’s why:

Pros:

- Guaranteed income for life

- Tax-deferred growth

- Can help fill pension or Social Security gaps

- Optional riders for inflation protection or death benefits

Cons:

- Early withdrawal penalties and surrender charges

- Complexity of contracts

- Lower potential returns compared to stocks

Are Annuities a Good Investment?

Whether an annuity is right for you depends on your goals. If you value security and steady cash flow, they can be a strong fit. But if you need liquidity or want high growth, they may not be ideal.

A Gallup survey found that 88% of annuity owners said peace of mind was their top reason for buying, and 81% cited reliable retirement income.

Safety and Regulation

- State guarantees: Backed by state guaranty associations (usually up to $250,000 per insurer, per person. Check NOHLGA.com for your state).

- Check ratings: Aim for insurers with at least an “A” rating from Moody’s, Fitch or A.M. Best.

Final Take to GO: Is An Annuity The Right Call?

Annuities aren’t for everyone, but for retirees who want guaranteed income and less market stress, they can be a valuable tool. Before buying, compare options, read the fine print and confirm the company’s financial strength.

Bottom line: If you’ve been asking yourself what is an annuity and whether it’s worth it, the answer depends on your need for income stability, tax deferral and your comfort with locking up funds for the long term. A financial advisor can help you choose the right type or decide if you should skip them entirely.

Talk to a trusted financial advisor about a plan of action regarding annuities and check out top annuity rates once you’ve decided to invest. If you’re considering one, use a retirement calculator to see how an annuity fits your plan, compare multiple products and consult a fiduciary advisor before signing.

FAQ on Annuities

Here are the answers to some commonly asked questions about annuities:- What is an annuity in simple terms?

- An annuity is a financial product that provides guaranteed income, typically in retirement, in exchange for an upfront investment.

- How do annuities work for retirement?

- You invest a lump sum or series of payments, and in return, you receive monthly payments—either right away or starting later.

- What is the downside of an annuity?

- Downsides include fees, lack of flexibility, and penalties for early withdrawals.

- Are annuities better than 401(k)s or IRAs?

- Annuities can complement retirement accounts, but often have higher fees and less liquidity.

- Is an annuity right for me?

- If you want a guaranteed lifetime income and already have other savings, an annuity could be a helpful addition.

Information is accurate as of Aug. 14, 2025.

Our in-house research team and on-site financial experts work together to create content that’s accurate, impartial, and up to date. We fact-check every single statistic, quote and fact using trusted primary resources to make sure the information we provide is correct. You can learn more about GOBankingRates’ processes and standards in our editorial policy.

- CNN Business "Traditional pension plans are pretty rare. But here’s who still has them and how they work."

- Investor.gov "Annuities"

- Maryland Insurance Administration "A Consumer Guide to Annuities."

- Annuity.org "Annuity vs. Traditional 401(k): Which Is Best for My Retirement?"

- Employee Benefit Research Institute "2025 EBRI/Greenwald Retirement Confidence Survey"

- Annuity.org "How Much Does A $100,000 Annuity Pay Per Month?"

- The Committee of Annuity Insurers "Who Owns Annuities?"

- Gallup "2022 Survey of Owners of Individual Annuity Contracts"

Written by

Written by  Edited by

Edited by