COVID-19 Blew Up Everyone’s Plans — Guess Which Generation Is Planning to Retire Even Earlier

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

The pandemic isn’t just prompting people to reschedule their weddings and other immediate events – it’s also causing many folks to rethink their retirement timeline. A new study from Northwestern Mutual found that 20% of adults in the U.S plan to retire later than they expected due to the economic impact of COVID-19, while 10% intend to retire sooner than they’d previously planned.

Learn More: What a Comfortable Retirement Will Cost You in Each State

The 2020 Planning & Progress Study, conducted by The Harris Poll on behalf of Northwestern Mutual, surveyed 2,702 adults this past summer, and found that Gen Xers (25%) were the most likely to be postponing retirement because of the pandemic.

Twenty percent of Gen Z respondents said they were pushing back their target date for retirements, followed by millennials (19%) and then baby boomers (14%).

The poll found that millennials are the most likely generation to be inspired to retire early due to COVID, with 15% saying they were moving up their retirement timeline.

Only 8% of Gen Z respondents said that they were accelerating their retirement plans, as did just 6% of Gen-Xers and 4% of boomers.

Fact Check: Economy Explained: What’s the Difference Between Effective Tax Rate and Marginal Tax Bracket?

“Millennials appear to prioritize retirement earlier on, whereas other generations may be quicker to extend their retirement timelines outward,” Christian Mitchell, executive vice president and chief customer officer at Northwestern Mutual stated in a press release for the report.

“Much of this depends on individual circumstances, of course, but it also underscores that a long-term financial plan has to factor in the unexpected and be nimble enough to adjust course,” added Mitchell.

Just want to be able to retire early and sit in a garden and read and spend time with my family frankly

— Gee Whiz (@divrajsingh) December 2, 2020

The report found that Gen Z is looking at 62.5 years of age on average for retirement; Gen X is eyeing 63.2; and boomers are targeting an average age of 68.8. Millennials have targeted the youngest age for retirement, at 61.3.

Though this might seem overly ambitious given that millennials have been hit hard by job loss during the pandemic, it’s worth noting that millennials have always been particularly steadfast when it comes to the issue of retirement.

Seek Stability: 25 Tried-and-True Jobs That Will Last Through Any Recession

A 2019 T.Rowe Price survey found that 43 percent of millennials expect to retire before the age of 65; and a Bankrate survey in 2018 found that millennials cited 61 as the ideal retirement age. The feasibility of millennials’ plans to retire early have frequently come under debate there has been scrutiny over what mass early retirement would mean for the economy.

Still, it adds up that an economic event deemed even more traumatic than the Great Recession (which many millennials met head-on fresh out of college) would move millennials to save even more aggressively in the hopes of retiring even earlier than previously planned.

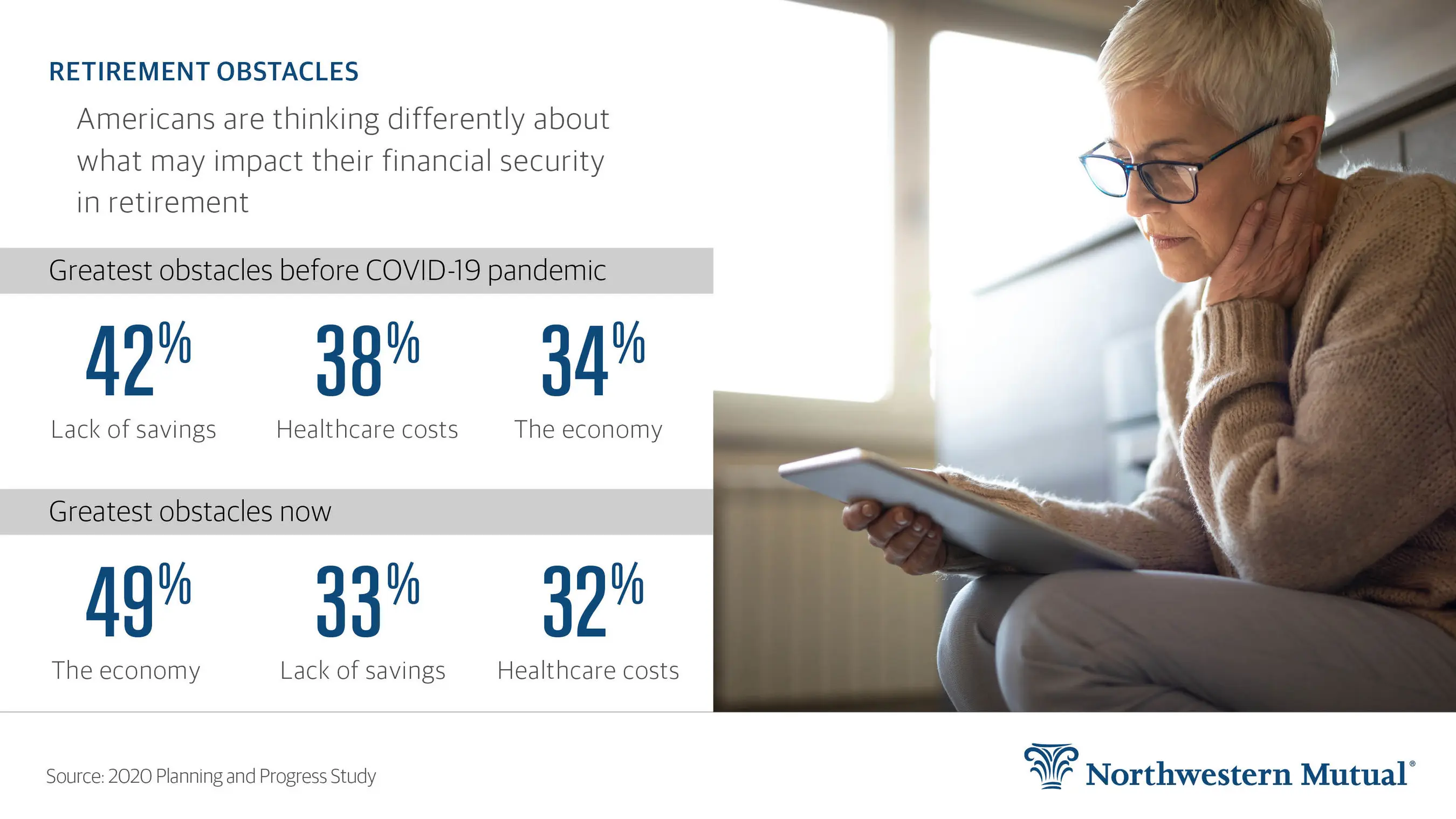

Though the pandemic has wrought havoc on the economy with no end in sight, Northwestern’s study found that the most common roadblocks to financial security haven’t changed — they’ve just been reordered. Before the pandemic struck, working folks cited lack of savings (42%) as their biggest obstacle, followed by healthcare costs (38%) and the economy (34%). Now, as the pandemic rages on, people feel most blocked by the economy (49%) followed by lack of savings (33%) and healthcare costs (32%).

- 4 Tips for Saving Money While in the Military

- 17 Tips To Live Comfortably Off Just a Social Security Check

- 10 Cheap Cryptocurrencies To Check Out

- Big Personal Goals That You Should Put Your Money Toward

Last updated: May 28, 2021

Written by

Written by  Edited by

Edited by