Advertiser Disclosure

GOBankingRates works with many financial advertisers to showcase their products and services to our audiences. These brands compensate us to advertise their products in ads across our site. This compensation may impact how and where products appear on this site. We are not a comparison-tool and these offers do not represent all available deposit, investment, loan or credit products.

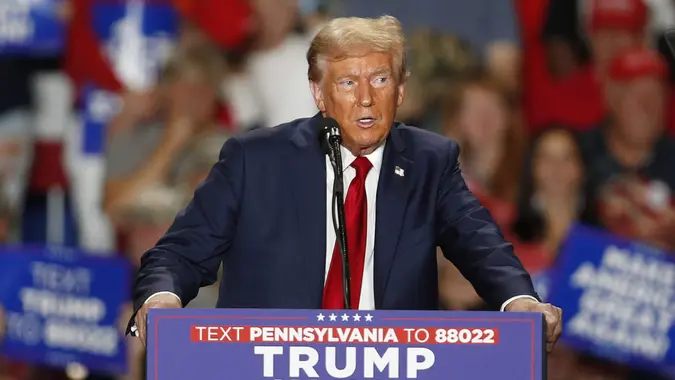

Trump Wants To Eliminate Social Security Taxes: 10 States Where Retirees Would Save the Least

Written by

Heather Taylor

Written by

Heather Taylor

Edited by

Chris Cluff

Edited by

Chris Cluff

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 YearsHelping You Live Richer

Reviewed by Experts

Trusted by Millions of Readers

What could a retiree’s financial picture look like without Social Security taxes? Donald Trump, the Republican candidate for president, has presented an economic plan to eliminate tax on Social Security wages along with a lowered corporate tax rate.

While this plan would provide some seniors with immediate relief, this type of federal tax cut wouldn’t be universally beneficial to all in retirement. This is particularly true of retirees who live in states where they are taxed the most. Because Trump’s proposed federal tax cut would not affect state taxes, these retirees ultimately would save the least.

Utilizing GOBankingRates data ranking all 50 states based on the best and worst to retire rich in, we pulled 10 states with tax rates and state taxes that still would make it complicated for retirees to save a lot of money if Social Security taxes were eliminated.

California

- State sales tax: 8.85%

- Median property tax rate: 0.75%

- Estimated property tax: $6,017

- Average Social Security benefits: $1,883

- State tax on Social Security benefits: No

Colorado

- State sales tax: 7.81%

- Median property tax rate: 0.55%

- Estimated property tax: $3,087

- Average Social Security benefits: $2,022

- State tax on Social Security benefits: Yes

Connecticut

- State sales tax: 6.35%

- Median property tax rate: 1.79%

- Estimated property tax: $7,510

- Average Social Security benefits: $2,171

- State tax on Social Security benefits: Yes

Hawaii

- State sales tax: 4.50%

- Median property tax rate: 0.32%

- Estimated property tax: $3,180

- Average Social Security benefits: $1,942

- State tax on Social Security benefits: No

Massachusetts

- State sales tax: 6.25%

- Median property tax rate: 1.14%

- Estimated property tax: $7,227

- Average Social Security benefits: $2,080

- State tax on Social Security benefits: No

New Jersey

- State sales tax: 6.60%

- Median property tax rate: 2.23%

- Estimated property tax: $11,806

- Average Social Security benefits: $2,139

- State tax on Social Security benefits: No

New Mexico

- State sales tax: 7.62%

- Median property tax rate: 0.67%

- Estimated property tax: $2,016

- Average Social Security benefits: $1,789

- State tax on Social Security benefits: Yes

New York

- State sales tax: 8.53%

- Median property tax rate: 1.40%

- Estimated property tax: $6,108

- Average Social Security benefits: $1,931

- State tax on Social Security benefits: No

Rhode Island

- State sales tax: 7.00%

- Median property tax rate: 1.40%

- Estimated property tax: $6,470

- Average Social Security benefits: $2,018

- State tax on Social Security benefits: Yes

Vermont

- State sales tax: 6.36%

- Median property tax rate: 1.83%

- Estimated property tax: $7,035

- Average Social Security benefits: $2,045

- State tax on Social Security benefits: Yes

Editor’s note on election coverage: GOBankingRates is nonpartisan and strives to cover all aspects of the economy objectively and present balanced reports on politically focused finance stories. You can find more coverage of this topic on GOBankingRates.com.

Tax data was sourced from The Tax Foundation and is accurate as of May 7, 2024.

Share This Article:

You May Also Like

How Much the Average Upper Class Retiree Receives in Social Security Benefits at Age 83

January 31, 2026

3 min Read

How Many Hours Can You Work and Still Collect Social Security Benefits?

February 02, 2026

3 min Read

What 2026 Senior Tax Deduction Means for Social Security and Retirement Planning

January 30, 2026

3 min Read

Retirement Planning: How Each Generation Should Account for Social Security

January 30, 2026

3 min Read

What a $460 Monthly Cut in Social Security Would Mean for Millions of Retirees

January 30, 2026

3 min Read

Social Security's Built-In Benefit Cut Is Coming -- Here's What It Means for You

January 29, 2026

3 min Read

Can You Really Retire on Social Security Alone in 2026? An Honest Budget Breakdown

January 29, 2026

3 min Read

Make your money work for you

Get the latest news on investing, money, and more with our free newsletter.

By subscribing, you agree to our Terms of Use and Privacy Policy. Unsubscribe at any time.

Thanks!

You're now subscribed to our newsletter.

Check your inbox for more details.

Sending you timely financial stories that you can bank on.

Sign up for our daily newsletter for the latest financial news and trending topics.

For our full Privacy Policy, click here.

Looks like you're using an adblocker

Please disable your adblocker to enjoy the optimal web experience and access the quality content you appreciate from GOBankingRates.

- AdBlock / uBlock / Brave

- Click the ad blocker extension icon to the right of the address bar

- Disable on this site

- Refresh the page

- Firefox / Edge / DuckDuckGo

- Click on the icon to the left of the address bar

- Disable Tracking Protection

- Refresh the page

- Ghostery

- Click the blue ghost icon to the right of the address bar

- Disable Ad-Blocking, Anti-Tracking, and Never-Consent

- Refresh the page