Fixed Expenses vs. Variable Expenses for Budgeting: Your Essential Guide

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

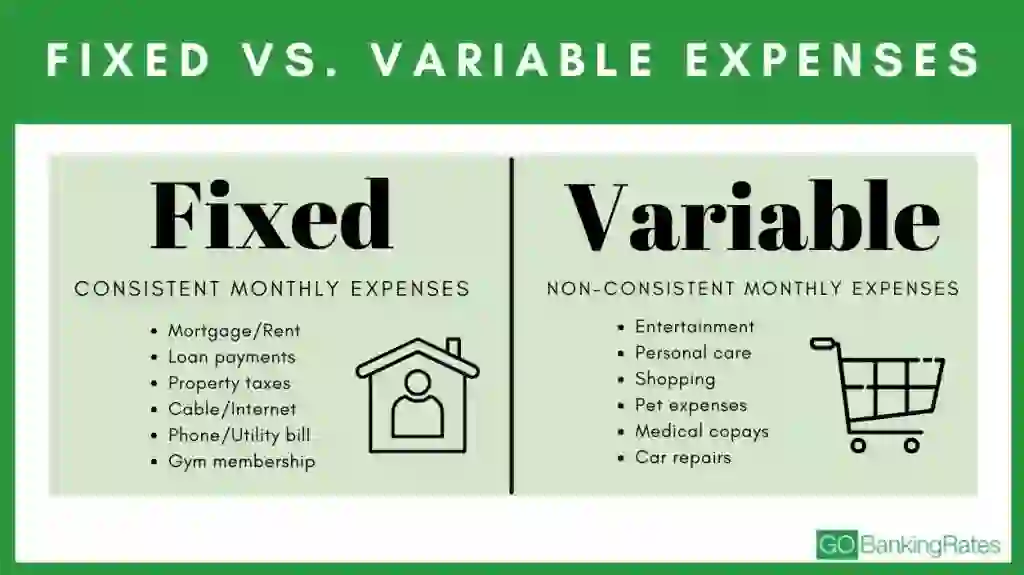

Fixed expenses are easier to plan around because they stay the same from one month to the next. Variable expenses, on the other hand, are less predictable. Understanding both types and how they impact your budget is the key to taking control of your finances.

Keep reading to learn how to calculate fixed and variable expenses and incorporate them into your budget.

Fixed Expenses: Predictable Costs You Can Count On

Whether you’re managing your own money, your family’s or your small business, budgeting is necessary to reach your financial goals. Fixed expenses should be your first consideration as you plan your budget.

So, what is a fixed expense? It’s a constant in your month-to-month budget, predictable in terms of how much and how often you pay. These expenses might fluctuate periodically, but once you commit to the amount, it stays the same for a predictable interval.

Fixed expense examples include:

- Rent: Your landlord might increase it after a year, but that’s not a frequent change.

- Mortgage: If your rate is fixed, you’ll pay the same amount each month. Your payment could go up or down periodically with a variable rate, but there’s no question that you’ll have to pay it each month.

- Property tax: You know in advance how much you’ll pay, so the tax is a fixed expense whether you pay it directly or as an escrowed expense with your mortgage.

- Debt payments: Loan payments and minimum credit card payments are usually fixed expenses.

- Insurance: The amount might change when the policy renews, but the expense is generally predictable.

- Childcare: Your childcare provider likely bills you each week or each month, for the same amount each time.

- Tuition: You know in advance how much your tuition will be for the coming semester or year. If you don’t pay upfront, you’ll have predictable, consistent payment arrangements.

- Subscriptions and memberships: Payments for streaming services, fitness memberships and other services are predictable and due at regular intervals. However, some can turn into variable expenses if you purchase add-ons.

It’s important to keep track of fixed expenses charged in an interval other than monthly.

You can budget for these expenses by dividing them by the number of months they cover and then adding that amount to your budget as a monthly expense.

For example, if you pay biannually on your car insurance, divide the premium by six to calculate the per-month cost.

Variable Expenses: Costs That Fluctuate With Your Choices

Variable expenses change regularly and can be affected by your day-to-day choices. For instance, if you need clothes, you can buy them from a thrift shop rather than a designer boutique.

However, not all variable expenses are in your control. For example, if you have a medical emergency, you have no choice but to head to the hospital and pay your medical bills.

Here are some variable expense examples:

- Entertainment: You can choose whether to spend money on entertainment or not. If you do decide to spend, you can control how much you’ll pay.

- Gas: Gas is a mandatory expense if you need your car to get to work or to medical appointments. But your total gas expense also depends on how much leisure driving you do.

- Medical expenses: Chances are, you schedule at least some medical appointments as you need them rather than according to a specific schedule. Those appointments might have out-of-pocket expenses, such as for a new medication or a service your insurance doesn’t cover.

- Groceries: Groceries are a variable expense because you can control the cost through your food choices and choice of stores.

- Personal care: If you schedule appointments irregularly or only as you need them, the expense is variable.

- Home and auto repairs: Routine maintenance expenses for your home and auto are often fixed — you might get an oil change every three months, for example, or schedule preventative maintenance for your heating and air system once or twice a year. Repairs are usually one-time expenses for breakdowns and failures you didn’t anticipate.

What’s the Difference Between Fixed and Variable Expenses?

If you want to make sure you have enough money to cover your expenses, you must create a budget that prioritizes fixed expenses, which you must pay but can’t control, and leaves room for variable expenses. You can adjust most variable expenses as needed.

What’s the Difference Between Fixed and Variable Expenses?

Here’s an at-a-glance look at how these expenses compare.

| Feature | Fixed Expenses | Variable Expenses |

|---|---|---|

| Predictability | High: Consistent amounts, regular intervals | Low: Fluctuating amounts and/or intervals |

| Control | Low: Little to no opportunity to adjust once committed | High: Relatively easy to adjust/reduce |

| Impact on budget | Baseline for essential spending | More flexibility and opportunities to save |

| Examples | – Rent or mortgage – Insurance |

– Groceries – Entertainment |

Strategies for Budgeting with Fixed and Variable Expenses

A realistic budget devotes enough money to fixed expenses and gives you some flexibility with variable ones. Ideally, you’ll have money left for savings.

Budgeting With Fixed Expenses

Fixed expenses include most of your needs, so prioritize paying them first.

Keep it simple by writing down each monthly expense and the monthly amount needed to cover less frequent ones. This will give you a clear picture of where your money is going and could reveal opportunities to cut back.

Look to save on nonessentials first, but don’t ignore necessary expenses. For example, you might have subscriptions you don’t often use. Perhaps you can save money on insurance by looking for an insurer with better deals, or by automating your payments or paying in advance in exchange for a discount.

Review your fixed expenses one per year to look for ways to trim your budget.

Budgeting With Variable Expenses

Since variable expenses can change, you might find it hard to manage them. Organizing them in a spreadsheet or budgeting app could make them easier to track. Many of the best budgeting apps have free versions to get you started.

A good way to budget variables is to categorize each one as either a want or a need. This will help you distinguish which are most important.

As you work, look for areas where you can lower costs. This might require some lifestyle changes, such as cutting back on restaurant meals and finding free entertainment. If your grocery bill is high, try planning meals around sales and eliminating expensive prepared foods you can make cheaper from scratch.

After evaluating your spending on variable wants and needs, set a limit for each item.

Implementing a Budget: Putting It All Together

It can be easier to make a budget when you use a tried and true method for allocating your money.

50-30-20 Rule

The 50/30/20 rule is one way to do it. The rule says you should allocate 50% of your income to needs, 30% to wants and 20% to savings. You can change the percentage according to your circumstances but make sure you’re budgeting for the essentials first.

Zero-Based Budgeting

Zero-based budgeting, the method popularized by personal finance expert Dave Ramsey, finds a use for every dollar of income. Start with your income, then subtract the amount you want to allocate to each item in your budget. You should have $0 left after covering your fixed and variable expenses and your savings.

Neither of these budgeting methods differentiates between fixed and variable expenses, but understanding the concepts will help you implement the methods more effectively.

Taking Control of Your Money by Managing Expenses

No matter what method you use, understanding fixed expenses vs. variable expenses for budgeting is the key to ensure your essential expenses are covered each month — and that you enjoy your discretionary income while working toward savings goals. The sooner you start, the sooner you’ll be on your way to long-term financial stability.

FAQs on Fixed vs. Variable Expenses

Here are the answers to some of the most frequently asked questions about fixed and variable expenses.- What are examples of a fixed expense?

- Fixed expenses are predictable bills you pay regularly, usually in about the same amount each time. Examples include rent and insurance premiums.

- Is a mortgage a fixed expense?

- Yes. Even variable-rate mortgage loans get paid monthly and have predictable payments between rate changes.

- What are five examples of fixed expenses?

- Additional examples of fixed expenses include your wireless bill, streaming subscriptions, real estate taxes, professional dues and utility bills.

- What are examples of flexible expenses?

- Flexible expenses are those you can control, such as entertainment.

- What are variable expenses?

- Variable expenses are those that change from month to month or that you incur occasionally. They're usually within your control.

- How do fixed and variable expenses impact budgeting?

- Fixed expenses are easier to budget because they're predictable. Once you have that baseline of expenses you know you have to pay, you can adjust variable expenses to conform to your remaining income.

- Can a fixed expense become variable?

- Yes. Healthcare, for example, is a fixed expense during periods when your only cost is insurance. If you become ill and need care that leads to out-of-pocket costs, healthcare becomes a variable cost -- it changes according to the type and frequency of care you receive.

Caitlyn Moorhead and Scott Jeffries contributed to the reporting for this article.

Our in-house research team and on-site financial experts work together to create content that’s accurate, impartial, and up to date. We fact-check every single statistic, quote and fact using trusted primary resources to make sure the information we provide is correct. You can learn more about GOBankingRates’ processes and standards in our editorial policy.

- Ramsey Solutions. "What Is a Zero-Based Budget?"

Written by

Written by  Edited by

Edited by