One Time Dave Ramsey and Rachel Cruze Disagree About Money — Expert Shares Who’s Right

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

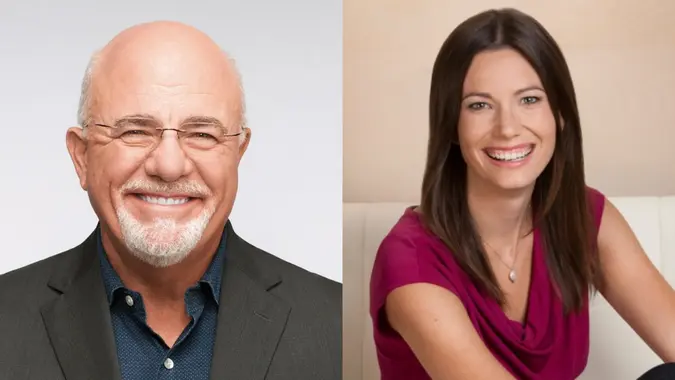

Father-daughter personal finance team Dave Ramsey and Rachel Cruze agree on most money matters: Paying down debt, building emergency savings and living below your means. But every so often, like any family members, they go head-to-head on what’s best when offering advice to viewers of The Ramsey Show.

Below is one time they both disagreed with each other on money matters and who may be right.

New vs. Used

In 2021, when the price of used cars rose and it was difficult to find a new vehicle, a Ramsey Show viewer called in asking if the experts would recommend buying a new car rather than a used car, if the new car was actually cheaper. Jared, age 24, asked, “Are we in a situation where it might be acceptable to buy new, if you’ve got the cash for it, rather than buy used?”

Cruze agreed that “math is math” and it makes sense to buy the less expensive car in that economic climate. Looking back on the show in a YouTube video, she acknowledged those were crazy times.

Ramsey disagreed on ever buying a new car, for any reason, until you have a net worth exceeding $1 million.

“I don’t want you to get in the habit of asking the wrong question,” Ramsey said to the caller. “The wrong question is: ‘How can I figure out a way to violate a proven system towards wealth and still be okay because I want a truck?’ The rationalization process is what gets people in trouble. Cars go down in value.”

Do Experts Agree With Cruze or Ramsey?

The car market has somewhat stabilized in 2025 and it would be highly unusual to find a used car priced higher than a new vehicle. GOBankingRates asked Elana Feinsmith, certified financial planner (CFP) and certified financial therapist (CFT) with Oak Financial Coaching, if Ramsey was right in that economic climate to stick to his philosophy of never buying a new car. Further, we asked, in today’s world, should anyone ever purchase a new car?

“I don’t want to make anyone right or wrong in this. What was right at one time may or may not be correct now. If times have changed, they need to look at what made financial sense in that time,” she said, acknowledging that times were different back then.

She said many factors come into play when deciding whether to buy a new or used vehicle, such as: “What are the total costs of this? Will the insurance on the new car be much more than an older car? What’s the mileage [on the used vehicle]? What’s the estimated repair costs on each car?”

The Emotions Driving a Car Purchase

Equally important, Feinsmith said, is to consider the emotional component of the purchase. “You have to ask, how do you feel in the car? If you’re going to get in the [used] car each time and be miserable, because you bought X but really wanted Y, you need to look at what it’s worth to you. If you love the new car and it’s similar financially, then it would make sense to buy the new car,” she said.

“There are times that rules should be broken,” Feinsmith said, agreeing with Cruze.

However, it’s important to consider all angles and options before jumping into a major purchase. “As a financial therapist, I want to get people from avoidant to empowered. It’s worth asking: Is there another solution that would give you as much joy [as the new car] and doesn’t cost as much?” Feinsmith explained.

Written by

Written by  Edited by

Edited by