Empowering women to take control of their finances.

Women and AI: Strategies To Increase Your Earning Power in 2026

Artificial intelligence is transforming how Americans work, earn and grow their careers. While headlines often focus on job displacement, AI can actually help women increase their incomes — if they know how to harness it. In this “Financially Savvy Female” column, we’re chatting with Becky Heidesch, author of “The Career Masterclass for Women,” about how women can leverage AI to earn more, advance faster and stay competitive in an evolving economy. How can AI help women increase their incomes? Everyone can harness AI to boost earning potential today, but for women, it is especially important as they continue to lag…

Read MoreA Focus On Your Money

How Much Cash Women Really Have Saved — and Why It Falls Short

More than 1 in 5 women have no cash savings at all — and even those who do may not have enough. A recent Fidelity study found that women have an average of $54,000 saved, compared to $62,000 for men. But with rising costs, economic uncertainty and the gender pay gap, that cushion might not go as far as you think. Read Next: 6 Things You Must Do When Your Savings Reach $50,000 Be Aware: 4 Surprising Things That Could Impact Your Wallet If a Recession Hits In this “Financially Savvy Female” column, we’re chatting with Alex Roca, host of…

Women and the Workplace

This One Common Mistake Can Cost Women $1.5 Million Over Their Lifetimes

When you’re just starting out in the working world, you may not feel comfortable negotiating your starting salary — but this can be a costly mistake. Research shows that not negotiating a salary at the beginning of your career can add up to between $1 million and $1.5 million in lost earnings over a lifetime. And this loss of potential income particularly effects women — a study of graduating university students found that only 7% of female students attempted to negotiate an initial job offer compared to 57% of men. Find Out: Suze Orman Says If You’re Doing This, You’re…

Relationships, Family & Finances

Newly Married? Here’s How To Build Wealth as a Couple

We’re currently in the midst of wedding season, which means many couples will be saying their “I dos” and officially merging their lives together. This also means that many couples will be navigating their finances together for the first time. Having frank conversations about money and wealth-building strategies early on can help couples navigate financial highs and lows down the line. See Our List: 100 Most Influential Money ExpertsRead: How To Build Your Savings From Scratch In this “Financially Savvy Female” column, we’re chatting with Cindy Scott, CFP with Schwab Intelligent Portfolios Premium, about how newly married couples can work together to…

The State of Women & Money

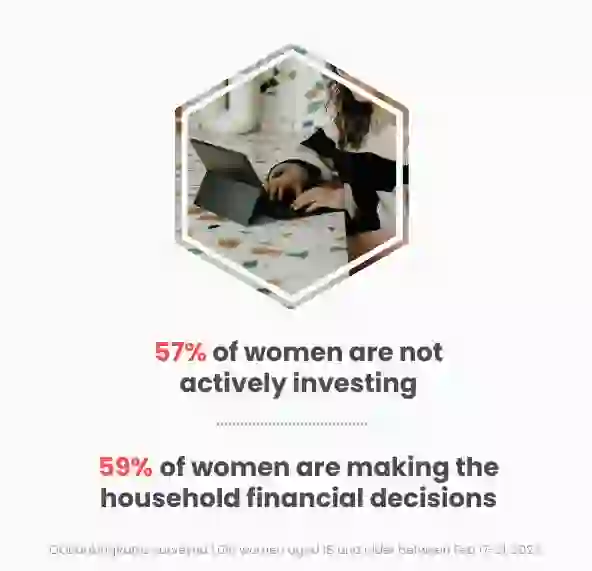

What Is the State of Women & Money?

Women have been making major strides in the world of personal finance. A recent LendingTree analysis found that single women now own more homes than single men. And Fortune reported that women CEOs now run more than 10% of the Fortune 500 companies. Still, the gender pay gap persists and women continue to be less likely to invest than men — even though data has shown that they tend to be better investors. To get a complete look at women’s financial standing in 2024, GOBankingRates surveyed over 1,000 American adults who identify as female about their financial obstacles and goals,…

Get More Valuable Info

All of our expert Financially Savvy Female advice in one spot.