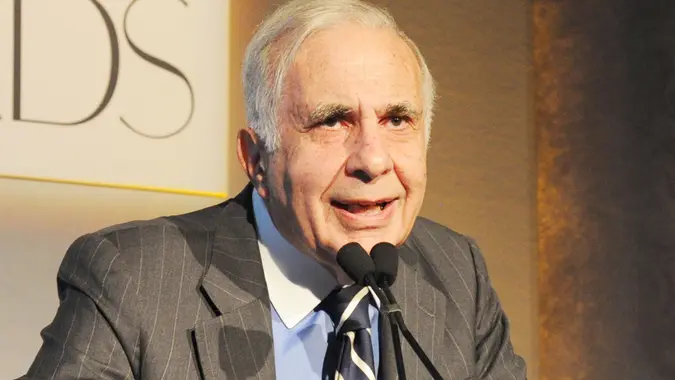

Billionaire Carl Icahn Shares 3 Investment Traps and Tips

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

Activist investor Carl Icahn — a Wall Street legend and chairman of publicly traded Icahn Enterprises — has a net worth standing at $6.11 billion, according to the Bloomberg Billionaires Index.

As The Motley Fool reported, Icahn — similarly to fellow billionaire investor Warren Buffett — believes in a value investing strategy.

Buying a Stock When No One Wants It

“Generally, Icahn is interested in investing in stocks whose prices don’t fully reflect the businesses’ full potential. Icahn has said he buys into a company when ‘no one wants it,'” The Motley Fool indicated.

Yet, unlike Buffett who is known for his holding strategy, Icahn is “willing to sell his stocks to lock in profits once the market figures out a company’s true value,” The Motley Fool added.

“I don’t know that we disagree completely,” Icahn told CNBC about Buffett in 2022. “I think we’re to a certain extent in a different business with Warren. I’m an activist,” Icahn said. “I look for a company that’s, in my mind, way undervalued such as [Southwest Gas], and there’s something I can do about it. That’s what I enjoy doing. That’s why I come to work every day.”

While he has long-term holdings, his strategy is more oriented toward making shorter-term bets on stocks.

Being an Activist Investor

Icahn has a reputation as a famed activist investor.

An activist investor is someone seeking to acquire a controlling interest in a company by gaining seats on the company’s board of directors. In turn, they make significant changes to the target company and unlock perceived hidden value within the target company, as the Corporate Finance Institute explained.

Some of these changes include giving more cash back to shareholders — or shedding divisions that the activists think are driving down the stock price, demanding board seats, replacing CEOs, and advocating specific business strategies.

“I have come to believe that activism, on a risk-reward basis, is the best investment paradigm that exists,” Icahn told Bloomberg on Feb. 21. “The reason activism works so well is that, somewhat unfortunately, many public companies are not well run.”

As Bloomberg reported, just last week, Icahn Enterprises won four board seats last week at JetBlue Airways Corp. and American Electric Power Co.

Refusing To Focus Too Much on Hot Trends

As The Motley Fool noted, part of investing like Icahn is refusing to focus too much on “hot trends in stocks or about buying the fastest-growth businesses.”

“There are lots of hidden gems out there that are simply unloved or forgotten companies with stocks trading for a discount. Buying a solid business for a fair price can lead to handsome returns for the patient investor,” The Motley Fool added.

Written by

Written by  Edited by

Edited by