States That Don’t Tax Military Retirement Income: Full Breakdown

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

If you’re a retired service member, knowing which states don’t tax military retirement can make a huge difference in how far your military pension goes.

Some states fully exempt military pensions from income tax, while others partially tax them. Choosing the right state can mean keeping thousands more in your pocket each year.

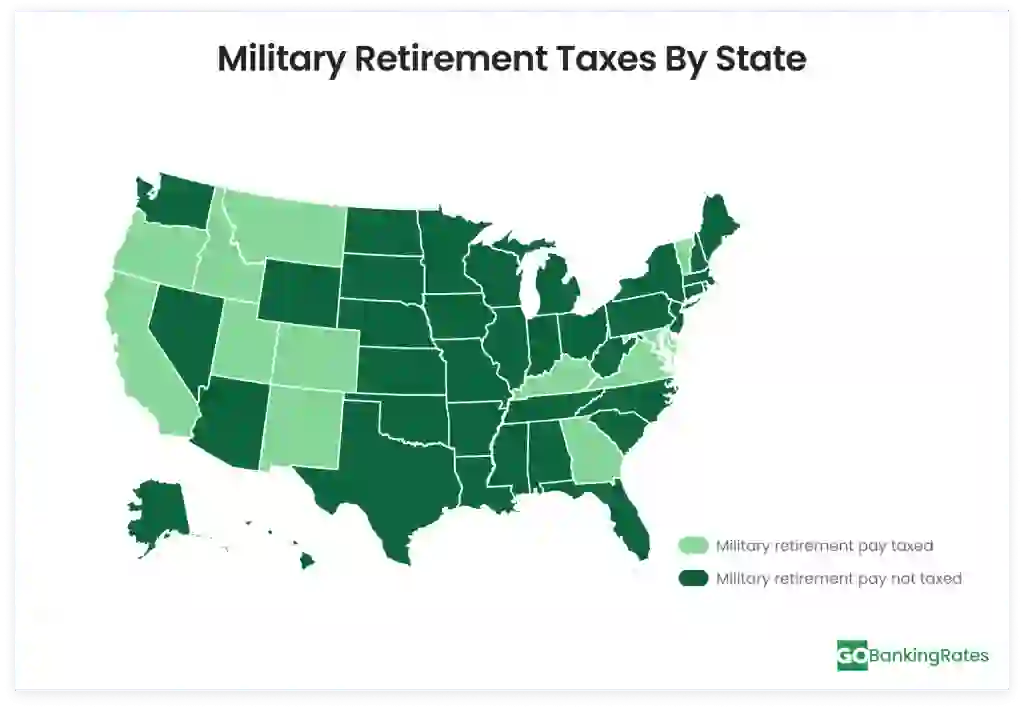

How States Tax Military Retirement Pay

States can choose to either fully exempt, partially exempt or fully tax military pensions. Some states have no state income tax, while others will give a partial exemption based on age.

Check out where your state lands using the graphic below:

States With No State Income Tax

Nine states currently do not have a state income tax. These states choose to collect revenue through higher sales taxes, property taxes or revenue from natural resources.

Here are the nine states without a state income tax:

- Alaska

- Florida

- Nevada

- New Hampshire

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

States That Fully Exempt Military Retirement Pay

These states do have a state income tax, but military pensions are not included.

- Alabama

- Arizona

- Arkansas

- Connecticut

- Hawaii

- Illinois

- Indiana

- Iowa

- Kansas

- Louisiana

- Maine

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Nebraska

- New Jersey

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Pennsylvania

- Rhode Island

- South Carolina

- West Virginia

- Wisconsin

States With Partial Military Retirement Tax Exemptions

| State | Exemption Amount | Key Conditions |

|---|---|---|

| California | Up to $20,000 | -Only for adjusted gross income (AGI) under $125k (Single) or $250k (Joint) -Starts in 2025 tax year |

| Colorado | $15,000 to $24,000 | -Under 55: $15,000 exclusion -Those aged 55 to 64: $20,000 exclusion -Anyone aged 65+: $24,000 exclusion |

| Delaware | $2,000 to $12,500 | -Under 60: $2,000 exclusion -Those aged 60+: $12,500 exclusion |

| Georgia | $17,500 to $65,000 | -Under age 62: $17,500 — plus $17.5k if earned income is more than $17.5k -Anyone ages 62 to 64: $35,000 -Those age 65+: $65,000 |

| Idaho | Limited full exclusion | -Must be 65 or older — or at least 62 with a disability -Subject to maximum limits — $41,140 in 2024 |

| Kentucky | Up to $31,110 or 100% | -Service before 1998: 100% exempt -Service 1998 to present: Exclusion capped at $31,110 |

| Maryland | $12,500 to $20,000 | -Anyone under 55: $12,500 exclusion -Those ages 55+: $20,000 exclusion |

| Montana | Up to 50% | -Must have become a resident after June 30, 2023, or started receiving benefits after becoming a resident -Available for five consecutive years |

| New Mexico | Up to $30,000 | -Flat exclusion available for tax years 2024 through 2026 |

| Oregon | Full or partial | -Service before Oct. 1991: 100% exempt -Mixed service: Partial exclusion based on percentage of service before/after 1991 |

| Vermont | Full or partial | -AGI under $125k: 100% exempt -AGI $125k to $175k: Partial exemption |

| Virginia | Up to $40,000 | -Effective for tax year 2025 |

Are There States That Fully Tax Military Retirement Pay?

No U.S. state fully taxes military retirement pay. All states either exempt it entirely or offer at least a partial exclusion.

Prior to 2025, California was the only state that taxed military pay, but it recently changed its legislation to allow a partial exclusion of up to $20,000 for eligible retirees with AGI limitations.

Recent Changes and Trends in Military Retirement Taxes

Here’s a breakdown of some recent trends and updates in military retirement taxation:

- California: There’s a new partial exclusion of up to $20,000 of eligible military retirement pay for many retirees, with income caps. It’s effective for tax year 2025.

- Virginia: Virginia increased the amount of military retirement income that retirees can deduct from their state taxes. For 2024, you can exclude up to $30,000. Starting in 2025 and beyond, you can exclude up to $40,000.

- New Mexico: The plan is to continue a stepped exemption that reaches $30,000 for tax years 2024 through 2026.

- Georgia: There’s a trend toward a broader exemption for military retirement that should take effect in 2026.

More and more states are moving to full exemption models or giving much larger exclusions. Also, states are implementing income caps. If you make a certain AGI, you may not qualify for an exemption.

Some states are revisiting how other retirement income is taxed so that individuals aren’t faced with choosing one exclusion over another.

Military Retirement Taxes vs. Total Cost of Living

Sometimes, the states with no income taxes on military benefits aren’t the ideal location for you to live. You have to factor in how much money will be spent on other costs and taxes:

- Property taxes: Some no-tax states, like Alaska, have higher housing and goods costs. Evaluate the property taxes before moving to certain states.

- Sales taxes: Typically, states with no income tax have high sales taxes. The costs of everyday goods and services can add up with a high sales tax.

- Housing costs: Housing costs are often the single highest ongoing expense for most people. In a state that is tax-friendly, there may be higher home prices, higher insurance premiums and costlier maintenance costs.

- Veteran-specific benefits: Many states, including Virginia and Ohio, offer full or partial property tax exemptions to disabled veterans, which can save homeowners thousands annually. Being near VA hospitals or military bases can reduce medical expenses.

How State Taxes Affect Take-Home Pay

The state you live in can impact how much you get to keep of your military pay.

For example, if you receive $60,000 in Texas, since there is no income tax, you get to keep a majority of the pay.

However, with the same pay in California, you are only allowed an exclusion of up to $20,000 for eligible retirees with AGI limitations.

In Texas, military personnel will be allowed to keep most of their pay, while in California, a large portion may be taxed.

What Other Income Streams Mean for Taxes

Your other streams of income, combined with your military pay, can impact your tax liability. Here’s how:

- Social Security: There’s a possibility that up to 85% of your Social Security income will be taxed, depending on your total income.

- Civilian pensions: Pensions are generally taxable as ordinary income. How much you’re taxed may vary based on the state you live in. Some states exempt civilian pensions and others tax fully. Adding the civilian pension and military together can push you into a higher tax bracket.

- Investment income: All investment income is taxed as ordinary income or is taxed at a special capital gains rate. Combining this income along with the military pay you receive could put you in a higher tax bracket. This will likely increase the amount you pay in taxes.

- VA disability benefits: Having VA disability benefits won’t impact your taxes. This benefit is not taxed at the state or federal level.

What To Do If You’re Moving Between States

Moving between states can impact how much tax you’ll pay on your military benefits. Prior to the move, you should consider the following:

- Compare how the state taxes military pay: In states with no state income tax, you can keep most of your military benefits. However, in states where they will partially exempt a part of your military pay, determine how it will impact you.

- Understand how your state taxes other income: How is investment income taxed? How are pensions treated? How is Social Security income taxed?

- Look at factors beyond income tax: How high are the property taxes? You should also look at sales tax and the cost of living.

Key Takeaways

Living in one of the states that doesn’t tax military retirement can help you keep more of your hard-earned pension, but taxes are just part of the equation. Consider the following before deciding where to live if you’re receiving military benefits:

- Is the state a no-income tax state?

- If the state does tax military benefits, how much is exempt?

- What are the state’s property taxes, cost of living and access to veteran-friendly services?

- How does the state tax other income?

Evaluating the answers to these questions will help you decide what works best to keep most of your military pay.

FAQ

Here are the answers to some of the most frequently asked questions about retirement benefits for veterans and how they work:- Which states don't tax military retirement pay?

- States with no state income tax do not tax military retirement pay. Those states include: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming.

- Other states that don't tax military pay include: Alabama, Arizona, Arkansas, Connecticut, Hawaii, Illinois, Indiana, Iowa, Kansas, Louisiana, Maine, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Nebraska, New Jersey, New York, North Carolina, North Dakota, Ohio, Oklahoma, Pennsylvania, Virginia and Wisconsin.

- Do any states partially tax military pensions?

- A few states including Colorado, Delaware, Georgia, Idaho, Kentucky, Maryland, New Mexico, Oregon and Vermont offer partial exemptions.

- Does VA disability pay count?

- VA disability pay doesn't count. It is 100% free from state and federal taxes.

- Can state tax rules change after I move?

- State tax rules can change. Once you move into that state, you're subject to those state tax laws.

- Should taxes be the only reason to relocate?

- Taxes shouldn't be the only reason to relocate. Many states that exempt military pensions may have high sales taxes, property taxes and a higher cost of living. Also, veteran benefits may differ from state to state.

Karen Doyle and Allison Hache contributed to the reporting of this article.

Information is accurate as of Jan. 12, 2026.

Our in-house research team and on-site financial experts work together to create content that’s accurate, impartial, and up to date. We fact-check every single statistic, quote and fact using trusted primary resources to make sure the information we provide is correct. You can learn more about GOBankingRates’ processes and standards in our editorial policy.

- Defense Finance and Accounting Service (DFAS). "Eligibility for Military Retirement Pay."

- Defense Finance and Accounting Service (DFAS). "Qualifying for a Disability Retirement."

- U.S. Office of Personnel Management (OPM). "Federal Retirement."

- Goarmy.com. "Retirement & Pension Plans."

- The Official Army Benefits Website. "Retired Pay For Soldiers."

- U.S. Department of Veteran Affairs. " Unlocking Veteran tax exemptions across states and U.S. territories."

- Veterans United Home Loans. "Complete List of Veteran Property Tax Exemptions By State."

- Military.com 2025. "State Tax Information for Military Members and Retirees."

- Veteran.com. 2024. "States That Don’t Tax Military Retirement Pay."

- U.S. Army. 2025. "Virginia Military and Veterans Benefits."

- TurboTax. 2025. "States that Don't Tax Military Retirement."

- The Military Wallet. 2025. "State Taxes on Military Retirement Pay."

- Georgia Department of Veterans Service. "Military Retirement Income Tax Exemption."

- U.S. Army. 2025. "New Mexico Military and Veterans Benefits."

- Military Officers Association of America. 2025. "State Tax Update: 2 More States Pass Partial Exemptions for Military Retirement Pay."

Written by

Written by  Edited by

Edited by